5-3-21 Weekly Market Update

The very Big Picture

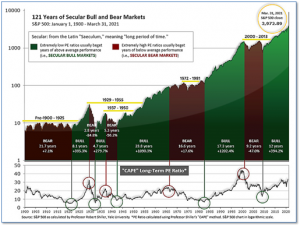

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 37.56, unchanged from the prior week. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The big Picture:

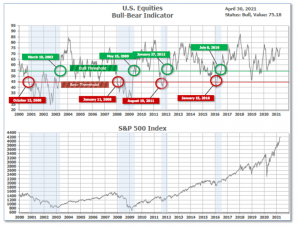

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 75.18 up from the prior week’s 74.26.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive on March 31, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on April 28 and ended the week at 19, up from the prior week’s 15.

In the Markets:

U.S. Markets: The major U.S. indexes ended the week mostly lower, but the S&P 500, Nasdaq Composite, and the S&P MidCap indexes all hit new highs before surrendering their gains late in the week. The Dow Jones Industrial Average shed 169 points to finish the week at 33,874, a decline of -0.5%. The technology-heavy NASDAQ Composite closed lower for a second week, giving up -0.4%. By market cap, the large cap S&P 500 finished flat, while the mid cap S&P 400 retreated -0.7% and the small cap Russell 2000 declined -0.2%.

International Markets: International markets finished the week mixed. Canada’s TSX rose 6 points to 19,108, essentially unchanged, while the United Kingdom’s FTSE 100 added 0.5%. On Europe’s mainland, France’s CAC 40 rose 0.2%, while Germany’s DAX declined -0.9%. In Asia, China’s Shanghai Composite retreated -0.8% and Japan’s Nikkei gave up -0.7%. As grouped by Morgan Stanley Capital International, both developed and emerging markets ended down -1.2%.

Commodities: Energy rebounded following last week’s decline. West Texas Intermediate crude oil rose 2.3% to $63.58 per barrel. Precious metals closed to the downside for a second week. Gold retreated -0.6% to $1767.70 per ounce, while Silver declined -0.8% to $25.87. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses rallied 3%.

April Summary: The Dow and NASDAQ Composite gained, 2.7% and 5.4%, respectively, while the large cap S&P 500 rose 5.2%, the mid cap S&P 400 gained 4.4%, and the small cap Russell 2000 added 2.1%. Almost all international markets finished April in the green. Canada’s TSX rose 2.2% while the United Kingdom’s FTSE 100 surged 3.8%. France’s CAC 40 added 3.3%, while Germany’s DAX 0.8%. China’s Shanghai Composite ticked up a bare 0.1%, but Japan’s Nikkei finished the month down -1.3%. As grouped by Morgan Stanley Capital International, emerging markets gained 1.2%, while developed markets rallied 3.0%. It was a solid month for commodities as oil gained 7.5%, gold rose 3.0%, silver added 5.5%, and copper surged 11.8%.

U.S. Economic News: The number of Americans filing first time claims for unemployment benefits dropped to another pandemic-low last week, with the accelerating pace of COVID vaccinations helping to support the labor market’s recovery. The Department of Labor reported initial jobless claims last week fell by 13,000 to 553,000. Economists had expected 542,000 new claims. It was the third consecutive decline in claims and the lowest level since March 2020. Continuing claims, which counts the number of Americans already receiving benefits, edged up by 9,000 to 3.66 million. “A growing number of employers report struggling to find qualified workers, particularly for entry level or lower wage positions,” Bankrate senior economic analyst Mark Hamrick said in an email. “The hard-hit leisure and hospitality sector, including bars and restaurants, appears to be ground zero for this challenge.”

The cost of purchasing a home increased by a record amount last month, according to two widely followed home price barometers. S&P CoreLogic Case-Shiller reported it index of home prices across 20 large cities increased at an annual pace of 11.9% in February. Month-over-month, home prices rose 1.2%–their biggest gain since February 2006. Prices rose in all of the 20 cities tracked by Case-Shiller. Among these cities, Phoenix saw the largest increase once again with a 17.4% leap, followed by San Diego (up 17%) and Seattle (up 15.4%). The separate national index, which measures home prices across the country, displayed a similar 12% gain over the past year.

