5-17-2023 Weekly Market Update

The very Big Picture

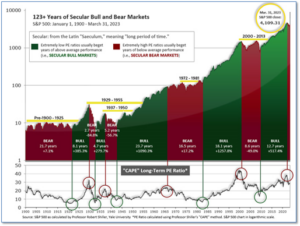

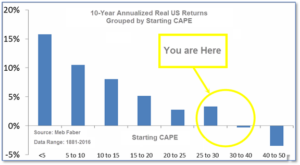

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.50, up from the prior week’s 29.27. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

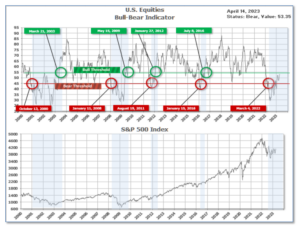

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 53.35, up from the prior week’s 51.28.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering April, indicating positive prospects for equities in the second quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on March 21, and ended the week at 15, up from the prior week’s 14.

In the Markets:

U.S. Markets: The major benchmarks ended the week higher, as investors weighed evidence of slowing growth against signs that inflation pressures were receding a bit more than expected. Materials and industrials shares outperformed within the S&P 500 Index, while technology shares lagged. The Dow Jones Industrial Average added 401 points finishing the week at 33,886, a gain of 1.2%. The technology-heavy NASDAQ Composite ticked up 0.3% to 12,123. By market cap the large cap S&P 500 rose 0.8%, while the mid cap S&P 400 gained 1.7%. The small cap Russell 2000 finished the week up 1.5%.

International Markets: International markets finished the week in the green as well. Canada’s TSX added 1.9% along with the United Kingdom’s FTSE which rose 1.7%. France and Germany added 2.7% and 1.3% respectively. China’s Shanghai Composite closed up for a fifth consecutive week, adding 0.8%. Japan’s Nikkei jumped 3.7%. As grouped by Morgan Stanley Capital International, developed markets added 1.8%, while emerging markets gained 0.8%.

Commodities: Precious metals ended the week mixed. Gold pulled back -0.5% to $2015.80 per ounce, while Silver rose 1.5% to $25.46. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week up 2.3%. Oil finished the week up a fourth consecutive week. West Texas Intermediate crude rose 2.3% to $82.52 per barrel.

U.S. Economic News: The number of Americans filing for first-time unemployment benefits rose by 11,000 to 239,000—a small but notable increase in layoffs. The number of people applying for unemployment benefits is one of the best barometers of whether the economy is getting better or worse. Most of the new jobless claims were filed in California, where a flurry of layoffs at high-tech companies have taken place. Thirty-seven of the 53 U.S. states and territories that report jobless claims showed an increase last week, while 16 posted an increase. Meanwhile, the number of people collecting unemployment benefits across the country fell by 13,000 to 1.81 million. Continuing claims remain low, but the gradual increase since last year suggests it’s taking longer for people who lose their jobs to find new ones. Chief economist Joshua Shapiro of MFR Inc wrote in a note, “Our view remains that layoffs will rise less dramatically than normally might occur as companies do all they can to avoid shedding workers who have been incredibly difficult to recruit and retain.”

Confidence among U.S. small-business owners deteriorated in March as uncertainty from the recent turmoil in the banking sector led to more pessimistic views of business conditions and sales prospects in the short term. The National Federation of Independent Business reported that its small-business optimism index decreased to 90.1 in March from 90.9 in February, well below the index long-term average and erasing the slight gains in confidence registered in the first two months of the year. Still, the reading is above the 89.0 consensus forecast from economists. The decline in confidence was driven by a worsening assessment of the short-term outlook, data from the survey showed. The number of owners expecting better business conditions over the next six months was unchanged from February at subdued levels, but those who expect real sales to be higher decreased markedly. “Small-business owners are cynical about future economic conditions,” NFIB chief economist Bill Dunkelberg said. The NFIB survey provides a monthly snapshot of small businesses in the U.S., which account for nearly half of private sector jobs.

Prices at the consumer level ticked up just 0.1% last month, largely because of a decline in the cost of energy, however overall inflation remains high and shows little sign of subsiding anytime soon. Economists had expected a 0.2% increase. On an annual basis, inflation slowed to 5% from 6% hitting its lowest level since May of 2021. Core inflation, that omits food and energy prices, rose a sharper 0.4%. The annual increase in the core rate moved up to 5.6% from 5.5%. Those prices have remained stubbornly high over the past year. A nearly 5% decline in seasonally-adjusted gas prices was largely responsible for the soft headline on inflation, but oil prices have risen again after OPEC announced it would cut production last week. Senior economist Sal Guatieri of BMO Capital Markets wrote, “The Fed will take some comfort from calmer headline inflation, but services inflation remains stubbornly high, largely due to the tight labor market. Another 25 basis point rate hike seems likely on May 3.”

Minutes released this week showed Federal Reserve officials agreed that stress in the banking sector would slow U.S. economic growth, but were uncertain of the extent. The twelve voting members on the Fed’s interest-rate committee “agree that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation, but that the extent of these effects were uncertain,” the minutes said. Members also said they would continue to be “highly attentive” to inflation risks. Given their assessment of the potential economic effects of the recent banking-sector developments, the Fed’s staff now sees “a mild recession starting later this year with a recovery over the subsequent two years.”

