8-3-20 Weekly Market Update

The very Big Picture

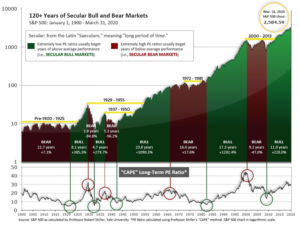

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

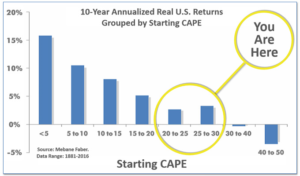

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.49, up from the prior week’s 29.97. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 20-30 range have been slightly-positive to slightly-negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Big Picture:

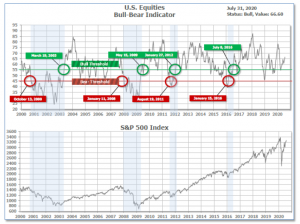

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 66.60 up from the prior week’s 64.92.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter of 2020. (On the ‘daily’ version of the Quarterly-Trend Indicator, where the intra-quarter status of the Indicator is subject to occasional change, both the U.S. Equities and International Equities readings remain in ‘Down’ status; the daily International reading turned to Down on Thursday, Feb. 27th; the U.S. daily reading turned to Down on Friday, Feb. 28th.)

Next, the short-term(weeks to months) Indicator for US Equities remained positive since June 16 and ended the week at 26, unchained from the prior week.

In the Markets:

U.S. Markets: All but one of the major U.S. indexes ended the week higher as investors reacted to a flood of quarterly earnings reports and some prominent economic data. Large caps and growth stocks outperformed as small caps and value shares lagged. The Dow Jones Industrial Average was the only index to finish the week in the red, giving up 42 points to 26,428—a decline of -0.2%. The technology-heavy NASDAQ Composite surged 3.7% on strong earnings from Apple, Facebook, and Amazon, while the large cap S&P 500 added 1.7%. Mid caps and small caps also finished the week positively, rising 0.8% and 0.9% respectively.

International Markets: Unlike the U.S., most major international indexes finished the week to the downside. Canada’s TSX finished up 1.1%, however the United Kingdom’s FTSE 100 declined -3.7%. On Europe’s mainland France’s CAC 40, Germany’s DAX, and Italy’s Milan FTSE declined -3.5%, -4.1%, and -4.9% respectively. In Asia, China’s Shanghai Composite rebounded 3.5% while Japan’s Nikkei slumped -4.6%. As grouped by Morgan Stanley Capital International developed markets declined -1.9% while emerging markets rose 0.3%.

Commodities: Gold and Silver continued their rallies on reaction to continued monetary stimulus from the Federal Reserve (or “currency debasement”, as the gold aficionados prefer to label it). Gold had its eighth consecutive positive close surging 4.7% for the week to $1985.90 an ounce. Silver rallied an even steeper 6.0% to $24.22 an ounce. Oil finished the week down -2.5% to $40.27 per barrel of West Texas Intermediate crude. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, had its second consecutive down week giving up -0.9%.

July Summary: All major U.S. indexes were positive for the month of July. The Dow Jones Industrial Average added 2.4%. The NASDAQ Composite surged 6.8%. By market cap, the large cap S&P 500 rose 5.5%, the mid cap S&P 400 added 4.5%, and the small cap Russell 2000 gained 2.7%. Internationally, China’s Shanghai was July’s big winner, gaining 10.9%, while most developed markets declined. Canada’s TSX rose 4.2%, but European markets all finished the month either flat or down. The UK’s FTSE declined -4.4%, France’s CAC 40 fell -3.1%, and Germany’s DAX finished the month flat. As grouped by Morgan Stanley Capital International, emerging markets rallied 8.3% while developed markets added a much smaller 1.9%. In commodities, silver was the big winner, rallying almost 30% in this single month. Gold followed with a 10.3% increase, while copper and oil added 5.2% and 2.6%, respectively.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits rose for a second consecutive week, a sign the economic rebound could be stalling in late July. The Labor Department reported initial jobless claims rose by 12,000 to 1.434 million new claims in the week ended July 25. Economists had expected 1.51 million new claims. Until the last two weeks, claims had been on a steady decline after peaking in late March. Continuing claims, which counts the number of people already receiving economic benefits, rose by 867,000 to 17.06 million. That number is a sign workers are staying on unemployment longer and rehiring has slowed. Continuing claims are reported with a one-week delay.

