9-25-2023 Weekly Market Update

The very Big Picture

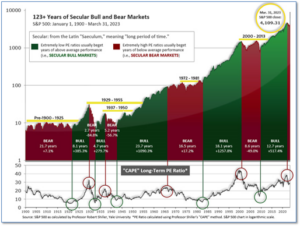

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

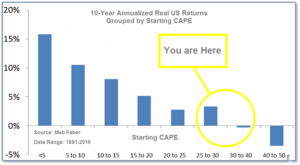

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.70, down from the prior week’s 30.59. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

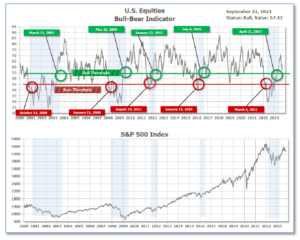

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 57.43 down from the prior week’s 60.59. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on August 10, and ended the week at 8, down 3 from the prior week.

In the Markets:

U.S. Markets: The major U.S. equity benchmarks finished the week in the red as investors reacted to hawkish forecasts from the Federal Reserve’s latest meeting and rising U.S. Treasury yields. The Dow Jones Industrial Average declined ‑1.9% to 33,964, while the technology-heavy NASDAQ Composite retreated -3.6%. By market cap, the large cap S&P 500 ended down -2.9%, the mid cap S&P 400 fell -2.8%, and the small cap Russell 2000 ended the week down ‑3.8%.

International Markets: International markets finished the week solidly to the downside as well. Canada’s TSX retreated ‑4.1%, while the United Kingdom’s FTSE 100 ticked down -0.4%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX declined -2.6% and -2.1% respectively. In Asia, China’s Shanghai Composite managed a 0.5% gain, while Japan’s Nikkei fell -3.4%. As grouped by Morgan Stanley Capital International, developed markets declined -2.1%. Emerging markets ended down -1.7%.

Commodities: Precious metals finished the week mixed. Gold declined -$0.60 to $1945.60 per ounce, while Silver rose 2% to $23.84. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -2.8%. West Texas Intermediate crude oil finished the week up a penny to $90.03 per barrel.

U.S. Economic News: The number of Americans filing first-time claims for unemployment benefits fell to an 8-month low last week as businesses retained their workers amid an acute labor shortage. The Labor Department reported initial jobless claims fell by 20,000 to 201,000. Economists had expected new claims to total 225,000. Meanwhile, ‘continuing claims’, which counts the number of people already receiving benefits fell by 21,000 to 1.662 million. Continuing claims remain near historic lows, indicating that the labor market remains especially tight.

Confidence among the nation’s homebuilders fell to their lowest level in five months as persistently high mortgage rates weighed on buyer demand. The National Association of Home Builders reported their monthly confidence index fell 5 points to 45 in September. Economists had expected a reading of 49.5. All three gauges that make up the report fell. Current sales conditions fell by 6 points, while future sales also fell by 6 points. Prospective buyer traffic also pulled back by 5 points. The share of builders cutting prices to boost sales rose to the highest level in nine months, up to 32% in September from 25% the previous month, the NAHB said. About 59% of builders were also using incentives other than price cuts to improve sales in September. Robert Dietz, chief economist at the NAHB, stated, “High mortgage rates are clearly taking a toll on builder confidence and consumer demand, as a growing number of buyers are electing to defer a home purchase until long-term rates move lower.”

The number of homes under construction fell 11.3% last month to their lowest level since June of 2020 as builders scaled back new projects. Housing starts fell to a 1.28 annualized pace from 1.45 million in July. Starts fell the most in the West, down -28.9%, while new home construction rose by 8.1% in the South. On a positive note, building permits, which are an indicator of future building activity rose 6.9% to a 1.54 million annualized rate. That reading is the highest since October of 2022. Capital Economics wrote in a note to clients, with “a slowing economy, we expect this will lead single-family starts to flatten-off at around 900,000 annualized until mid-2024, after which an economic recovery will help spur buyer demand and supporting renewed homebuilder confidence.”

