7-20-20 Weekly Market Update

The very Big Picture

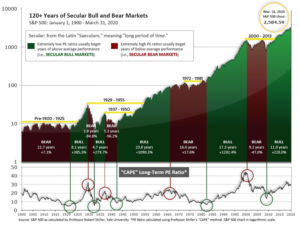

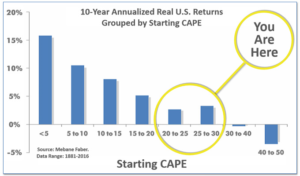

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.05, up from the prior week’s 29.87. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 20-30 range have been slightly-positive to slightly-negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

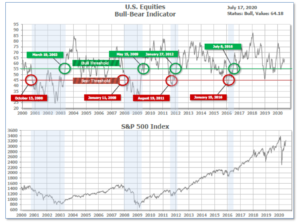

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 64.18 up from the prior week’s 62.62.

In the Quarterly- and Shorter-term Pictures

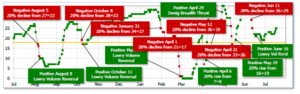

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter of 2020. (On the ‘daily’ version of the Quarterly-Trend Indicator, where the intra-quarter status of the Indicator is subject to occasional change, both the U.S. Equities and International Equities readings remain in ‘Down’ status; the daily International reading turned to Down on Thursday, Feb. 27th; the U.S. daily reading turned to Down on Friday, Feb. 28th.)

Next, the short-term(weeks to months) Indicator for US Equities remained positive since June 16 and ended the week at 25, up from the prior week’s 22.

In the Markets:

U.S. Markets: The major U.S. indexes ended the week mixed. Nothing “mixed” about the benchmark large cap S&P 500 index, however, which marked its third consecutive week of gains and reached levels not seen since the market sell-off began in late February. The Dow Jones Industrial Average rose nearly 600 points to finish the week at 26,672, a gain of 2.3%. The technology-heavy NASDAQ Composite retreated -1.1% following back-to-back weekly gains of more than 4%. By market cap, the large cap S&P 500 added 1.2%, while the mid cap S&P 400 and small cap Russell 2000 each gained 3.6%.

International Markets: Major international markets were also mixed. Canada’s TSX rose 2.6% along with the United Kingdom’s FTSE 100 which rose 3.2%. France’s CAC added 2.0% and Germany’s DAX finished up 2.3%. In Asia, China’s Shanghai Composite retreated -5.0%, following last week’s monstrous 9.5% gain. Japan’s Nikkei ended the week up 1.8%. As grouped by Morgan Stanley Capital International, developed markets rose 1.9%, while emerging markets declined -1.1%.

Commodities: Gold continued its rally. The precious metal rose a sixth consecutive week, adding 0.5% to finish at $1,810.00 per ounce. Similarly, Silver finished up 3.7% to $19.76 per ounce. Oil’s huge rally from the depths of April continued to sputter. West Texas Intermediate crude rose 0.5% to $40.75 per barrel. The industrial metal copper, known as “Dr. Copper” by some analysts for its alleged ability to forecast global economic trends, closed up for a ninth consecutive week, rising 0.24%.

U.S. Economic News: The number of Americans seeking first-time unemployment benefits hit a post-pandemic low last week, but layoffs are expected to rebound as states impose business restrictions. The Labor Department reported initial jobless claims fell by 10,000 to 1.3 million. Economists had expected 1.24 million new claims. Continuing claims, which counts the number of people already receiving benefits fell by 422,000 to 17.34 million. That reading is the lowest since mid-April. Ian Shepherdson, chief economist at Pantheon Macroeconomics wrote in a note, “The trend in initial jobless claims has now just about stopped falling. Next week could easily see an increase, for the first time since March, in the wake of the continued gradual re-imposition of restrictions across the South and parts of the West.”

