7-10-2023 Weekly Market Update

The very Big Picture

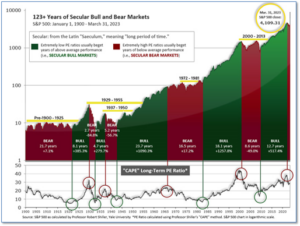

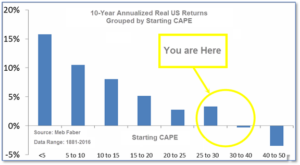

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.66, down from the prior week’s 31.07. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 66.30, down from the prior week’s 66.41. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering April, indicating positive prospects for equities in the second quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on May 25, and ended the week at 28, unchanged from the prior week.

In the Markets:

U.S. Markets: Stocks closed lower in a generally quiet week with investors awaiting the release of second-quarter earnings reports. Growth stocks held up modestly better than value shares. The Dow Jones Industrial Average shed 673 points closing at 33,735, a decline of -2%. The technology-heavy NASDAQ Composite pulled back -0.9% to 13,661. By market cap, the large cap S&P 500 gave up -1.2%, while the mid cap S&P 400 and small cap Russell 2000 ended down -0.7% and -1.3% respectively.

International Markets: Major international markets finished the week to the downside as well. Canada’s TSX and the United Kingdom’s FTSE 100 retreated -1.6% and -3.6% respectively, while France’s CAC ended down -3.9%. Germany’s DAX ended the week down -3.4%. In Asia, China’s Shanghai Composite ticked down -0.2%, Japan’s Nikkei retreated -2.4%. As grouped by Morgan Stanley Capital International, developed markets declined -2.2%, emerging markets fell -0.4%.

Commodities: Major commodities finished the week in the green. Gold added 0.2% to $1932.50 per ounce, while Silver rose 1.2% to $23.29. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, rose 0.6%. Energy rebounded with West Texas Intermediate crude oil rising 4.6% to $73.86 per barrel.

U.S. Economic News: The number of Americans who applied for unemployment benefits last week rose to 248,000, its highest level in almost two years. Most of the increase took place in a few states, including Michigan and New York, and might partly reflect annual summer retooling at automobile plants. New jobless claims advanced by 12,000 from a revised 236,000 in the prior week, government data showed. Unemployment claims typically rise when the economy weakens and a recession approaches. Claims have crept up this year from historic lows, but they still aren’t pointing to a sharp deterioration in the labor market. Meanwhile, the number of people already collecting unemployment benefits fell by 13,000 to 1.72 million. That’s the third decline in a row and puts these so-called continuing claims at a five-month low.

The Labor Department reported that employers added 209,000 nonfarm jobs in June, modestly below expectations and the lowest number in more than two and a half years, a sign the labor market may be cooling off as interest rates gradually weaken the economy. The increase in hiring in June was even weaker than it seemed. Some 30% of the new jobs created last month were in government. The private sector added just 149,000 jobs—mostly in healthcare and education. The unemployment rate edged down from 3.7% in May to 3.6% in June. The report also revealed that the number of people employed part time for economic reasons jumped by roughly 11% in June, “partially reflecting an increase in the number of persons whose hours were cut due to slack work or business conditions.”

The number of job openings dropped last month, but analysts say the labor market is still too strong for the Fed. The Labor Department reported job listings declined by 500,000 to a two-month low of 9.8 million in May. Economists had forecast job listings to total 10 million. Job postings have dropped from a record 12 million last year, but the Federal Reserve wants to see openings and hiring slow even further to ease the upward pressure on inflation. The Fed is worried that a tight labor market — too many jobs and not enough workers — will make it harder to get inflation under control. Labor is the biggest expense for most businesses.

A measure of business conditions at American factories fell to its lowest level since 2020 when the U.S. was locked down during the pandemic underscoring broad weakness in the industrial side of the economy. The Institute for Supply Management’s manufacturing survey dipped to 46% in June from 46.9% in the prior month. It was the lowest reading since May 2020. The index has been negative for eight months in a row–a bout of weakness that hasn’t occurred since the Great Financial Crisis of 2008. The index of new orders rose 3.0 points to 45.6% remaining close to recession levels, while the production barometer fell 4.4 points to 46.7%, also the lowest level since May 2020. “The fact there is no real demand in new-order levels is a concern,” said Timothy Fiore, chairman of the survey. “Without demand coming back, we are going to continue on this path.”

The services sector continued to strengthen last month. The Institute for Supply Management reported its ‘services index’ rose to 53.9, up 3.6 points from the prior month. Economists had expected the index to rise to just 51.3. It was the sixth consecutive reading above 50—the threshold for expansion versus contraction. Fifteen out of 18 industries reported growth in June. New orders, activity and employment all increased. The majority of respondents reported business conditions remain stable, but they are cautious relative to inflation and the outlook.

International Economic News: A strike by B.C. port workers prompted a dire economic crisis for Canada. Alberta Transportation Minister Devin Dreeshen says the B.C. port workers’ strike has caught Ottawa “flat-footed.” A prolonged strike could economically damage agriculture, manufacturing, retail, consumers, and railways. The crisis has already halted shipments in and out of thirty coastal ports for five days. The list included the country’s first and third ranked ports in shipping volume, Vancouver and Prince Rupert. Dreeshen and Matt Jones, the Jobs minister, noted that Alberta’s daily shipments through Vancouver and Prince Rupert comprise 16% of Canada’s total traded goods. “About $500 million worth of cargo every day flows through West Coast ports for Alberta, whether that’s perishable food coming in to the province or exports leaving the province,” Dreeshen said. Since May, Alberta’s inflation rate has been rising due to higher transportation costs. Coalescing a transportation crisis with a rising inflation rate is not ideal timing. Plus, the $30 billion Trans Mountain pipeline extension will be vulnerable to work stoppages once it opens. “This should have been on everyone’s radar. Proactiveness could have prevented a lot of economic hurt we’re feeling,” Dreeshen said.