The Federal Reserve held interest rates steady this week, while indicating a majority of officials expect one more quarter-point interest rate hike before the end of the year. In its statement, the Fed sent a clear message that interest rates were going to remain “higher for longer” by cutting its forecast for rate cuts next year from four to just two. As a result, officials see their benchmark rate still slightly above 5% at the end of next year. Fed Chair Jerome Powell said a “solid” economy would allow the central bank to keep additional pressure on financial conditions with much less of a cost to growth and the labor market than in previous U.S. inflation battles. Josh Jamner, investment strategy analyst at Clearbridge Investments stated, “There’s now a wider range of potential outcomes for when rate cuts are going to come, and that sets up the potential for increased volatility as we head into year end.”

A survey of manufacturing activity in the Philadelphia-area pulled back much more than expected, the Philadelphia Fed reported. The Philly Fed said its manufacturing index tumbled to a -13.5 this month, from positive 12 in August. Economists had expected just a slight pullback to -0.7. This is the index’s 14th monthly negative reading out of the last 16 months. In the report, the new orders index dropped to -10.2 from 16 in August, while the shipments index fell 9 points to -3.2. Firms reported a decline in employment and an overall increase in prices. Stephen Stanley, chief economist at Santander US, wrote in a note, “The factory portion of the economy is in a mild recession, but there is hope of a stabilization or small bounce by the end of the year if things go well.”

An index that measures U.S. business cycles fell for a 17th consecutive month in August, indicating that economic activity going forward looks set to slow down. The Conference Board reported its Leading Economic Index declined -0.4 to 105.4 after declining -0.3 in July. Economists had expected a decline of -0.5. “With August’s decline, the U.S. Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year,” said Justyna Zabinska-La Monica, senior manager, Business Cycle Indicators, at The Conference Board. Weak new orders, deteriorating consumer expectations of business conditions, alongside high interest rates and tight credit conditions all hit the index, she added. The organization now forecasts that the U.S. economy will grow by 2.2% in 2023, before cooling to 0.8% growth in 2024. The indicator is based on 10 components, among them initial claims for unemployment insurance, manufacturers’ new orders, building permits of new private housing units, stock prices and consumers’ expectations.

International Economic News: Tension between Canada and India could affect trade relations, specifically in the agriculture sector. Prime Minister Justin Trudeau accused agents of Indian Prime Minister Narendra Modi’s government to be linked to the killing of Canadian citizen Hardeep Singh Nijjar, a Sikh leader who advocated for the Khalistan movement. India denied Trudeau’s allegations and accused Canada of harboring “Khalistani terrorists and extremists.” In 2022, India was ranked Canada’s 10th largest trading partner. According to the Trade Commissioner Service, exports to India amounted to $5.4 billion worth of goods and $6.2 billion worth of services. Imports from India reached $6.4 billion worth of goods and $2.9 billion worth of services. Keith Currie, President of the Canadian Federation of Agriculture, said the agricultural sector hopes that cooler heads prevail. “The greatest vulnerability would be in the agriculture sector. Typically, when governments want to express their displeasure through trade measures … this has to do with how many inspections you need, what kind of chemicals you’re allowed to apply to the crop and that kind of thing,” said Jeff Nankivell, President of the Asia Pacific Foundation of Canada.

The Bank of England paused its historic interest rate hiking campaign after the inflation rate fell in August. Five members of the BoE’s monetary policy committee voted for maintaining the current rate, while four members opted to increase it to 5.5%. Further rate increases were not ruled out entirely and the central bank noted that borrowing costs must remain high to ensure a lasting inflation decrease. “Inflation is still not where it needs to be and there is absolutely no room for complacency,” said Governor Andrew Bailey. Paul Dales, chief UK economist at Capital Economics, said that rates would hold at their current level for longer than investors expect. “It would make sense that underlying economic growth is weakening, given that the dampening effect of higher interest rates should be building now,” Dales said.

