6-19-2023 Weekly Market Update

The very Big Picture

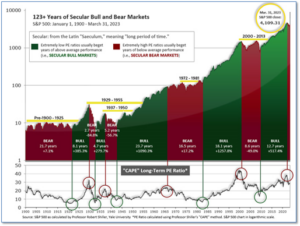

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

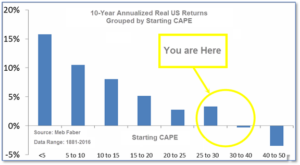

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.78, up from the prior week’s 30.09. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 66.41, up from the prior week’s 63.83. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering April, indicating positive prospects for equities in the second quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on May 25, and ended the week at 30, up 5 from the prior week’s 25.

In the Markets:

U.S. Markets: Favorable data on the inflation front appeared to have helped stocks continue the rally that began in late May. The benchmark S&P 500 index notched its longest stretch of daily gains since November 2021 and its best weekly performance since the end of March. The technology-heavy NASDAQ Composite led the way with a 3.2% gain this week, while the more narrowly focused Dow Jones Industrial Average closed at 34,299, a gain of 1.2%. By market cap, the large cap S&P 500 index added 2.6%, while the mid cap S&P 400 rose 1.5%. The small cap Russell 2000 finished the week up 0.5%.

International Markets: Major international markets finished the week solidly in the green. Canada’s TSX rose 0.4% and the UK’s FTSE 100 added 1.1%. France’s CAC 40 and Germany’s DAX tacked on 2.4% and 2.6% respectively. In Asia, China’s Shanghai Composite rose 1.3%. Japan’s Nikkei surged 4.5%–it’s tenth consecutive week of gains. As grouped by Morgan Stanley Capital International, both developed markets and emerging markets each gained 2.6%.

Commodities: Precious metals finished the week slightly to the downside. Gold pulled back -0.3% to $1971.20 per ounce, while Silver ended the week at $24.13 down -1.2%. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, rose 2.6% last week. Oil bounced back after two weeks of declines. West Texas Intermediate crude oil finished the week up 2.5% to $71.93 per barrel.

U.S. Economic News: The number of Americans filing first-time unemployment benefits remained unchanged last week, leaving it at its highest level since October 2021. The Labor Department reported initial jobless claims came in at 262,000. Economists had expected claims to drop to 245,000. The most recent report showed Texas and Pennsylvania joining Ohio and California in reporting higher claims over the past few weeks. The elevated level of claims suggests the labor market is losing some if its strength. Meanwhile, continuing claims, which counts the number of people already receiving benefits rose by 20,000 to 1.78 million. The gradual increase in continuing claims suggests it’s taking longer for people who lose their jobs to find new ones.

The Federal Reserve decided against what would have been its 11th consecutive interest rate increase as it measures what the impacts have been from the previous 10. “Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy,” the central bank’s post-meeting statement said. However, the surprising aspect of the decision came with the “dot plot” in which each of the individual members of the FOMC indicate their expectations for rates further out. The dots moved decidedly upward pushing the median expectation to a funds rate of 5.6% by the end of 2023. The decision left the Fed’s key borrowing rate in a target range of 5%-5.25%.

Optimism among the nation’s small business owners increased last month even though inflation and quality of labor remained top concerns. The National Federation of Independent Business reported its small business optimism index increased to 89.4 in May from 89.0 in April, remaining well-below the index’s historical average of 98. Still, the reading exceeded expectations of a reading of 88.7. The number of owners expecting better business conditions over the next six months declined one point from April to a net negative 50% in May. “Overall, small business owners are expressing concerns for future business conditions,” NFIB Chief Economist Bill Dunkelberg said. “Supply-chain disruptions and labor shortages will continue to limit the ability of many small firms to meet the demand for their products and services,” he added.

The latest reading of the Consumer Price Index (CPI) showed inflation continued to slow at the retail level. U.S. consumer prices ticked up just 0.1% in May, held down by cheaper gasoline. The small increase matched economists’ forecasts. The annual rate of inflation slowed to 4% from 4.9% marking its lowest level since March 2021. However, “core” inflation that omits food and energy rose 0.4% for the third month in a row. The Fed views the core rate as a better predictor of inflation trends. The annual increase in the core rate slipped to 5.3% from 5.5%–its smallest increase since the fall of 2021. These prices have fallen more slowly than the broader CPI suggesting the fight against inflation is far from over.

At the wholesale level prices receded again, their third drop in the past four months. The Producer Price Index (PPI) fell 0.3% in May, exceeding expectations of just a 0.1% decline. Over the past 12 months, the increase in wholesale prices slowed to 1.1% from 2.3% in the prior month. That was its lowest reading since December 2020. Core PPI, which strips out food and energy costs and trade margins, remained flat last month. The increase in core prices over the past year decelerated to 2.8% from 3.3%–its smallest increase since February 2021. The PPI report captures what companies pay for supplies such as fuel, raw materials and so forth. Analysts use the PPI to get an early indication of future CPI reports as these costs are often passed on to customers.