The confidence of America’s consumers jumped to a 14-month high as rising vaccination counts, falling coronavirus cases, and a surge in hiring eased worries over the pandemic. The Conference Board reported its index of consumer confidence climbed 12.7 points to 121.7 this month. That’s the highest level since February of 2020. Economists had expected a reading of just 113. In the report, the part of the survey that tracks how consumers feel about the economy right now surged to a 13-month peak of 139.6. Confidence in the future still hasn’t returned to pre-pandemic levels, however. The gauge that assesses how Americans view the next six months–the so-called future expectations index–only rose slightly to 109.8 from 108.3. The index stood close to a 20-year high of 132.6 shortly before the crisis began.

Orders for goods expected to last at least three years, so called “durable goods”, rebounded last month following a poor reading in February. However, manufacturers note that shortages of key supplies are still hampering production. The Census Bureau reported ‘Durable Goods Orders’ rose 0.5% last month. Economists had expected a 2.2% increase. Notably, orders for new cars and trucks increased 5.5% in March after slumping more than 9% in the prior month. Semiconductor shortages are still constraining production of some models, but automakers have managed to keep most of their assembly lines going. Furthermore, durable goods orders would have been three times stronger in March if not for a sharp drop in bookings for commercial and military aircraft. If transportation is excluded, new orders actually rose 1.6% in March. “Core orders”, which excludes defense and transportation, rose 0.9% in March. Manufacturers reported their biggest obstacles are shortages of key supplies, a lack of skilled labor, and rising prices for raw materials.

The sentiment of American consumers soared in March after most Americans received their $1400 stimulus checks. Consumers spent their checks on new cars, recreational goods, and takeout food in March, giving a big shot in the arm to an economy still recovering from the coronavirus pandemic. The government reported consumer spending soared 4.2% in March. Economists had expected a 4% increase. Economists predict even faster growth in the spring as vaccinated Americans get out and about and businesses ratchet up production to meet rising demand. Meanwhile, a key measure of inflation known as the PCE, increased 0.5% month-over-month in March. That pushed the yearly average up to 2.3% from 1.5% in the prior month, and analysts state it’s likely to head higher still over the next few months. Mickey Levy, chief economist for Americans at Berenberg Capital Markets stated, “PCE inflation will likely rise to 3% and the core PCE inflation close to 2.5%. Although these sharp spikes will dissipate, we anticipate the robust growth in aggregate demand will support more sustained inflation pressures.”

The Federal Reserve reiterated its strategy of supporting the economy with ultra-low interest rates, even as it saw broad signs of faster growth. The central bank held a key short-term interest rate near zero and maintained monthly purchases of $120 billion in Treasury and mortgage-backed bonds. These policies have enabled a housing boom and made it cheap for consumers and businesses to borrow. Chairman Jerome Powell said the Fed would stay the course until the economy strengthened even further and coronavirus cases fell sharply. Powell reiterated that the Fed is not considering a pullback anytime soon. “There is a long way to go until we reach our goal,” he said.

Real Gross Domestic Product is nearly back to pre-recession levels as GDP increased at a 6.4% annual rate in the first quarter—a 2.1% increase over the previous quarter. It was the third consecutive quarterly gain following the deep contraction in the first half of 2020. Real output is now 0.4% higher than a year ago, and only 0.9% short of its pre-pandemic peak. The swift recovery has been supported by the successful vaccine rollout this year and multiple rounds of fiscal and monetary stimulus. Total COVID fiscal support has amounted to nearly 25% of 2020 GDP. Nearly all GDP components increased in the first quarter.

