8-14-2023 Weekly Market Update

The very Big Picture:

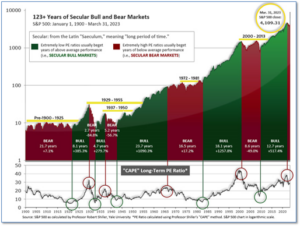

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

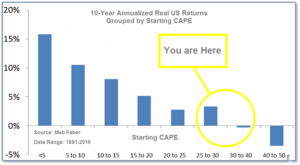

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.79, down from the prior week’s 31.94. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

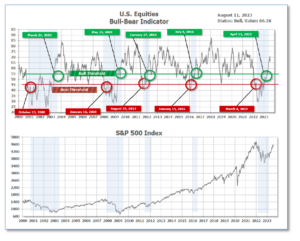

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 66.36, down from the prior week’s 68.89. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on August 10, and ended the week at 24, down from the prior week’s 28.

In the Markets:

U.S. Markets: The major benchmarks ended the week mixed as investors weighed inflation data against worries over the recent rise in long-term interest rates. Value stocks handily outperformed growth stocks. The narrowly focused Dow Jones Industrial Average managed a modest gain of 0.6% to 35,281. The technology-heavy NASDAQ Composite pulled back -1.9% to 13,645. By market cap, the large cap S&P 500 ticked down -0.3%, while the mid cap S&P 400 fell -0.8%. The small cap Russell 2000 ended the week down -1.7%.

International Markets: International markets finished the week mixed as well. Canada’s TSX rose 0.8%, while the UK’s FTSE 100 ended down -0.5%. France’s CAC gained 0.3%, while Germany’s DAX ended down -0.8%. China’s Shanghai Composite fell 3%, while Japan’s Nikkei added 0.9%. As grouped by Morgan Stanley Capital International, developed markets finished the week flat, while emerging markets ended the week down -2.4%.

Commodities: Precious metals ended the week in the red. Gold declined -1.5% to $1946.60 per ounce, while Silver retreated -4.1% to $22.74. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -3.8%. Crude oil finished the week to the upside. West Texas Intermediate crude oil rose 0.5% to $83.19 per barrel.

U.S. Economic News: The number of Americans filing first-time claims for unemployment benefits spiked to its highest level in a month the Labor Department reported. U.S. initial jobless benefit claims rose by 21,000 to 248,000 in the week ending Aug. 5. Economists polled by The Wall Street Journal had estimated new claims would rise 5,000 to 231,000. Claims have risen for two consecutive weeks. Meanwhile, continuing claims, which counts the number of people already receiving benefits, fell by 8,000 to 1.64 million. That number is reported with a one-week delay.

Consumer prices rose a mild 0.2% in July, but it was still an uptick in inflation for the first time in more than a year. The annual rate of inflation rose to 3.2% from 3%, its first increase in 13 months and a sign that it’s going to take a while to get the rise in the cost of living under control. On a positive note, inflation has eased considerably since hitting a 40-year high of 9.1% in the middle of 2022. Meanwhile, the “core” rate of inflation, which excludes food and energy, also rose 0.2% last month. The increase in core inflation over the past year slowed a tick to 4.7% from 4.8%–its lowest rate in almost two years. Given the tepid increase in inflation in this report, financial markets are putting the odds close to zero that the Fed will hike interest rates at its next meeting in September. Phillip Neuhart, director of market and economic research at First Citizens Bank Wealth stated, “This report gives the Fed latitude to keep the federal funds rate unchanged at their September meeting.”

On the producer side, prices rose more than expected in July, a sign higher inflation may be coming down the pipeline. The Labor Department reported the Producer Price Index rose 0.3% in July, its largest gain since January. Economists had expected just a 0.2% advance. Furthermore, core producer price index, which excludes volatile food and energy prices, rose 0.2 in July, up from a 0.1% gain in the prior month. This is the largest increase since February. A big part of the increase in producer prices was in the services sector. The cost of services rose 0.5% last month, up from a 0.1% drop in June. Rubeela Farooqi, chief U.S. economist at High Frequency Economics noted we may not be out of the woods yet regarding inflation. Farooqi wrote, “While we do not expect further rate hikes this year, if inflation surprises to the upside and the labor market and growth do not slow, another increase in interest rates cannot be ruled out in 2023.”

