7-24-2023 Weekly Market Update

The very Big Picture

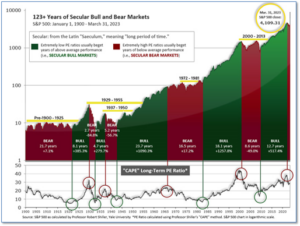

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

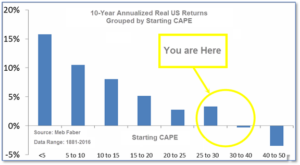

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 31.62, up from the prior week’s 31.40. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 69.18, up from the prior week’s 67.62. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering April, indicating positive prospects for equities in the second quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on May 25, and ended the week at 30, up from the prior week’s 29.

In the Markets:

U.S. Markets: Most of the major U.S. equity indexes finished the week in the green on hopes that the tight labor market and moderating inflation would help the economy avoid a ‘hard landing’. The Dow Jones Industrial Average added 718 points finishing the week at 35,228—a gain of 2.1%. The technology-heavy NASDAQ Composite retraced part of last week’s gain, finishing down -0.6% to 14,033. By market cap, the large cap S&P 500 rose 0.7%, the mid cap S&P 400 gained 1.2%, and the small cap Russell 2000 added 1.5%.

International Markets: In international markets, Canada’s TSX rose 1.4% and the United Kingdom’s FTSE 100 surged 3.1%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX added 0.8% and 0.4% respectively. In Asia, China’s Shanghai Composite pulled back -2.2% and Japan’s Nikkei fell -0.3%. As grouped by Morgan Stanley Capital International, developed markets added 0.2% while emerging markets ended the week down -1.7%.

Commodities: Precious metals finished the week mixed. Gold closed up 0.1% to $1966.60 per ounce, while Silver declined -1.4% to $24.86. West Texas Intermediate crude oil rose for a fourth consecutive week adding 2.2% closing at $77.07 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -2.9%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits dropped to a two-month low reaffirming that the labor market remains robust. The Labor Department reported initial claims for unemployment fell by 9,000 to 228,000. Economists had expected new claims to total 240,000. Meanwhile, the number of people already collecting unemployment benefits rose by 33,000 to 1.75 million. Yet the available evidence continues to show laid-off workers are finding new jobs relatively quickly. The relatively small increase in jobless claims this year is a sign most companies have enough demand for their goods and services to keep workers busy. Stuart Hoffman, senior economic adviser at PNC Financial Services wrote, “Even with the increase this year, initial claims remain quite low on an historical basis.”

Confidence among the nation’s homebuilders rose for a seventh consecutive month, according to the National Association of Homebuilders. The NAHB monthly confidence index rose by one point in July, to 56, the trade group said. A persistent shortage of previously-owned homes for sale is fueling the optimism. With mortgage rates at nearly 7% or above, many homeowners are finding little incentive to sell and new listings are down more than 25% from the same time last year according to Realtor.com. That has boosted interest in new homes and given builders reason to remain confident about their outlook. Still, builders were concerned about mortgage rates rising to 7% and how that could affect demand. Robert Dietz, chief economist at the NAHB wrote, “Although builders continue to remain cautiously optimistic about market conditions, the quarter-point rise in mortgage rates over the past month is a stark reminder of the stop and start process the market will experience as the Federal Reserve nears the end of the ongoing tightening cycle.”

Manufacturing activity in the New York area dipped this month but remained positive according to the latest data from the New York Federal Reserve. The NY Fed’s Empire State Business Conditions index fell 5.5 points to 1.1 this week. The reading exceeded economists’ estimates of a flat reading. In the report, the index for new orders remained little changed, while the shipments index fell 8.6 points but remained positive at 13.4. Notably, the index for number of employees rose into positive territory for the first time since January. Michael Feroli, chief economist at JP Morgan Chase wrote in a note, “Momentum has been weak across a broad range of manufacturing surveys recently, and choppy inventory data are not yet pointing to a clear catalyst for improvement this month despite resilience elsewhere in the economy.”

Sales at the nation’s retailers rose a tepid 0.2% in June, reflecting a shift in consumer spending and signaling weakness in some parts of the economy. Retail sales represent about one-third of all consumer spending and usually offer clues on the strength of the economy. However, the retail report has recently been less reliable as a bellwether, because Americans are spending more on services than they are on goods. Retailers showed widely varying results. Sales rose sharply at internet retailers and stores that sell furniture and electronics. Yet sales sank at home centers, department stores and gas stations. Retail sales have leveled off after explosive growth over the last two years. Since then households have shifted spending to services that were banned during the pandemic. They are traveling more, dining out, and spending more on recreation. Quincy Krosby, Chief Global Strategist at LPL Financial stated, “As long as the labor market remains solid, consumers will continue to lead the economy.”

