5-15-2023 Weekly Market Update

The very Big Picture

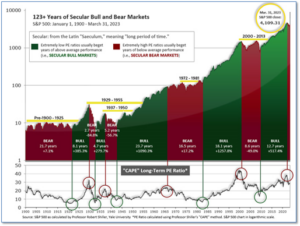

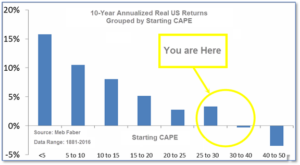

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 28.91, down from the prior week’s 29.73. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

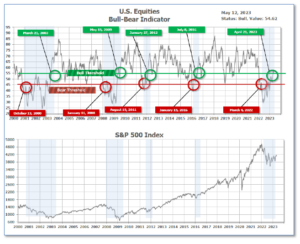

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 54.62, down from the prior week’s 56.42.(see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering April, indicating positive prospects for equities in the second quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on March 21, and ended the week at 11, unchanged from the prior week.

In the Markets:

U.S. Markets: The major indexes finished the week mixed as the flow of first-quarter earnings reports neared its end. The technology-heavy Nasdaq Composite outperformed, while the narrowly focused Dow Jones Industrial Average lagged. The Dow Jones Industrial Average shed 373 points last week closing at 33,301—a decline of -1.1%. The NASDAQ rose for a third consecutive week adding 0.4%. By market cap, the large cap S&P 500 ticked down -0.3%, while the mid cap S&P 400 and small cap Russell 2000 retreated -1.2% and -1.1% respectively.

International Markets: International markets finished the week predominantly to the downside. Canada’s TSX fell -0.6% along with the United Kingdom’s FTSE 100 which pulled back -0.3%. France’s CAC declined -0.2% and while Germany’s pulled back 0.3%. In Asia, China’s Shanghai Composite ended down -1.9%. Japan’s Nikkei finished the week up 0.8%–its fifth consecutive week of gains. As grouped by Morgan Stanley Capital International, developed markets pulled back -1%. Emerging markets ended the week down -2.1%.

Commodities: Precious metals finished the week in the red. Silver plunged -6.9% to $24.15 per ounce, while Gold pulled back -0.25% to $2019.80. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of industrial uses, ended the week down -4%. West Texas Intermediate crude oil closed down for a fourth consecutive week, retreating -1.8% to $70.04 per barrel.

U.S. Economic News: The number of Americans filing claims for first-time unemployment benefits jumped to a one-and-a-half year high last week, pointing to a labor market starting to crack. Initial claims for state unemployment benefits increased by 22,000 to 264,000, its highest reading since October of 2021. Economists had forecast claims would total 245,000. Though claims remain below the 270,000-300,000 level that economists said would signal a deterioration in the labor market, last week’s increase could mark the start of an upward trend as the cumulative and lagged effects of the Fed’s rate hikes broaden out in the economy. Still, the labor market remains tight with 1.6 job openings for every unemployed person in March, well above the 1.0-1.2 range that is consistent with a jobs market that is not generating too much inflation. Meanwhile, the number of people already collecting benefits, known as ‘continuing claims’, increased by 12,000 to 1.813 million. That number remains low by historical standards.

For the first time in two years, U.S. consumer price inflation fell below 5%. The Labor Department reported consumer prices rose 0.4% in April, up from 0.1% in March. However, over the past 12 months inflation increased 4.9%–below the 5% annualized increase in March and significantly down from the 9.1% peak hit last summer. Meanwhile, inflation excluding food and energy, the so-called “core rate”, also rose 0.4% matching forecasts. The core rate remains up 5.5% over the past year. Shelter costs were the biggest contributor to headline inflation, but that’s also been receding. The 0.4% gain in shelter in April was the lowest in a year. Tom Simons, economist at Jefferies wrote in a note to clients, “Inflation remains stubbornly firm, but there are some encouraging signs in this data we haven’t seen in a long time. Some of the biggest drivers of inflation this month seem like they may be idiosyncratic (e.g. gasoline and used cars, while other persistent drivers of inflation over the past 2 years show some signs of softening.”

In further good news on the inflation front, prices at the producer level ticked up just 0.2% in April as inflation pressures continue to ease. Economists had expected an increase of 0.3%. Excluding food and energy, the core Producer Price Index (PPI) rose 0.2%, matching expectations. On an annual basis, headline PPI increased just 2.3%–its lowest reading since January 2021. Most of the gain in producer prices was due to an increase in services. Quincy Krosby, chief global strategist at LPL Financial wrote, “This morning’s PPI release indicates that prices are inching lower, a significant indicator for a market concerned about an elevated trend in prices paid.”