Confidence among the nation’s home builders rose in July as Americans look to leave the big cities in favor of the suburbs. The National Association of Home Builders (NAHB) reported its monthly confidence index rose 14 points to a reading of 72 in July. Readings above 50 indicate improving confidence, while numbers below represent a declining outlook. In April, the index had fallen to its lowest level since June 2012. In the details of the report, expectations of current single-family home sales jumped 16 points to 79. Builders’ views on the traffic of prospective buyers moved 15 points higher to a reading of 58. Expectations of home sales in the next six months improved by a smaller amount, rising only seven points to a reading of 75. NAHB Chairman Chuck Fowke, a custom home builder from Tampa, Fla, said in the report, “Builders are seeing strong traffic and lots of interest in new construction as existing home inventory remains lean.”

The nation’s small business owners grew more optimistic last month, however a fresh spike in coronavirus cases and tightening restrictions in states such as California and Texas may snuff out hopes for a faster economic recovery. The National Federation of Independent Business (NFIB) reported its Small Business Optimism Index jumped 6.2 points in June to 100.6—its biggest gain since December 2016. The reading took the NFIB index closer to where it was in February, just before the start of the recession. The surge in optimism reflected the partial reopening of the economy and the impact of the “Paycheck Protection Program” loans. However, with the recent spike in COVID cases, analysts expect some of this optimism to reverse in the coming months.

Increases in the price of food and at the gas pump lifted consumer prices for the first time in four months in June. The Bureau of Labor Statistics reported its Consumer Price Index (CPI) rebounded 0.6% last month. Economists had expected a reading of 0.5%. Energy prices surged the most in 11 years jumping 5.1%, while food prices advanced 0.6%. Gasoline is still fairly cheap, however, with prices down more than 23% compared to a year earlier. Core CPI, which excludes the volatile food and energy categories, rose 0.2% – also slightly above the consensus of 0.1%. Year-over-year, core CPI eased to just 1.2%, its slowest pace since February 2011. Despite the Federal Reserve’s massive monetary stimulus in response to the coronavirus pandemic, analysts don’t expect inflation to become a problem anytime soon. Michael Gregory, Deputy Chief Economist at BMO Capital Markets wrote, “Inflation is not going to be an issue for a long while.”

Sales at the nation’s retailers posted a big increase in June, the second consecutive increase. The Commerce Department reported retail sales climbed 7.5% last month, following a record 18.2% increase in May. Economists had expected a 5.4% increase. Sales, however, still have yet to return to pre-crisis trends. In the report, sales jumped 8.2% at auto dealers, which have gotten a big boost from plunging interest rates. Sales also increased 15.3% at gas stations largely because of a steady increase in the price of oil after it fell to an 18-year low earlier in the year. If autos and gasoline are stripped out, retail sales still rose a robust 6.7% last month.

The Federal Reserve’s Beige Book, a collection of anecdotal reports from each of the Federal Reserve’s member banks, showed economic activity increased in almost all districts. One caveat: business contacts remained highly uncertain about the outlook for the U.S. economy, as it was unclear how long the crisis would last. Overall, while the Beige Book was more positive than its prior report in May, there was no sense that the economy was out of the woods. Tom Simons, economist at Jefferies wrote, “Although the early days of the “reopening” were quite strong and quite encouraging, that pace of activity is not sustainable. Getting back to any sense of a normal pace of economic activity is going to take a long time, and there is an enormous amount of slack that the economy needs to absorb before any sort of policy response is warranted.”

Business activity in the New York region increased in July for the first time since the pandemic began in March according to the New York Fed’s Empire State Manufacturing Survey. The Empire State business conditions index rose to 17.2 in July, its first positive reading since February. A reading above zero indicates improving conditions. Economists had expected a reading of 8.9. Forty-one percent of manufacturers reported that conditions were better in early July than in June, up from 36% in the prior survey. Overall, the Empire State index has improved steadily since hitting a record low of -78.2 in April.