France’s central bank raised its 2023 forecast but expects the economy to grow less than expected in the next two years. The EU’s second largest economy is on track to grow by 0.9% in 2023, according to the Bank of France. The central bank’s outlook was improved by unexpected 0.5% growth in Q2, partially due to refineries restarting after strikes. Subsiding inflation is expected to improve France’s consumer spending in the subsequent two years. However, the central bank cited weakness in Germany’s economy, alongside limited growth in China, to hold down France’s gains in 2024 and 2025. Employment is expected to remain strong this year, but dissonance between the labor market and the broader economy could cause more jobs to be dropped than created in 2024.

The Bundesbank expects the German economy to shrink in Q3. Due to consumer restraint and growing weakness in industry, Germany is on track to see four consecutive quarters of negative or flat growth. “Despite the somewhat slowing pace of price increases, strong wage increases and the good labour market, private households are still holding back on spending,” the central bank said. The Bundesbank expects the rise in financing costs to weigh down economic growth, alongside the declining order intake for the country’s vital industrial sector. Germany’s industry is strongly dependent upon exports, which have been hit hard by weak demand from China. “The low and continued decline in incoming orders, and the declining order backlog are increasingly having an impact on industrial production,” the central bank said.

China is keeping its benchmark lending rates unchanged as recent data shows economic stabilization. The world’s second-largest economy seems to have regained its footing, while yuan declines have reduced the urgency for aggressively lower interest rates. The central bank caught markets off guard this week by keeping the five-year rate unchanged. The one-year loan prime rate (LPR) was kept at 3.45%, while the five-year LPR remained at 4.20%. Most new and outstanding loans in China are based on the one-year LPR, whereas mortgage prices are influenced by the five-year rate. “Monetary policy rollout maintains its steady pace, and there are still chances for reductions to LPRs next month,” said Xing Zhaopeng, senior China strategist at ANZ. Xing expects economic data to continue improving into Q4. “The policy impact will extend to the next few quarters. We have revised our 2023 and 2024 GDP forecast up to 5.1 per cent and 4.2 per cent,” Xing added.

The Bank of Japan left its interest rates unchanged on concerns of ‘extremely high uncertainties’. In a policy statement after its September meeting, the Bank of Japan said it would maintain short-term interest rates at -0.1%. The BOJ also capped the 10-year Japanese government bond yield around zero, as widely expected. “With extremely high uncertainties surrounding economies and financial markets at home and abroad, the Bank will patiently continue with monetary easing, while nimbly responding to developments in economic activity and prices as well as financial conditions,” the Bank of Japan said. The Japanese central bank’s ultra-loose monetary position though, marks Japan as an outlier among major central banks, which have raised interest rates in the last two years to control spiraling inflation.

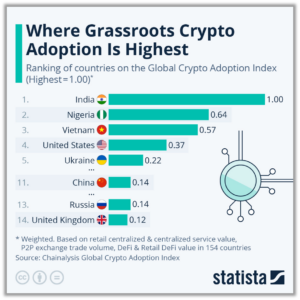

Finally: Of 154 countries analyzed by blockchain data platform Chainanalysis, India ranks the highest in grassroots cryptocurrency adoption by a wide margin. While countries with higher purchasing power would naturally score better when looking at transaction volumes, according to Chainalysis experts, the index measures where “average, everyday people are embracing crypto the most.” As Statista’s Florian Zandt shows in the chart below, based on Chainalysis’s Global Crypto Adoption Index, only three countries score higher than 0.5 out of 1.0. Apart from India, residents of Nigeria and Vietnam are most likely to utilize cryptocurrencies, while the United States and Ukraine rank fourth and fifth with scores of 0.37 and 0.22, respectively. Of the countries with the highest marks on the index, nine out of the top 20 are in Asia, three in Latin America and two in Africa.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.