Home prices continued to rise in May, but at a slower rate according to the latest data from S&P Case-Shiller. The S&P CoreLogic Case-Shiller 20-city home price index posted a 3.7% year-over-year gain in May, down 0.2% from the previous month. On a monthly basis, the index increased 0.4% between April and May. The national index noted a 4.5% increase in home prices across the country over the past year. Phoenix continued to lead the country with a 9% annual price gain in May, followed once again by Seattle with a 6.8% increase. Tampa, Fla., came in third, with a 6% uptick. However, a look at the individual cities in the index showed that home-price growth could be slowing—the pace of price growth increased in just three of the 19 cities Case-Shiller analyzed (the list didn’t include Detroit again because transaction records were unavailable).

The number of home sales in which a contract has been signed but not yet closed rebounded across the nation in June. The National Association of Realtors (NAR) reported its pending home sales index rose 16.6% in June as compared with May. Compared with the same time last year, contract signings were up 6.3%. Lawrence Yun, the NAR’s chief economist stated, “It is quite surprising and remarkable that, in the midst of a global pandemic, contract activity for home purchases is higher compared to one year ago. Consumers are taking advantage of record-low mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary policy.”

Orders for goods expected to last at least 3 years, so-called ‘durable goods’, climbed in June as a rebound in vehicle purchases offset a decline in aircraft manufacturing. The Commerce Department reported durable-goods orders rose 7.3% last month following historic declines in the early spring. Economists had expected a 7% increase. In the details, orders for new cars and trucks leapt 86% last month as automakers made up lost ground; however aircraft manufacturers posted a whopping 462% decline in bookings. Boeing has seen demand for its planes plummet following the plunge in global travel during the coronavirus outbreak. Stripping out transportation and defense, “core” orders rose a more modest 3.3%.

Confidence among American consumers waned this month, pointing to a rockier economic recovery. The Conference Board reported its consumer confidence index declined -5.7 points in July to 92.6. Economists had expected a reading of 96.0. While still above its pandemic low of 85.7, the index remains a long way from its 20-year high of 132.6 set in February. Lynn Franco, senior director of economic indicators at the board stated, “Consumers have grown less optimistic about the short-term outlook for the economy and labor market and remain subdued about their financial prospects.” In the report, the index that measures how consumers feel about the economy right now actually rose as massive federal aid has helped millions of Americans get by. However the gauge that measures how Americans feel about the next six months—the so-called ‘future expectations index’, sank to a four-month low of 91.5 from 106.1 in June.

Federal Reserve Chairman Jerome Powell said this week that the sharp acceleration in COVID-19 infections since mid-June is restraining the ability of the economy to recover from its historic contraction in the second quarter, during which all non-essential businesses shut down. “On balance, it looks like the data are pointing to a slowing in the pace of the recovery. But I want to stress it is too early to say both how large that is and how sustained that will be,” Powell said at a press conference. Powell noted that it is likely the economy will need more assistance from the Fed and from Congress. The Fed “is committed to using our full range of tools to support the economy and help assure that the recovery from this difficult period will be as robust as possible,” Powell said.

The U.S. economy contracted by about -9.5% in the second quarter, which would work out to an annualized -32.9% if the remainder of the year were just as bad. The scare-mongering headlines mostly mislead readers into thinking the entire economy shrank by 32.9% in Q2; many misguided prominent newscasters made the same error (most notably Brian Williams on MSNBC). Analysts had forecast an annualized -35% decline in GDP. The economy began to recover in mid-May after a severe contraction at the beginning of the quarter, but the U.S. faces a long road back, analysts say. Previously GDP had never shrunk by more than -10% on an annualized basis in any quarter since the government began keeping track shortly after World War Two.

