5-17-21 Weekly Market Update

The very Big Picture

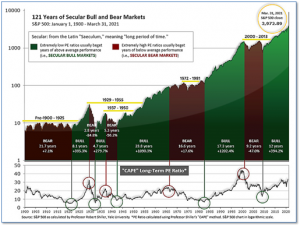

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 37.32, down from the prior week’s 37.84. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The big Picture:

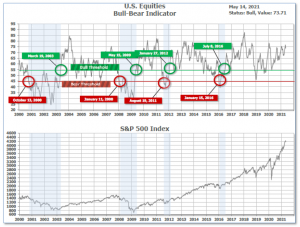

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 73.71 down from the prior week’s 76.55.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive on March 31, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned Negative on May 12 and ended the week at 9,down from the prior week’s 18.

In the Markets:

U.S. Markets: U.S. stocks fell further from record highs as investors confronted clear signs of higher inflation, but a rally late in the week lessened the week’s declines. The Dow Jones Industrial Average retraced some of last week’s gain shedding -1.1% to 34,482. The technology-heavy NASDAQ Composite had its fourth consecutive week of declines, falling -2.3%. By market cap, the large cap S&P 500 retreated -1.4%, while the mid cap S&P 400 and small cap Russell 2000 finished the week down -1.7% and -2.1%, respectively. Within each market cap grouping, the “Value” group performed considerably better than the “Growth” group.

International Markets Canada’s TSX declined -0.5%, while the United Kingdom’s FTSE 100 gave up -1.2%. On Europe’s mainland, France’s CAC 40 finished the week unchanged, while Germany’s DAX added 0.1%. In Asia, China’s Shanghai Composite rose 2.1% while Japan’s Nikkei dropped a sharp -4.3%. As grouped by Morgan Stanley Capital International, developed markets declined -1.1% and emerging markets retreated -3.2%.

Commodities: Precious metals finished the week mixed. Gold rose 0.4% to $1838.10 per ounce, while Silver declined ‑0.4% to $27.36. Crude oil rose for a third consecutive week. West Texas Intermediate crude finished the week up 0.7% to $65.37 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -1.98% after five consecutive weeks of gains.

U.S. Economic News: The number of Americans filing first-time unemployment claims last week fell to a new pandemic low, reflecting the more aggressive efforts by companies to hire new workers amid a rapid economic recovery. The Labor Department reported initial jobless claims dropped by 34,000 to 473,000 last week. It was the fifth decline in a row. Economists had forecast new claims would total a seasonally-adjusted 500,000. Businesses are hiring more people as the economy moves toward a full re-opening and consumers venturing back out to shop and dine. New applications for jobless benefits fell the most in Michigan, New York, Florida and Vermont. The only states to post a notable increase in new claims were Georgia and Washington.

The number of job openings in the U.S. topped 8 million in March for the first time ever, the Labor Department reported. The number of job openings is now well above pre-pandemic levels and easily exceeds the all-time peak of 7.57 million set in November 2018. They had fallen to as low as 4.6 million last year in the early stages of the pandemic. Job openings rose the most in March at restaurants and hotels, two of the industries deeply damaged by the pandemic. Job openings in the sector increased by 185,000 to 993,000—the second highest level ever. Meanwhile, the “quits rate” rose one tick to 2.7%, matching a 20-year high. The quits rate is rumored to be closely watched by the Federal Reserve as a more accurate picture of the labor market as it is assumed one would only leave a position for a more lucrative one, rose one tick to 2.7%.

A record number of small business owners reported they were unable to fill open jobs last month, adding to the controversy over whether enhanced unemployment benefits are encouraging scores of people to remain out of the labor force. The National Federation of Independent Business (NFIB) reported 44% of small businesses said job openings went unfilled in April. The NFIB is the nation’s largest small-business lobbying group. NFIB chief economist Bill Dunkelberg stated, “Small-business owners are seeing a growth in sales but are stunted by not having enough workers. Finding qualified employees remains the biggest challenge for small businesses and is slowing economic growth.” After the disappointing jobs report, the U.S. Chamber of Commerce called on Washington to end a temporary $300 federal stipend that’s not set to expire until September. About one in four unemployed workers earns more from government benefits than they would from their prior job, according to the Chamber.

Inflation in the U.S. soared to a 13-year high in April the government reported, as businesses cope with supply shortages and the rising cost of goods and services. The Consumer Price Index (CPI) leaped 0.8% in April, matching its biggest monthly increase since 2009. Economists had been expecting just a 0.2% advance. The rate of inflation over the past year jumped to 4.2% from 2.6%–the highest level since 2008. The pace of inflation surged after years of being range-bound, largely due to the rapid reopening of the U.S. economy. Senior Federal Reserve officials insist the increase is temporary, contending that inflation will subside by next year once the pandemic fades. Meanwhile, core CPI, which excludes the often-volatile food and energy categories, rose an even bigger 0.9%. That pushed the annual core inflation rate up to 3% from 1.6%–the highest level in 26 years.