International Economic News: The Bank of Canada held its key interest rate unchanged at 0.25% as it waited for the national economic picture to improve. Low interest rates are meant to help households and businesses recover from the COVID-19 pandemic by making borrowing relatively inexpensive. In its updated economic outlook released this week, the bank expects Canada’s economy to contract by 7.8% this year, driven downward by a year-over-year contraction of 14.6% in the second quarter. Then it expects growth of 5.1% in 2021. Both figures are less rosy than those Prime Minister Justin Trudeau’s administration relied on in their economic update released one week ago.

Across the Atlantic, the United Kingdom’s economy grew less than expected in May as the lockdowns from the coronavirus began to ease. Official figures showed the UK’s GDP expanded by 1.8% in May. Economists had expected a rebound of 5.5%. The Office for National Statistics stated “the level of output did not recover from the record falls seen in March and April 2020 and has reduced by 24.5% compared with February 2020.” Jonathan Athow, deputy national statistician for economic statistic stated that while the retail sector saw record online sales in May, many other areas of the economy remained in the “doldrums”.

On Europe’s mainland, French President Emmanuel Macron promised an additional 100 billion euros to finance France’s economic recovery from the coronavirus pandemic. That follows the 460 billion euros already allocated. Macron vowed to press on with his economic reforms to “modernize” France during the final two years of his mandate. Macron stated, “On top of the money already announced, with this recovery plan we are putting in at least 100 billion euros to ensure an industrial, environmental, local, cultural and educational relaunch.” He said he would not drop plans for a comprehensive reform of the country’s complex and costly pension system, which triggered big trade union demonstrations last year.

The ZEW economic research institute said economic expectations for Germany fell slightly in July following three months of increases. Expectations declined to 59.3 in July, down 4.1 points from June, the institute said. The outcome is below economists’ forecasts of 60.0. However, the institute’s assessment of the current economic situation in Germany improved slightly, rising to minus 80.9 points in July from minus 83.1 in June. Achim Wambach, president of the ZEW institute stated, “After a very poor second quarter, the experts expect to see a gradual increase in gross domestic product in the second half of the year and in early 2021.”

China state media praised the country’s quick economic recovery from the coronavirus pandemic, after Beijing announced better than expected growth figures for the second quarter of the year. The government reported China’s GDP grew 3.2% in the second quarter of 2020, following a record contraction in the first quarter of the year. The reading means China escaped the official definition of a recession, described as two consecutive quarter of negative growth. The rebound had been widely expected. China — the early epicenter of the outbreak and the first in the world to impose draconian measures to quell the virus — was the first major economy to reopen.

The Bank of Japan forecast the nation’s economy to shrink 4.7% in fiscal 2020 despite recent signs of a gradual recovery. The estimate, released in a quarterly outlook report, is the median of forecasts from all BOJ policy board members, which ranged from minus 4.5% to minus 5.7%. The range represented a worsening from the April estimate of a contraction of between 3.0% and 5.0%. “The downshift reflects a slower-than-expected recovery, both in Japan and overseas,” said Hideo Kumano, chief economist at Dai-ichi Life Research Institute. Haruhiko Kuroda, the central bank’s governor stated, “The pace of recovery is expected to be gradual.” The BOJ’s funding assistance to businesses will need to be kept in place for some time, he added.

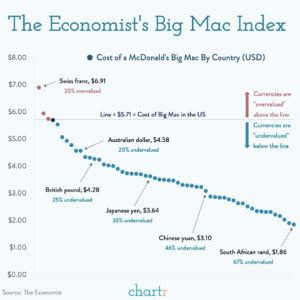

Finally: When measuring the “value” of a currency, most think of a traditional yardstick such as gold. However, economists sometimes also look at more readily and widely available commodities for their studies. The Economist just released the latest version of its Big Mac Index, which tracks the cost of a McDonald’s Big Mac around the world. In this year’s Big Mac Index, you’ll find that the Swiss are paying the Swiss Franc equivalent of $6.91 for a Big Mac, making it the most “expensive” Big Mac on the planet. But Big Mac fans everywhere might be glad to know that to know you can still get a Big Mac for less than two bucks…in South Africa. There, you’ll pay just the Rand equivalent of $1.86! (Chart by chrtr.co, data from The Economist)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.