5-8-2023 Weekly Market Update

The very Big Picture

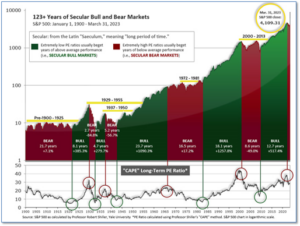

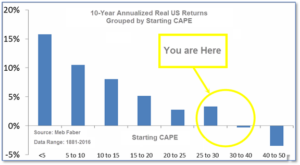

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.73, up from the prior week’s 29.50. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

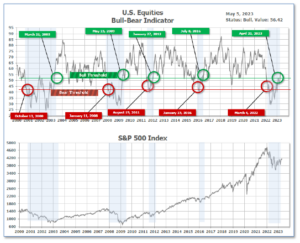

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 56.42, down from the prior week’s 57.43.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering April, indicating positive prospects for equities in the second quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on March 21, and ended the week at 15, up from the prior week’s 14.

In the Markets:

U.S. Markets: Despite a strong rally on Friday, it was a difficult week for U.S. markets. The Dow Jones Industrial Average shed 424 points last week finishing at 33,674—a decline of -1.2%. The technology-heavy NASDAQ Composite ticked up 0.1% to 12,235. By market cap, the large cap S&P 500 finished down -0.8%, while the mid cap S&P 400 declined -1.2%. The small cap Russell 2000 ended the week down -0.5%.

International Markets: Major international markets finished the week mixed. Canada’s TSX retreated -0.5%, while the United Kingdom’s FTSE 100 fell -1.2%. France’s CAC 40 pulled back -0.8%, while Germany’s DAX rose 0.2%. In Asia, China’s Shanghai Composite rose 0.3% and Japan’s Nikkei finished up 1%. As grouped by Morgan Stanley Capital International, developed markets rose 0.4%, while emerging markets gained 0.7%.

Commodities: Precious metals finished the week in the green with Gold rising 1.3% to $2024.80 per ounce, while Silver added 2.8% to $25.93. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -0.2%. Oil finished down for a third consecutive week falling -7.1% to close at $71.34 per barrel of West Texas Intermediate crude.

U.S. Economic News: The number of Americans filing first-time unemployment benefits rose last week as the labor market gradually softens amid higher interest rates cooling the economy. Initial jobless claims rose by 13,000 to 242,000 last week. Economists had expected claims to total 240,000. There was a surge in filings in Kentucky and Massachusetts as well as California. Meanwhile, the number of people already receiving benefits fell by 38,000 to 1.805 million. That was the largest drop in ‘continuing claims’ since last July, suggesting some of the laid-off workers are finding employment.

The April jobs report showed the US labor market remains robust, with more than a quarter million new jobs added to the economy last month as the unemployment rate fell to match its lowest level since May 1969. The Bureau of Labor Statistics reported the US economy added 253,000 nonfarm payroll jobs last month and the unemployment rate dropped to 3.4%. Economists had forecasted a gain of just 185,000 new jobs. Furthermore, the report showed wage growth remained stronger than forecasted in April, with wages rising 4.4% over the prior year, an acceleration from the gains seen in March. By industry, the largest gains were seen in education and healthcare services, which added 77,000 workers last month. Business services employment rose by 41,000 in April, while leisure & hospitality jobs, which have been a significant driver of much of the labor market’s rebound since the pandemic, increased by 31,000. April marks the 13th-straight month reported job gains from the BLS came in higher than had been forecast by Wall Street economists.

The number of job openings tumbled to their lowest point in nearly two years. The Bureau of Labor Statistics reported the number of open jobs in the U.S. totaled 9.59 million in March. That’s down from 9.974 million reported in February—and the third consecutive month that jobs have fallen. Economists had expected a reading of 9.775 million. Julia Pollak, chief economist at ZipRecruiter stated, “Demand for labor is cooling, and the dynamics of the labor market are normalizing. After two years of incredibly rapid churn and highly elevated demand, things are now all going back to normal levels and rates.” Some of the industries seeing the biggest cutback in open positions include those within transportation, warehousing and utilities, construction, and other services.

The services sector maintained a steady pace of growth in April, according to ISM, as new orders increased amid a surge in exports. ISM said its ‘non-manufacturing PMI’ edged up to 51.9 from 51.2 in March. Readings above 50 indicate growth in the services industry, which accounts for more than two-thirds of the economy. Economists had expected a reading of 51.8. However, analysts note that risks to the economy are rising. Credit conditions have tightened and Treasury Secretary Janet Yellen warned that the federal government could run out of money within a month amid a standoff to raise its $31.4 trillion borrowing cap.

Manufacturing activity rebounded from a three-year low last month, but activity remained depressed amid higher borrowing costs and tightening credit. The Institute for Supply Management reported its manufacturing Purchasing Managers’ Index (PMI) rose by 0.8 to 47.1 last month. Economists had forecast a reading of 46.8. It was the sixth consecutive month that the PMI remained well below 50, which indicates contraction. In the details of the report, new orders improved slightly and employment rebounded, but higher borrowing costs and tighter credit raised the risk of a recession this year. ISM says a PMI reading below 48.7% over a period of time generally indicates the economy is in a recession.