International Economic News: The Conference Board of Canada forecast the country’s real GDP to climb 1.3% in 2023 before slowing to a 1.1% gain the following year. Ted Mallett, Director of Economic Forecasting at the Conference Board of Canada said, “Economic commentary in Canada typically revolves around a recession and whether it will be a hard or soft-landing, but slow motion might be a more accurate way of describing the coming years.” The ongoing threat of a recession amid high inflation continues to cultivate lower consumer confidence. Meanwhile job growth is slowing leading to lower forecasts for the first quarter of 2024. The Conference Board of Canada added that maintenance activities in varying oil fields, and the side-effects of British Columbia’s and Alberta’s wildfires, will consequently lead to a 1.2% contraction in the second quarter. “We believe the overall economy will be supported in large part by commodities, health care and other sectors still on the mend from the pandemic,” said Mallett.

The UK’s inflation rate fell below economists’ forecasts coming in at an annualized 7.9%. Despite the slight improvement, inflation remains high above the Bank of England’s 2% target. The government and Bank of England remain concerned that high inflation could lead to a cost-of-living crisis where price inflation paired with a tight labor market, leading to increases in wages sparking higher prices and so on. On a monthly basis, CPI increased by 0.1%, below the 0.4% forecast. Core inflation, which excludes food and energy, fell from May’s 31-year high of 7.1% but held at an annualized 6.9%. John Glen, Chief Secretary to the Treasury, said that the drastic decline in the inflation rate was encouraging. “But there’s no complacency here in the Treasury,” he added. “We’re working closely in lockstep with the Bank of England as we try to halve it this year and get it down to its long-term norm of 2%.”

France’s third-largest bank, Société Générale, became the country’s first company to obtain a cryptocurrency license. Société Générale’s cryptocurrency division, SG Forge, was designated a digital asset service provider, or DASP, by France’s Autorité des Marchés Financiers (AMF) this week. Forge, Société Générale’s crypto unit, is now licensed to offer services, including crypto custody, trading and sales, ramping up the investment bank’s expansion into digital assets. Crypto markets rallied through 2023, fed by expanding interest in the volatile asset class by prominent US financial firms, such as BlackRock and Fidelity. Numerous crypto firms, including Binance, have registered with France’s AMF market regulator. Licensed firms are undergoing more demanding rules in areas including corporate governance, IT, and compliance. Jean-Marc Stenger, the CEO of Forge said, “This step will allow us to continue supporting our institutional clients wishing to benefit from services on digital assets that meet the highest standard of compliance and banking security.”

The German economy appears to have returned to slight growth in the second quarter after shrinking the two previous quarters, according to that country’s central bank. Germany’s national statistics office, Destatis, said in late May that Europe’s biggest economy contracted by 0.3% in the first three months of this year, its second consecutive quarterly decline and the official definition of a recession. In its monthly report, the Bundesbank said economic output appears to have “increased slightly” in the second quarter, without quantifying the expected gain. It said private consumption apparently stabilized, thanks to a solid labor market, pay increases and the lack of a further significant increase in inflation.

China’s economy missed growth forecasts in the second quarter of this year, adding to worries over surging youth unemployment and a weak property sector. The world’s second largest economy grew at a 6.3% annual pace in the April-June quarter, much slower than the 7% plus growth analysts had forecast. Unemployment of youths aged 16 to 24 rose to a record 21.3% in June, up from 20.8% the month before. Officials have acknowledged that the economy is facing stiff headwinds, but said they expected growth to still reach the ruling Communist Party’s official target for this year of about 5%. The government will adjust policies to stabilize growth, National Bureau of Statistics spokesman Fu Linghui said. Analysts have been far less optimistic than the Chinese government about the outlook for the year, given weakening demand for Chinese exports in other major economies. The numbers are a “worrying result,” said Moody’s Analytics economist Harry Murphy Cruise.

After several decades Japan’s workers have finally gotten a raise. In 2022, Japanese workers took home an average salary of $41,509 in purchasing parity terms, hardly unchanged from the $40,379 in 1991 according to data from the Organization for Economic Cooperation and Development (OECD). While Japan’s wages rose by just 2.8% over that period, average pay across the OECD climbed by 32.5%. Today, Japanese employees earn only about three-quarters as much as their developed country counterparts. Japan’s wage growth has been stagnant since the bursting of its stock market and real estate bubbles in the early 1990s. The crash, coupled with a strong yen, low labor productivity, a shrinking population and controversial policy decisions such as consumption tax hikes, has been blamed for a decades-long spiral of declining prices that has only recently begun to reverse.

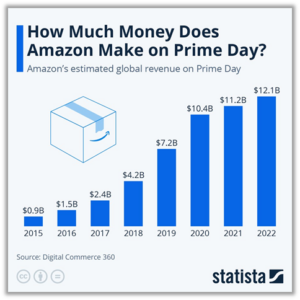

Finally: Earlier this month Amazon had its Prime Day event, a 48-hour campaign meant to offer its Prime subscribers a variety of deals across a broad range of consumer goods. While Amazon itself doesn’t release its official sales figures for the campaign, estimates by various e-commerce research experts such as Digital Commerce 360 showed a meteoric rise in revenue. As Statista’s Florian Zandt shows in the chart below, revenues grew from around $900 million in 2015 to more than $12 billion in 2022.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.