7-18-2022 Weekly Market Update

The very Big Picture

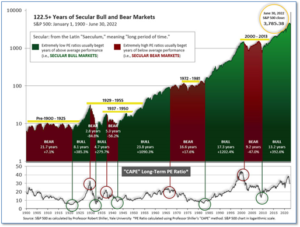

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market is now above that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 28.98, down from the prior week’s 30.13. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 32.27, up from the prior week’s 32.02.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Negative entering July, indicating negative prospects for equities in the third quarter of 2022.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on June 24, and ended the week at 13, up from the prior week’s 12.

In the Markets:

U.S. Markets: Stocks remained volatile in relatively light trading, as investors absorbed inflation data and the beginning of second-quarter corporate earnings reports. The Dow Jones Industrial Average ticked down -0.2% to 31,288, while the technology-heavy NASDAQ Composite declined -1.6% to 11,452. By market cap the large cap S&P 500 declined -0.9%, while the mid cap S&P 400 gave up -0.7% and the small cap Russell 2000 ended the week down ‑1.4%.

International Markets: International markets finished the week predominantly to the downside. Canada’s TSX declined -3.3%, while the United Kingdom’s FTSE 100 gave up -0.5%. France’s CAC 40 finished flat, while Germany’s DAX shed -1.2%. In Asia, China’s Shanghai Composite declined -3.8% but Japan’s Nikkei finished up 1%. As grouped by Morgan Stanley Capital International, developed markets closed down -1.5%. Emerging markets declined ‑3.6%.

Commodities: Most commodities finished the week with sizeable losses. Gold declined -2.2% to $1703.60 per ounce and Silver ended down -3.3% to $18.59. West Texas Intermediate crude oil closed down for a second consecutive week, giving up -6.9% to $97.59 per barrel. Brent crude oil declined -5.6% to $101.16. The industrial metal copper plunged -8.2%.

U.S. Economic News: The number of Americans filing first-time unemployment benefits rose to their highest level since last November, the Labor Department reported. Initial jobless claims rose by 9,000 to 244,000 last week. Economists had expected new claims would inch down to 234,000 from 235,000. That was the highest level of new claims since early November 2021. Meanwhile, the number of people already collecting jobless benefits fell by 41,000 to 1.33 million. That number is now back to pre-pandemic levels.

Small businesses haven’t been this pessimistic about the economy in almost 50 years, the National Federation of Independent Businesses (NFIB) reported. Their small-business optimism index fell 3.6 points to 89.5—its lowest level since the start of the pandemic in 2020. The index has declined in five of the past six months. Furthermore, the share of small firms that expect business conditions to improve in the next six months fell to its lowest level on record. Small businesses once again identified high inflation as their biggest problem. Firms have raised prices to cover their own rising costs, but in many cases, not enough to maintain profit margins, the survey found. “As inflation continues to dominate business decisions, small business owners’ expectations for better business conditions have reached a new low,” said NFIB Chief Economist Bill Dunkelberg. About the only bright spot in the report was that small businesses still report trying to add workers. However, 94% of firms actively trying to hire found “few or no qualified applicants,” the survey said.

The latest Consumer Price Index showed that inflation rose to a 41-year high, as the price of gasoline and food continued to surge higher. The Labor Department reported the Consumer Price Index (CPI) jumped 1.3% last month, pushing the annual rate of inflation up 0.5% to 9.1%–the highest level since November 1981. Meanwhile, the core rate of inflation, which omits food and energy, rose by “just” 0.7%. That was also above forecasts, but the increase in the core rate slowed to 5.9% from 6% in May. The Fed views the core rate as a more accurate measure of future inflation trends because gas and food prices tend to be more volatile. Analysts don’t expect inflation to cool anytime soon. Senior economist Sal Guatieri of BMO Capital Markets wrote, “Inflation may not peak for a while and might remain stubbornly high for longer than anticipated.” Furthermore, the hotter-than-expected inflation numbers means the Federal Reserve may have to counter with a more aggressive rate hike than earlier-anticipated. “The odds of a larger-than-75-basis point Fed rate hike on July 27 just went up materially,” Guatieri added.

Prices again surged at the wholesale level, implying there will be no relief anytime soon for consumers. The Labor Department reported its Producer Price Index (PPI) jumped 1.1% last month, with little evidence that broad inflation pressures were going to moderate in the near future. Economists had expected a 0.8% gain. On an annual basis, the increase in wholesale prices rose to 11.3%, from 10.9%. Just a year-and-a-half ago, prices were rising at a less than 2% pace. If food, gas, and retail trade margins are omitted, so-called ‘core’ producer price rose just 0.3%–its smallest increase in four months. U.S. economist Mahir Rasheed of Oxford Economics stated, “Despite a modest improvement in supply conditions, price pressures will remain uncomfortable in the near term and bolster the Fed’s resolve to prevent inflation from becoming entrenched in the economy.”

Sales at the nation’s retailers rose more than expected last month, as consumers remain resilient despite higher prices. The Commerce Department reported retail sales increased by 1% in June, better than estimates of a 0.9% rise. That marked a big jump from the 0.1% decline in May. However, unlike most other government statistics, the retail figures are not adjusted for inflation. But inflation rose 1.3% during the month, which suggests retail sales were actually slightly negative. Rising costs for food and gasoline in particular helped propel the increase, which was nonetheless broad-based against the various metrics in the report. Andrew Hunter, senior U.S. economist at Capital Economics wrote, “The 1.0% [month-over-month] rise in retail sales in June isn’t as good as it looks, as it mainly reflects the boost to nominal sales values from surging prices.”