Sentiment among the nation’s consumers tumbled to a six-month low on renewed fears of an imminent recession. The University of Michigan reported its gauge of consumer sentiment fell to a preliminary May reading of 57.7 from a reading of 63.5. It’s at its lowest level since November of last year. Economists had expected a reading of 63. Americans view on near-term inflation moderated slightly in May. They now expect the inflation rate in the next year to average about 4.5%. Inflation expectations had surged to 4.6% in April from 3.6% in March. In the details of the report, the gauge that measures what consumers think about their financial situation — and the current health of the economy — fell to 64.5 from 68.2 in April. Another measure that asks about expectations for the next six months plunged to 53.4 in May from 60.5 in the prior month.

International Economic News: Analysts hit Canadian banks with a wave of downgrades as a looming recession weighs on outlooks. Barclays Bank PLC analyst John Aiken downgraded many of the nation’s largest banks writing, “While we do not anticipate that the Canadian banks’ second quarter will demonstrate much earnings weakness, we believe that cracks in the foundation will become evident. Further, with an uncertain outlook and a looming recession, we anticipate that there will continue to be pressure on the banks’ valuations and declining confidence in their earnings outlook.” Aiken added that he’s still expecting loans to eke out some growth across the banks, along with help from a stronger rebound in the spring housing market.

The Bank of England hiked its key interest rate by 25 basis points and revised its economic projections to now exclude the possibility of a U.K. recession this year. The Monetary Policy Committee voted 7-2 in favor of the quarter-point increase to take the main bank rate from 4.25% to 4.5%, as the bank reiterated its commitment to taming stubbornly high inflation. The headline consumer price index rose by an annual 10.1% in March, driven by persistently high food and energy prices. The MPC no longer expects the U.K. economy to enter a recession this year, according to the updated growth forecasts in its accompanying Monetary Policy Report. U.K. GDP is now expected to be flat over the first half of this year, growing 0.9% by the middle of 2024 and 0.7% by mid-2025.

On Europe’s mainland, French Foreign Minister Catherine Colonna and her Chinese counterpart Qin Gang agreed on the need to “develop an economic relationship that is both stronger and more balanced”, the foreign ministry in Paris said following a meeting this week. China’s foreign minister Qin Gang said in a separate statement the two countries should explore new areas of cooperation and build a more resilient transnational supply chain. Qin added that China’s determination to promote high-quality development and a high-level opening up is unswerving, and it is willing to work with France and other countries in the world. Qin said the two sides should strengthen cooperation in international affairs and work together to address global challenges including the Ukraine crisis.

Germany’s financial regulator warned that the country’s banking system is undergoing a real-life stress test amid the current volatility, also predicting significant weakness in Germany’s commercial property sector. Mark Branson, president of the German regulator BaFin (Federal Financial Supervisory Authority), stated Germany has seen the same impacts from higher rates as many other nations around the world. He added that the German banking system “has taken some pain,” but highlighted that there is “no systemic danger” and the financial system has managed to absorb the impacts of higher rates well. “We don’t have a global banking crisis at the moment, but we have a nervous time and a kind of real-life stress test for parts of the system.”

In Asia, China’s imports contracted sharply while export growth slowed reinforcing views of a slowdown in global economic growth. China’s economy grew faster than expected in the first quarter thanks to robust services consumption, but factory output lagged and the latest trade numbers remain far below pre-pandemic levels. Inbound shipments to the world’s second-largest economy fell an annualized 7.9% in April, extending the 1.4% decline seen a month earlier. Exports grew 8.5%, down from the 14.8% surge in March, customs data showed. Xu Tianchen, an economist at the Economist Intelligence Unit stated, “At the beginning of this year, one would assume that imports will easily surpass 2022 levels following the reopening, but that hasn’t been the case.”

The Group of Seven’s top financial leaders met in Japan this week united in their support for Ukraine and their determination to enforce sanctions against Russia. The finance ministers and central bank chiefs ended three days of talks in Niigata, Japan, with a joint statement pledging to bring inflation under control, help countries struggling with onerous debts and strengthen financial systems. They also committed to collaborating to build more stable, diversified supply chains for developing clean energy sources and to “enhance economic resilience globally against various shocks.” The leaders pledge to work together both within the G-7 and with other countries to “enhance economic resilience globally against various shocks, stand firm to protect our shared values, and preserve economic efficiency by upholding the free, fair and rules-based multilateral system.”

Finally: Mother’s Day is an annual celebration that honors mothers and motherhood. The modern holiday was first celebrated in the United States in 1908, and later in 1911 it was observed as a holiday in all U.S. states. Initially the holiday was celebrated out of sentiment, however, it was soon commercialized when Mother’s Day cards were put on shelves in the early 1920s. In 2022, U.S. consumers planned to spend nearly three and a half billion U.S. dollars on just gift cards for Mother’s Day. This year, analysts expect consumers to spend almost $36 billion celebrating their mothers.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.