Inflation weighed down the UK economy through the first two quarters of 2023. Earlier this year, inflation eroded households’ disposable income. Now economists forecast a recession risk looms ahead of Britain’s economy as higher interest rates remain strong even as inflation eases. According to the Office for National Statistics, the economy grew 0.1% in the first quarter, with output 0.5% below the final quarter of 2019. The cost of living outgrew incomes and the overall saving ratio remained above pre-pandemic levels. The Bank of England raised interest rates to a 15-year high of 5% last month. “The final Q1 2023 GDP data confirms that the economy steered clear of a recession at the start of 2023. But with around 60% of the drag from higher interest rates yet to be felt, we still think the economy will tip into one in the second half of this year,” said Ashley Webb, an economist at consultancy Capital Economics.

Riots in France near an economic cost of €1 Billion as massive police deployment drops the level of unrest. Since the police shooting of 17-year-old Nahel, the largest employer federation in France, Mouvement des entreprises de France (MEDEF), estimated the cost of violence at €1 billion ($1.1 billion), with 200 businesses looted, and 300 bank branches and 250 tobacco stores decimated. “The videos of the riots that circulated around the world hurt the image of France,” said Medef head Geoffroy Roux de Bézieux. “It’s always difficult to say if the impact will be long lasting, but there will certainly be a drop in reservations this summer, although the season had seemed promising. Many have already been canceled,” he continued. In Arpajon, a town south of Paris, Finance Minister Bruno Le Maire met with store owners to discuss the crisis. French insurers agreed to extend the delay for store owners to make damage claims to thirty days from the initial five. “If your store has been burned to the ground and a life’s work has been reduced to ashes, the state must be by your side,” Bruno Le Maire said.

Growth in Germany’s services sector lost momentum amid signs of resurging demand. The HCOB final services Purchasing Managers’ Index (PMI) fell from a 13-month high of 57.2 to 54.1 in June. However, Germany’s PMI remained well above the 50 level, which determines growth in activity. Chief economist at Hamburg Commercial Bank, Cyrus de la Rubia, claimed the sluggish growth was expected, as France, Italy and Spain had already lost momentum a month earlier. “It was also inevitable that the decline in demand in the manufacturing sector, which began in the middle of last year, would have to leave its mark on the service sector at some point,” he said. On average, companies within Europe’s largest economy continued to expect growth in the future, although their expectations had dropped since May. Companies continued to hire more staff than in June, which reinforces a degree of confidence. The composite PMI index, which incapsulates services and manufacturing sectors, fell from 53.9 in May to 50.6 in June. The composite PMI showed overall economic growth in the second quarter, but the index was scarcely above the growth threshold last month. “Germany will probably escape a continuation of the recession that set in during the fourth quarter of last year. However, the risk of the economy slipping into recession again in the second half of the year has increased,” Cyrus de la Rubia said.

U.S. Treasury Secretary Janet Yellen called for market reforms in China and criticized its recent tough actions against U.S. companies and mineral export controls, while China’s premier called on her to “meet China halfway” and put bilateral relations back on track. Yellen met with Premier Li Qiang this week during a visit to Beijing aimed at repairing fractious U.S.-Chinese economic relations, but made clear in her public remarks that Washington and its Western allies will continue to hit back at what she called China’s “unfair economic practices.” Despite talk of U.S.-China economic decoupling, recent data show that the world’s two largest economies remain deeply linked, with two-way trade hitting a record $690 billion last year. “We seek healthy economic competition that is not winner-take-all but that, with a fair set of rules, can benefit both countries over time,” Yellen told Chinese Premier Li Qiang in a meeting that the Treasury said was “candid and constructive.” China released a statement from Li calling for strengthened communication, consensus on economic issues and “candid in-depth and pragmatic exchanges, so as to inject stability and positive energy into Sino-U.S. economic ties.”

Japanese business sentiment ameliorated in the second quarter, suggesting a steady economic recovery. According to a central bank survey, the removal of pandemic policies and a peak in raw material costs endorsed factory output and consumption. Companies are expecting capital expenditure increases and project inflation to remain above the Bank of Japan’s 2% target for the next five years. This provides the policymakers with some optimism that conditions for phasing out their extensive monetary stimulus may be falling into place. “While input prices have declined, output prices continue to rise–a sign companies are being able to pass on costs. That’s a good sign for the BOJ’s inflation outlook and may prod the bank to tweak its yield control policy later this year,” said Atsushi Takeda, chief economist at Itochu Economic Research Institute. The sentiment index for large non-manufacturers improved to +23 last month from +22 three months ago, marking the fifth consecutive quarterly increase and hitting the highest level since 2019. The removal of pandemic curbs boosted tourism demand and improved the sentiment among hotels and restaurants. Inflation still exceeds the Bank of Japan’s 2% goal. Until wages reach a level to sustain the price growth around the BOJ’s 2% target, recently appointed BOJ Governor Kazuo Ueda continues to stress the necessity for an ultraloose monetary policy.

Finally: If the hotdogs and hamburgers this fourth of July tasted just a little bit more like an expensive delicacy, well they were. As Statista’s Martin Armstrong points out, spending on food this fourth is expected to have risen to a record $9.5 billion this year. In 2014, total spending was estimated at just $6.3 billion, and this year’s 23 percent year-over-year increase is the largest on record. With 87 percent of respondents saying they were going to celebrate this year, an average of $93.34 is forecast to be spent per person on food, up from $84.12 last year.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.