Confidence among the nation’s small-business owners rose last month, but remained below its long-term average as high inflation and the tight labor market continued to weigh on sentiment. The National Federation of Independent Business said Tuesday that its small-business optimism index increased to 91.9 in July from 91.0 in June, well below the index’s 49-year average of 98. This marks nearly two straight years that confidence has remained below the historical average, NFIB said. The reading was nevertheless a little better than expected by economists. Inflation is the single most important problem for many small-business owners, NFIB said, despite price rises slowing to their lowest level in two years in June. Many owners are also reporting a struggle to fill job openings, the federation said. “Inflation has eased slightly on Main Street, but difficulty hiring remains a top business concern,” said Bill Dunkelberg, NFIB’s chief economist.

Consumer borrowing picked up in June according to the latest report from the Federal Reserve. Consumer credit rose $17.8 billion in June, up from a $9.5 billion gain in the prior month. That translates into a 4.3% annual rate. Credit growth rose at a revised 2.3% gain in June, higher than the initial estimate of a 1.3% gain. The reading was far above economists’ forecasts of an $11 billion gain. In the details of the report, all of the gain came in nonrevolving credit, typically auto and student loans. This borrowing rose 6% in June, up sharply from a 0.3% growth rate in the prior month. This category of credit is usually much less volatile. Revolving credit, such as credit cards, fell 0.6% in June after an 8.1% gain in the prior month. This is the first decline since April 2021.

International Economic News: Canada’s economy is losing momentum as rising unemployment continued to weigh on the labor market. For the third consecutive month, Canada’s unemployment rate continued to rise. Statistics Canada reported that its economy lost an additional 6,400 jobs and its unemployment rate climbed to 5.5%. The federal agency says the construction industry contributed to the job losses in July, while the highest job gains were made in health care and social assistance. Canada’s population growth and unemployment rate suggests that the economy isn’t creating enough jobs to match an expanding workforce. “We’ve seen a consistent increase in the number of people without a job in Canada, but people that are still in the labor force,” said James Orlando, TD’s director of economics. BMO’s chief economist, Douglas Porter stated, “The soft July employment report is just the latest arrow in the quiver of signs that the economy is losing momentum.”

Wages in the United Kingdom continue to lag behind rising prices, leaving households feeling squeezed. The UK’s National Institute for Economic and Social Research (NIESR) said that wage growth is set to fall in regions including the West Midlands and East of England. While most regions are expected to see a fall in wages between 0.5% and 5%, people’s “real wages” in London are forecasted to jump by 7%, 4.6% in Wales, and by 4% in Northern Ireland. Stephen Millard, Deputy Director for Macroeconomic Modelling and Forecasting at NIESR, said that London was fortunate. “It’s full of industries that are traded, highly competitive, and where productivity growth has been high,” he said. NIESR said it expected the UK to avoid a recession in 2023, but that there was a “60% risk” of one by the end of 2024. Juxtaposed to NIESR’s forecasts, the Bank of England does not expect the UK to enter a recession, but that growth will be limited, and unemployment will rise over the next few years. Millard said, “The government needs to think beyond the next few years by investing in public infrastructure, education, healthcare, in the green transition.” “The result will eventually be higher growth, but it takes a while, at least a couple of parliaments,” Millard added.