Wholesale prices rose at their fastest level since 2009. The Labor Department reported its Producer Price Index jumped 0.6% last month, double economists’ forecasts. Furthermore, the rate of wholesale inflation over the last 12 months climbed to 6.2% from 4.2% in the prior month. The current reading is at its highest level since the index was reformulated in 2009. Back then a record spike in the price of oil drove most of the increases in wholesale prices. Now the costs of a broad range of raw and partly finished goods are rising, ranging from farm produce to computer chips. About two-thirds of the increase in wholesale prices last month was concentrated in services such as air travel, medical care, financial advice, retailing and transportation. The core rate of wholesale inflation, meanwhile, also rose by 0.7% last month. The core rate is a less volatile measure that strips out food, energy and trade margins. The increase in the core rate over the past 12 months moved to 4.6% from 3.1%. That’s the biggest gain since the government first began calculating the rate in 2014. Senior economist Jennifer Lee of BMO Capital Markets wrote in a note to clients, “There is only so much that producers can absorb before they begin to share the pain with the consumer level and that has already begun.”

International Economic News: Bloomberg News is reporting the Canadian government is holding internal discussions about plans to reopen the United States-Canada border to non-essential travel. The border has been closed to non-essential travel since March 2020 and is still closed until at least May 21. “There is absolutely no reason why the U.S.-Canadian border can’t open to those who have been vaccinated both on the U.S. side and the Canadian side,” said New York Rep. Brian Higgins. “We are two countries but really one region, we are a regional economic block that has been suffering, in terms of tourism and families,” said Rep. Chris Jacobs. According to Bloomberg, over one-third of Canadians have received at least one COVID-19 vaccine, and over 45% of all Americans have received at least one COVID-19 vaccine.

Across the Atlantic, a rapid rollout of the Covid-19 vaccine across the United Kingdom lifted GDP by 2.1% in March, helping prevent a steep decline in the economy. The economy retreated by a better than expected 1.5% during the first quarter of 2021 as the UK’s vaccine program allowed the government to begin easing restrictions while businesses adapted to the constraints at a quicker pace than expected. Economists upgraded their growth forecasts for the rest of the year after the figures from the Office for National Statistics showed momentum in the economy exceeded their expectations.

On Europe’s mainland, French President Emmanuel Macron’s plans for bringing France out of the pandemic aren’t just about re-opening restaurants, boutiques and museums, but about preparing his run for a second term. A year before the next presidential election, Macron is focusing on saving jobs and reviving the pandemic-battered French economy as his country inches out of its third partial lockdown. While he has not officially declared his candidacy, Macron has made comments suggesting he intends to seek re-election. The coronavirus reopening strategy Macron unveiled this month calls for most restrictions on public life to be lifted June 30, when half of France’s population is expected to have received at least one vaccine shot.

Germany’s Economy Minister Peter Altmaier stated Europe’s largest economy can expect a strong recovery from the coronavirus pandemic, with an even more positive outlook for 2022. The German economy will grow between 3 and 4% this year as coronavirus restrictions are lifted, the country’s economy minister said. “By 2022, Germany will have recovered its old strength,” Peter Altmaier predicted in comments to German tabloid Bild. It is a positive forecast for Europe’s largest economy that shrank by almost 5% last year as entire sectors were put on hold amid the COVID-19 pandemic.

In Asia, the Australia and New Zealand Banking group, commonly called ANZ, warned that China’s aging population will have a big impact on the world as the global supply chain is highly reliant on the world’s second-largest economy. China’s latest census showed the population of the mainland grew to 1.41 billion people as of Nov. 1, 2020. That was the slowest growth rate since the 1950s. “The trend of the old age dependency is going to rise…This is a warning not only for China, but also across the whole world, as China is the core of the supply chain,” Raymond Yeung, Greater China chief economist at ANZ. “Over the next few years, China will be losing 70 million (of its) workforce … so this is a big shock to the global supply chain.”

Japan’s economy is set to grow much slower than previously hoped this quarter, weighed down by extended emergency measures put in place to halt a rise in coronavirus infections, a Reuter’s poll showed. According to the poll of 33 economists Japan’s economy is likely to expand an annualized 1.7% this quarter, less than half the 4.7% projected just last month. Nearly all the economists polled believe the government will produce an extra budget to support the world’s third-largest economy, with 60% expecting it to come before the end of the third quarter.

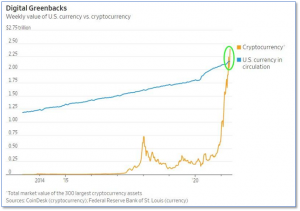

Finally: An interesting event occurred this past week. The total market value of the 300 largest cryptocurrency assets surpassed the value of all physical U.S. dollars in circulation. Statistician Willy Woo analyzed recent trading data and concluded this year’s bull run is different from the rest because speculative hands are not holding and seasoned investors – including banks and institutions – are buying up the slack at higher prices than ever. “This cycle is different; the movement of coins to strong holders is unprecedented,” he summarized.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.