The Federal Reserve’s ‘Beige Book’, a collection of anecdotal reports from each of the Federal Reserve’s member banks, stated the U.S. economy grew at a modest pace since mid-May, but several of the central bank’s regional districts reported growing signs of slowing demand and recession concerns. Most districts reported that consumer spending moderated as high food and gas prices diminished discretionary income. Substantial price increases were reported across all districts. The outlook for future GDP growth “was mostly negative,” with business contacts noting expectations of further weakening of demand over the next six to 12 months.

International Economic News: The Bank of Canada raised its policy rate a full point to 2.5% in an effort to curb inflation. The full-percentage-point rate increase (not seen since 1998) surprised markets. The bank cited “higher and more persistent inflation” and added more rate hikes would be needed. The move was more forceful than the 75-basis point increase economists had forecast. In its decision the bank wrote, “With the economy clearly in excess demand, inflation high and broadening, and more businesses and consumers expecting high inflation to persist for longer, the Governing Council decided to front-load the path to higher interest rates.” The Bank of Canada also dramatically raised its near-term inflation forecasts and made clear it expects price gains to go higher, averaging approximately 8 percent in the middle quarters of 2022.

Across the Atlantic, the United Kingdom’s economy unexpectedly returned to growth in May, fueled by a boom in holiday bookings and healthcare expenditures. The UK’s Office for National Statistics said gross domestic product (GDP) rose by 0.5%, following a revised 0.2% decline in April. Despite the overall rise in activity on the month, the latest snapshot revealed a decline in consumer services driven by falling retail sales and a slump in sports activities and recreation. The ONS said healthcare was the biggest driver as more people saw GPs, offsetting the winding down of the coronavirus test and trace and vaccination schemes. Paul Dales, chief UK economist at Capital Economics stated there is “still a real risk” that the economy could fall into recession in the fall when energy prices are set to rise again.

On Europe’s mainland, the Bank of France said the country’s economy grew about 0.25% in the second quarter of the year. The increase came despite record inflation, the knock-on effects of Russia’s invasion of Ukraine and growing uncertainty about the outlook for business. An assessment based on a monthly survey of 8,500 firms published by the central bank showed that industrial activity last month was stable and services advanced slightly. This month, business leaders expect a slight decline in industry and moderate growth in services. Bank of France Governor Francois Villeroy de Galhau stated, somewhat poetically, “Activity isn’t brilliant, but it is resilient.”

Europe’s economic powerhouse, Germany, announced that it will halt all imports of Russian coal next month and Russian oil by the end of the year. A top economic aide to German Chancellor Olaf Scholz announced the move amid pressure on European countries to end their dependence on Russian energy. “In accordance with the sanctions, imports of Russian coal will go down to zero despite the fact that Russia supplied 40% of all our coal,” Joerg Kukies stated. Kukies added that Germany also aims to end its dependence on oil supplies from Russia by the end of the year. “Ridding yourself of that dependence [on the Druzhba oil pipeline] is not a trivial matter, but it is one that we will achieve in a few months,” he said. Germany is the second-largest buyer of Siberian coal after the Netherlands.

In Asia, China – the world’s second-largest economy – reported its worst economic performance in two years adding to concerns of the prospect of a global recession. China’s economy shrank by 2.6% in the second quarter, its National Bureau of Statistics said. On an annual basis, growth slowed to just 0.4%. It was the worst quarterly GDP report since the first quarter of 2020, when China reported a 6.8% contraction as the coronavirus pandemic took hold. The sharp slowdown is a painful setback for China, which last year was leading the pack of major economies in its rebound from the pandemic. Fu Linghui, spokesperson for the National Bureau of Statistics, said, “Looking at the next stage, the risk of stagflation in the global economy is rising.”

Bank of Japan Governor Haruhiko Kuroda warned of “very high uncertainty” over the economic outlook and stressed anew the central bank’s readiness to ramp up stimulus as needed to underpin Japan’s fragile recovery. The remarks reinforced expectations the Bank of Japan will remain the outlier among central banks raising interest rates to combat soaring global inflation. “Uncertainty regarding Japan’s economy is very high” given risks such as the COVID-19 pandemic’s impact, the conflict in Ukraine and rising commodity costs, Kuroda said. “We won’t hesitate to take additional monetary easing steps as necessary,” he stated.

Finally: If it made up the majority of the Labor Department’s “CPI basket”, the rate of inflation would currently be…zero. We’re talking about the ever-reliable $1.50 Costco hot dog combo, priced at $1.50 when introduced in 1985 and unchanged since then. Before Craig Jelinek became CEO of Costco in 2012, he suggested to then-CEO Jim Sinegal that the retailer raise the price of its hot dog combo as they were losing money on it. According to Jelinek, Sinegal said, “if you raise [the price of] the effing hot dog, I will kill you.” Had the Costco hot dog combo just kept pace with inflation, it would now cost about $4.13! (Chart from thehustle.co)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat,0020Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.