At the producer level, wholesale prices fell 0.5% in March marking its biggest decline in almost three years, potentially a sign of further easing in inflation in the months ahead. Economists had forecast no change in the Producer Price Index. Wholesale costs often precede future inflation trends. The increase in wholesale prices over the past 12 months also slowed again to 2.7%, from 4.9% in the prior month. That’s the lowest reading since January 2021. A separate measure of wholesale prices that strips out volatile food and energy costs as well as trade margins rose a scant 0.1% last month, the government said. That was also below Wall Street’s forecast. The increase in these so-called core prices over the past year eased to 3.6% from 4.5%. The PPI report captures what companies pay for supplies such as fuel, metals, packaging and so forth. These costs are often passed on to customers at the retail level and give an idea of whether inflation is rising or falling.

Sales at the nation’s retailers tumbled again in March in another sign of a softening U.S. economy. The Census Bureau reported sales dropped 1% last month, the fourth decline in five months. Sales had been forecast to drop just 0.4%. Excluding auto dealers and gas stations, sales shrank a smaller 0.3%. Even after setting aside car dealers and gas stations, retail sales were weak. Sales fell in most major categories, including home centers, electronics stores and department stores. The only segment to stand out: Internet retailers where sales jumped 1.9%.

International Economic News: Bank of Canada Governor Tiff Macklem said the BoC is prepared to end quantitative tightening earlier than planned in the event it needs to stimulate the economy. Speaking after the central bank held rates steady, Macklem said policymakers plan to allow their balance sheet to shrink as interest rates return to more normal levels. But he warned that if the economy slows and rate cuts are needed, officials could temporarily halt their quantitative tightening program. “If you’re normalizing rates, we’d expect to continue QT. If you’re dropping rates quickly to provide stimulus you’d probably suspend QT and go back into reinvestment,” Macklem said. The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

Across the Atlantic, the United Kingdom economy stagnated in February as widespread industrial action and persistently high inflation weighed on activity. Data showed a flat GDP in February, missing consensus expectations of 0.1% growth. Both the services and production sectors contracted, partly offset by a record 2.4% expansion in construction. Large-scale strikes had been carried out in recent months by teachers, doctors, civil servants and rail workers, among others — members of the sectors that were the largest contributors to the fall in February services output. “There was anecdotal evidence, reported on monthly business survey returns, to suggest that industrial action in February 2023 had a notable impact on different industries of varying degrees,” the Office for National Statistics said.

On Europe’s mainland, French President Emmanuel Macron shocked Washington last weekend when he argued that Europe shouldn’t get sucked into a U.S. confrontation with China over Taiwan. French President Emmanuel Macron questioned whether “it is in our interest to accelerate [a crisis] on Taiwan” for fear of a “Chinese overreaction” in an interview. He added that the “worst thing” that Europe could do would be to “take our cue from the U.S. agenda” geared to defending Taiwan. Chinese media welcomed the statements with Beijing’s Global Times writing Macron’s statements “signals a dead end for the U.S. strategy of luring Europe to contain China.”

Germany’s Bundesbank President Joachim Nagel announced that the country’s energy worries are over and Europe’s largest economy has the “inherent strength” to recover from the dual shocks of the pandemic and the war in Ukraine. Despite a report from the International Monetary Fund projecting German GDP will contract by 0.1% this year, Nagel said he is “more positive than the IMF” and does not see a recession this year. “The German economy proved a lot over the past couple of weeks and months, so the adaptation capacity of the German industry is pretty high, the energy crisis is more or less solved. So we had a really worried situation in the past, but this is now over, and the outlook is good,” he said.

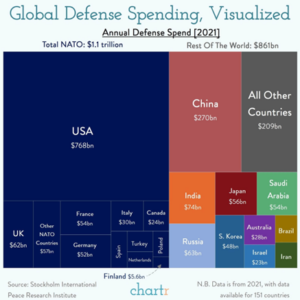

In Asia, the United States is pressing the need for its allies to coordinate economic coercion against the Chinese ahead of its G7 meeting in Japan. US Ambassador to Japan Rahm Emanuel said in an interview days before the ministerial meeting begins in Karuizawa, “It keeps the United States in the center of gravity and helps our allies and alliance and our friends to know that we are in the game.” China is set to be a key focus of discussions at the meeting, which is to lay the groundwork for a leaders’ summit in Hiroshima next month. Emanuel said that China’s strategy on coercion was “part of a defense build-up” and not “some aberration.”

Japan’s new central bank governor Kazuo Ueda said he will communicate closely with the government and guide monetary policy flexibly amid high economic outlook uncertainty. Ueda also said he agreed with Prime Minister Fumio Kishida that there was no immediate need to revise a joint statement between the government and the BOJ, under which the central bank pledges to achieve its 2% inflation target at the earliest date possible. Japan’s long-stagnant inflation and wage growth are showing signs of change. After hitting a 41-year high of 4.2% in January, core consumer inflation remains above 3% as more firms hike prices in response to rising raw material costs.

Finally: this week the Finnish flag was raised outside NATO Headquarters in Belgium as the nation officially became the 31st member of the alliance. Despite having less than 1% of the total population of NATO member countries, the admission is notable due to its 832-mile long shared border with Russia. Finland’s swift application to join NATO last year was the fastest to be approved in the organization’s history. Sweden’s, however, has yet to receive the unanimous approval needed as both Hungary and Turkey are blocking it.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.