Sales at the nation’s retailers rose again last month pointing to the resilience of the U.S. consumer. Sales at retailers rose 0.3% in May, far outpacing the 0.2% drop analysts had expected. Retail sales represent about one-third of consumer spending and offer insight into the strength of the economy. Retail sales have clearly slowed over the past year, yet overall consumer spending is still fairly strong and offers little evidence of an impending recession. Looking farther out, senior economist Lydia Boussour of EY Parthenon wrote in a note, “We expect the slowdown in consumer spending to accelerate in the second half of the year as labor market gains falter, the buffer from excess savings shrinks and credit conditions tighten further.”

International Economic News: Former Bank of Canada governor David Dodge says the central bank has a year to 18 months to get inflation under control or risk a return to the “pretty awful era” between the mid-1970s and ’80s characterized by a lack of pricing predictability and social upheaval. “We hope that with just these rather modest, by historical terms, interest rate increases of six per cent or thereabouts that this will be enough to squeeze demand back more in less in line with supply, and we will get very quickly back to a period where people expect prices to be stable again,” said Dodge, one of the authors of an extensive economic outlook report published by law firm Bennett Jones LLP. Reining in inflation will mean forgoing some consumption in the near term, which will be hard on some segments of society, but that is necessary, said Dodge.

The UK economy returned to growth in April, driven by the rebound in consumer spending and fewer strikes, but the prospect of higher interest rates clouds the outlook. Gross domestic product grew 0.2 per cent between March and April, reversing some of the contraction of the previous month, according to data published by the Office for National Statistics. The figure was in line with analysts’ expectations and was driven by the services sector, which expanded 0.3 per cent. The expansion “will further raise hopes that the economy will escape a recession this year”, said Ruth Gregory, economist at the consultancy Capital Economics. However, she added that with the “full drag from high interest rates yet to be felt, it is too soon to sound the all-clear.”

France’s top politicians stated they see the beginnings of global regulation on artificial intelligence coming by the end of this year, with French President Emmanuel Macron saying the country wants to work with the U.S. on rules around the fast-growing technology. The comments come as interest in AI, sparked by the rapid growth of chatbot ChatGPT, continues to rise and governments around the world debate how the technology should be regulated. France has looked to position itself as the European hub for AI development even as the European Union pushes forward with first-of-its kind regulation. Macron, Finance Minister Bruno Le Maire and Digital Minister Jean-Noel Barrot, all spoke at the VivaTech conference in Paris, expressing a desire for global regulation on AI.

The German economy will contract in 2023, two leading economic institutes announced this week, revising down earlier forecasts after persistently high inflation contributed to a weaker-than-expected start to the year. Europe’s largest economy is expected to shrink by 0.2 percent this year, the Berlin-based DIW institute said, after previously predicting modest growth. Germany’s fW Kiel economic institute now sees a contraction of 0.3 percent, down from a previous forecast of 0.5 percent growth. The downgrades come after Germany fell into a mild recession in the final months of 2022 and the start of 2023, as inflation and higher interest rates curbed consumer demand.

China’s central bank has cut its main policy rate for the first time in 10 months as new data reinforced concerns over a stalling post-Covid recovery in the world’s second-largest economy. The People’s Bank of China trimmed its medium-term lending facility rate, a one-year rate that influences bank funding costs, from 2.75 per cent to 2.65 per cent, amid widespread expectations that Beijing would be forced to take further action to support the economy. The move signaled official dissatisfaction with the state of the Chinese economy, which was widely expected to bounce back after authorities abandoned strict coronavirus controls at the start of the year. But growth has remained weak due to a slowdown in the property sector, weaker demand for exports and a lack of business and consumer confidence.

Japan’s benchmark stock index, the Nikkei 225, has jumped nearly 30 percent this year, far outstripping the gains for the S&P 500, the benchmark in the United States. The Nikkei has not been this high since the early 1990s, when Japan was slumping into what is known as the Lost Decade. Company profits are improving, and Japan’s economy, the world’s third largest, is basking in a postpandemic glow: Inflation has finally returned, consumer spending is rising and foreign tourists are back. “The fundamental economic conditions in Japan, including corporate earnings, are better than in the U.S., Europe and China,” said Yuichi Murao, a top executive at Nomura Asset Management in Tokyo. “In terms of G.D.P. growth, Japan is going to outperform.” The increase in Japan’s gross domestic product for the first three months of the year was revised sharply up last week, to an annual rate of 2.7 percent from an initial reading of 1.6 percent.

Finally: German carmaker Mercedes-Benz is the first (but certainly won’t be the last) manufacturer to integrate ChatGPT AI technology into its vehicles. This week Mercedes rolled out a new beta program for over 900,000 vehicles in the U.S. equipped with its MBUX infotainment system. Drivers can activate the new voice assistant to ask complex questions, details about their destinations, or pretty much anything all while keeping their hands on the wheel and eyes on the road. The initiative will be limited to the United States market.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.