International Economic News: Canada’s GDP bounced back in its latest reading, but remained below where it was before COVID-19. Statistics Canada reported Canada’s gross domestic product expanded by 4.5% in May, a strong rebound from the low hit in April. However, it still remains 15% below its February level. In the details, the agency stated 17 of the 20 sectors of the economy it tracks grew. Goods-producing industries bounced back especially strongly, up 8%, while the service sector rebounded 3.4%. The only parts of the economy that shrank again were management, public administration, and the arts and entertainment sector. “The entertainment sector is going to be under ongoing pressure, though the restart of the NHL with both hubs in Canada should provide some support,” Bank of Montreal economist Benjamin Reitzes noted.

Across the Atlantic, according to analysis from the EY Item Club it could take the United Kingdom’s economy until 2024 to return to the size it was before the coronavirus lockdown. Furthermore, the forecasters suggested unemployment will rise to 9% from 3.9%. Consumers have been more cautious than expected, they said, while low business investment will dampen growth. Howard Archer, chief economic adviser to the EY Item Club stated, “We believe that consumer confidence is one of three key factors likely to weigh on the UK economy over the rest of the year, alongside the impact of rising unemployment and low levels of business investment.”

On Europe’s mainland, French GDP dropped at its fastest rate in history, contracting 14% in the second quarter. However, the result was actually better than expected as economists had predicted a decline of 15.2%. France’s “negative developments in the first half of 2020 is linked to the shut-down of ‘non-essential’ activities in the context of the implementation of the lockdown between mid-March and the beginning of May,” the country’s statistics agency said. This was the third consecutive decline for France, with output falling 19% from the same period last year, and showed just how badly the pandemic has hit one of Europe’s biggest powers.

Similarly, economic output in Germany—the powerhouse of Europe—shrank during the second quarter contracting by ‑10.1% compared with the same period last year. The downturn is the steepest since that country’s Federal Statistics Office began tracking quarterly economic data a half-century ago. Henrik Bohme, an economic analyst for German state broadcaster DW stated, “It’s an astounding figure — minus 10.1%, never before in Germany’s postwar history has the country’s economy slumped as sharply as in the second quarter of 2020.” The historic slump surpassed the 9% contraction economists had forecast.

In contrast to the US and Europe, China’s economy continued its strong recovery from the coronavirus in July as suggested by new sentiment data. China’s National Bureau of Statistics reported its manufacturing purchasing managers’ index (PMI) was 51.1 for July, with readings above 50 signifying growth in factory output. Furthermore, China’s non-manufacturing PMI was 54.2, with both surveys now reporting positive outlooks for five consecutive months. The PMI is a sentiment gauge, conducted through a survey of factory owners and purchasing managers. It offers an early snapshot of the state of China’s economy during the month ahead, quizzing operators on issues like hiring, export orders and inventory.

Japan expects its economy to shrink in the mid -4% range for all of fiscal 2020. The revised projection for real gross domestic product marks a significant downward revision from the prospect of 1.4% growth planned by the cabinet at the start of the year. The figure exceeds the -3.4% decline in GDP in fiscal 2008, when the economy was hit by the global financial crisis. The new projection will be presented during the upcoming Economic and Fiscal Advisory Council. Each year Japan’s cabinet approves its economic outlook for the next fiscal year in January and reviews it around July to reflect current economic indicators.

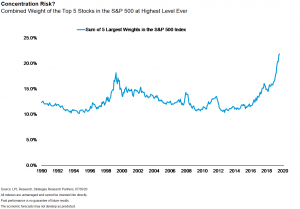

Finally: Apple, Microsoft, Amazon, Google and Facebook have led the charge higher in the stock market since the late March lows. The average return for these five stocks so far this year has been a gain of more than 30%, while the broader S&P 500 index is just marginally positive—up 1.2% through July 31st. So while most other areas of the market have remained largely static, the total market value of these stocks has dramatically increased, which has made them an increasingly large piece of indexes like the S&P 500. As research from LPL Financial shows, the combined weight of the top five stocks in the S&P 500 has increased to its highest level ever, at nearly 22%, far higher even than during the bubble of 1999. This is called “concentration risk”, and is real although LPL states that it believes that the recent gains from those stocks have been justified by their fundamentals and their utility during the ongoing pandemic “stay-at-home” trend. (Chart from LPL Financial)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.