International Economic News: The Bank of Canada reported it is expecting strong consumption-led growth in the second half of the year as vaccinations against COVID continue. In comments to the House of Commons Finance Committee, Governor Tiff Macklem stated that slack in Canada’s economy should be absorbed in the second half of next year. The bank signaled last week it could start hiking rates from their record lows in late 2022, as it sharply boosted its outlook for the Canadian economy and reduced the scope of its bond-buying program. Macklem said the biggest potential cause of uncertainty was how the coronavirus progressed.

Global investment bank Goldman Sachs believes the United Kingdom’s economy will grow faster than the United States due to its accelerated rollout of the COVID-19 vaccine. Early indicators show the country is bouncing back faster than expected, said Goldman economist Sven Jari Stehn, as half the population has now had its first COVID-19 shot and restrictions on nonessential shops and restaurants have been relaxed. “The U.K. economy is rebounding sharply from the COVID crisis,” said Stehn, in a note. “Given recent upward revisions to real gross domestic product, our 2021 forecast is now at a striking 7.8% for 2021, above our expectations for the U.S. and sharply above the Bloomberg consensus of 5.5%.” The turnaround is all the more surprising because the U.K. was the worst-performing economy of the G-7 last year, with an economy that shrank by 9.8%.

On Europe’s mainland, French Economy Minister Bruno Le Maire and German Finance Minister Olaf Scholz unveiled their respective national recovery and resilience plans at a joint press conference ahead of the deadline set by the European Commission. “It was important for us to make this presentation together, because Germany and France have been working hand in hand since the beginning of the crisis,” said Le Maire, who voiced hope that the French economy would return to 2019 levels by 2022. “We are not introducing reforms for the benefit of the European Commission. We are introducing reforms for the benefit of French citizens and the nation,” Le Maire said. France plans to invest 100 billion euros through ‘France Relance’, a strategy based on ecology, competitiveness and social and territorial cohesion. Germany, for its part, has announced that 40% of the budget allocated to the recovery, worth 11 billion euros–will be earmarked for the climate.

In Asia, Taiwan’s government has accused China of waging economic warfare against the island’s technology sector by stealing intellectual property and enticing away engineers, as its parliament considers strengthening legislation to prevent such alleged activity. Taiwan is home to a thriving and world-leading semiconductor industry, used in a wide variety of products from vehicles to smart phones, and the government has long been worried about China’s efforts to copy that success. Four Taiwanese policymakers from the ruling Democratic Progressive Party are leading a proposal to amend the commercial secrets law to widen the scope of what is considered a secret and toughen penalties. In a report to Parliament about the proposed amendments, Taiwan’s National Security Bureau blamed China for most cases of industrial espionage by foreign forces discovered in recent years.

Japan’s parliament approved joining the world’s largest free-trade deal, the Regional Comprehensive Economic Partnership (RCEP), as signatories aim for it to come into effect from the start of next year. The approval by Japan’s upper house comes after the lower house gave the green light earlier this month and a day after China called for the deal to be ratified to shore up the economy in the Asia-Pacific. The China-backed RCEP was signed in November of last year and included the 10 members of the Association of Southeast Asian Nations (Asean) plus China, Japan, South Korea, Australia and New Zealand. By eliminating tariffs on 91% of goods, the RCEP will create a free-trade zone covering nearly one-third of the world’s economy, trade and population.

Finally: With upward price pressures already impacting the economy in areas like construction and building supplies, it was only a matter of time before food price inflation arrived at a supermarket near you. The Bloomberg Agriculture Spot Index has risen by 76% year-over-year – the biggest rise in nearly a decade. This is more than just a problem at the American dinner table as there is extensive literature connecting big jumps in food prices to periods of social unrest. The Arab Spring unrest in 2010-11 coincided with the last jump of this magnitude. Deutsche Bank’s Jim Reid points out that “…emerging markets are more vulnerable to this trend, since their consumers spend a far greater share of their income on food than those in the developed world.” And Warren Buffet said at this weekend’s Berkshire Hathaway annual meeting that “We are seeing substantial inflation. We are raising prices. People are raising prices to us, and it’s being accepted.” Berkshire Hathaway owns, among many other holdings, food processing giant Kraft Heinz.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.