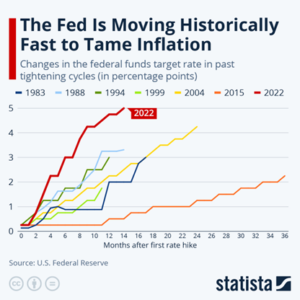

The Federal Reserve raised interest rates by a quarter of a percentage point this week, bringing its benchmark funds rate to 5-5.25%. The increase marked its 10th consecutive rate hike. Powell led off his comments by addressing the state of the US banking industry. “Conditions in the sector have broadly improved since early March, and the US banking system is sound and resilient,” he said. “We will continue to monitor conditions in the sector. We’re committed to learning the right lessons from this episode.” As a result of the banking system turmoil, the Fed expects that credit will continue to tighten for households and businesses and, as a result, slow the economy. “These tighter credit conditions are likely to weigh on economic activity, hiring and inflation,” Powell said. “The extent of these effects remains uncertain.”

International Economic News: Canada’s economy barely expanded in February and early data suggests it contracted in March, which would indicate the slowest quarterly growth in output since 2020. Statistics Canada reported the Canadian economy grew by 0.1% in February. The February figure came in lower than was expected by Statistics Canada as wholesale and retail trade as well as manufacturing all contracted. The federal agency’s preliminary estimate for March suggests the economy contracted by 0.1%. “After sprinting out of the gate to start 2023, the Canadian economy had already hit a wall by March,” CIBC economist Andrew Granthan wrote in a client note.

Britain’s services sector kicked off the second quarter with its fastest growth in a year, boosted by new orders, but it passed the cost of rising wage bills on to consumers, adding pressure on the Bank of England to keep raising interest rates. The final S&P Global/CIPS UK Services Purchasing Managers’ Index (PMI) rose to 55.9 from 52.9 in March, above the 50 threshold for growth and higher than a provisional reading of 54.9. The reading added to a series of improved measures of the economy, which had appeared to be heading for a recession in early 2023. “A strong rate of service sector growth meant that the UK economy started the second quarter of 2023 in positive fashion,” Tim Moore, economics director at S&P Global Market Intelligence said.

Protests erupted in France this week, in the wake of hugely unpopular changes to France’s pension system that were signed into law last month. Over 100,000 people took part in the protest in Paris after one of France’s largest unions, the CGT, had called for “historic” protests following months of unrest and widespread strikes that saw transport grind to a halt and garbage mount in the streets of Paris. In April, France’s Constitutional Council, which plays a similar role to the US Supreme Court, approved the most controversial part of the reform – the raising of the retirement age from 62 to 64.

Germany’s Federal Statistics Office, Destatis, reported Germany’s economy stagnated in the first quarter of 2023 with its gross domestic product (GDP) showing zero growth. Timo Wollmershaeuser, head of forecasts at the ifo Institute stated, “On the one hand, manufacturers are benefiting from easing supply bottlenecks as well as lower energy prices, and they are now on course for growth. On the other hand, high inflation is eroding the purchasing power of private households and causing consumption to shrink.” Overall, the government expects GDP growth of 0.4% in 2023, up from 0.2% projected in late January. Next year, Germany’s economy is forecast to grow more strongly, by 1.6%.

In Asia, China’s factory activity unexpectedly contracted last month as new orders and domestic demand weakened. The Caixin/S&P Global manufacturing purchasing managers’ index (PMI) fell into contraction at 49.5 in April from 50.0 in March. Economists had expected a reading of 50.3. It echoed a similarly disappointing official PMI that shows the unevenness of China’s economic recovery, with the services sector so far outperforming manufacturing and helping the world’s second-largest economy grow a robust 4.5% year-on-year in the first quarter. “The latest survey readings are consistent with still rapid growth at the start of the second quarter, but momentum is slowing relative to what was achieved in the first quarter,” said Julian Evans-Pritchard, head of China Economics at Capital Economics.

Japan and South Korea held their first finance leaders’ meeting in seven years this week and agreed to resume regular dialogue as tensions in the wider region and slowing growth prod them to increase co-operation and mend strained relations. The resumption of bilateral financial discussions comes ahead of Japanese Prime Minister Fumio Kishida’s planned visit to South Korea early next week for talks with President Yoon Suk Yeol. In a joint statement issued after their meeting, Asian finance leaders warned of risks to the region’s economy and called for countries to stay vigilant to potential spillovers from the recent U.S. and European banking sector turmoil. “Japan and South Korea are important neighbors that must cooperate to address various challenges surrounding the global economy, as well as the regional and international community,” Japanese Finance Minister Shunichi Suzuki said at the meeting with his South Korean counterpart Choo Kyung-ho.

Finally: This week the Federal Open Market Committee (FOMC) announced its third consecutive 25 basis point rate increase this year. The Fed has taken very aggressive action to tame inflation over the past 14 months, raising the federal funds target rate by 500 basis points since March 2022. As the following chart from Statista shows, this tightening cycle has been the fastest in more than four decades.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.