The French current account deficit dropped from -€39.3 billion to -€9.6 billion, primarily due to a fall in energy prices, which decreased the cost of importing goods. The aviation industry exports, which makes up the largest slice of exports, rose by 12% over the last six months. The automobile industry saw an 8% export increase for electric vehicles. According to French Trade Minister, Olivier Becht, “We see an improvement in the trade balance even when factoring energy and military spending costs out.” French exports to China increased 7.3% over the past two quarters of this year, driven primarily by the aviation sector. France’s world market share in goods grew from 2.5% to 2.8% in six months. French President Emmanuel Macron’s reindustrialization strategy, currently under scrutiny in Parliament, is expected to ease business with international investors. “We remain prudent, and there is still a long road ahead to close off the trade deficit completely,” Becht said. He added that “existing trends are subject to the whims of an international economic environment”.

Germany’s recent decline in industrial output raises the risk of another contraction in manufacturing, which could steer the economy back into recession. Europe’s powerhouse fell 1.5% in June, driven by the automotive sector’s 3.5% drop. The construction sector, where output declined 2.8%, negatively impacted overall industrial production, according to the country’s statistics office. Jörg Krämer, Chief Economist at Commerzbank, is forecasting a fall in GDP over the last two quarters of this year. Germany emerged from a recession in the second quarter, but recent data suggests that the emergence may be short-lived. “We expect a drop in industrial output to be one of the factors causing a renewed contraction in German GDP in the second half of this year,” Franziska Palmas, senior Europe economist at Capital Economics, wrote. Germany’s car industry accounts for around 5% of the economy, which has been struggling to recover after the pandemic and problematic supply chains. 2.2 million cars rolled off production lines in the first two quarters, according to the German Automotive Industry Association. While that was a notable improvement in production from last year, it remained 10% lower than in 2019. Europe’s largest carmaker, Volkswagen, has been grappling for sales in its single most prominent market, China, losing out to local competitors. Volkswagen reported a 14.5% drop in its deliveries in China in the first quarter of 2023.

China’s exports dropped 14% last month, the largest drop in over three years. As global demand decelerated, further pressure was added on Beijing to reinvigorate the world’s second-largest economy. Shipments to the U.S., China’s single largest trading partner, fell 13%. The value of exports dropped by 14.5% last month from 2022, the most drastic drop since 2020, according to Chinese customs statistics. Exports are expected to decline further over the subsequent months, as global goods demand falls and monetary tightening weighs down consumer spending. Exports accounted for 17% of China’s GDP in 2022 and throughout the pandemic years. However, those shipments decreased under the weight of surging inflation and as rapid interest rates deteriorated global demand.

Japanese authorities will most likely forego intervening in foreign exchange markets. The yen has stabilized some support as a currency against the U.S. dollar, but the possibility of it weaking further can’t be completely dismissed. Former finance official, Eisuke Sakakibara, said that the yen is poised to hit 130 against the U.S. dollar by the final quarter, while the Federal Reserve ends its aggressive monetary tightening. Sakakibara expects Bank of Japan head, Kazuo Ueda, will hold to his easy policy and avoid the deflationary trends that have burdened the economy. “I think the Ministry of Finance and the Bank of Japan are reasonably satisfied with what has been going on, so I don’t foresee any intervention to warn or to change the course of the exchange rate,” Sakakibara said.

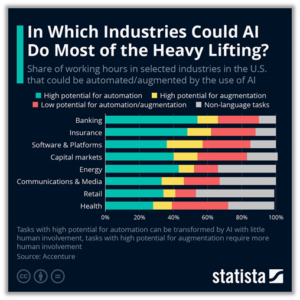

Finally: Finally, the year 2023 may become known as the year that ‘Artificial Intelligence’ went mainstream. With the meteoric rise in visits to OpenAI’s ChatGPT and similar services one of the most pressing questions on many people’s minds became “Will AI eventually take my job?”. Statista’s Felix Richter set out to find that answer. Using data from Accenture research based on data from the U.S. Department of Labor Statistics, he found that 40% of all hours worked in the U.S. in 2021 could be impacted by large language models such as ChatGPT, whether through automation (little human involvement required) or augmentation (more human involvement necessary). The following chart shows which industries involve the most tasks that can be automated or augmented by AI, with banking and insurance on top of the ranking.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.