5-20-19 Weekly Market Update

The very big picture:

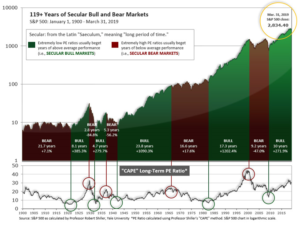

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”). The market is currently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 30.14, down from the prior week’s 30.38, above the level reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In the big picture:

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 62.85, down from the prior week’s 66.32.

In the intermediate and Shorter-term picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned negative on March 22nd. The indicator ended the week at 25, down from the prior week’s 29. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was positive entering April, indicating positive prospects for equities in the second quarter of 2019.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is historically too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) remains positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is positive for Q2, and the shorter (weeks to months) timeframe (Fig. 4) is negative. Therefore, with two indicators positive and one negative, the U.S. equity markets are rated as Neutral.

In the markets:

U.S. Markets: The major U.S. indexes ended the week lower despite a midweek rally that erased most of Monday’s steep losses. Large caps outperformed smaller-cap benchmarks, and the small cap Russell 2000 index finished the week as the only major index back in “correction” territory (down 10% from recent highs). The Dow Jones Industrial Average finished the week down -0.7% to 25,764. The technology-heavy NASDAQ Composite fell a steeper -1.3%, following last week’s -3% decline. The large cap S&P 500 retreated -0.8%, while the mid cap S&P 400 index and Russell 2000 index ended the week down a much larger -2.3% and -2.4%, respectively.

International Markets: Canada’s TSX rose 0.6%. Major European markets finished the week solidly to the upside with all major indexes rebounding from last week’s declines. The United Kingdom’s FTSE rose 2%, while France’s CAC 40 gained 2.1% and Germany’s DAX added 1.5%. But In Asia, China’s Shanghai Composite ended down -1.9% and Japan’s Nikkei declined -0.4%. As grouped by Morgan Stanley Capital International, developed markets finished down -0.9% while emerging markets plunged over -4.0%.

Commodities: Precious metals retreated, with gold declining -0.9% to $1275.70 an ounce and silver falling -2.7% to $14.39. Oil rebounded following 3 consecutive weeks of declines by rising 2% to $62.92 per barrel. The industrial metal copper, seen by some as a barometer of world economic health due to its variety of uses, declined for a fifth straight week, down -1.3%.

U.S. Economic News: The Labor Department reported the number of Americans seeking first-time unemployment benefits fell by 16,000 to 212,000, their lowest level in a month. The decline pulled new jobless claims back near a 50-year low. Economists estimated new claims would total 217,000. The less-volatile monthly average of new claims rose by 4,750 to 225,000. Continuing claims, which counts the number of people already receiving benefits, fell by 28,000 to 1.66 million. That number is reported with a one-week delay.

Confidence among the nation’s homebuilders rose to a 7-month high as headwinds in the housing market continue to ease. The National Association of Home Builders’ (NAHB) monthly confidence index rose 3 points to 66 this month, its highest reading since last fall. Economists had expected just a one point increase. In May, the sub-gauge that tracks current sales conditions jumped 3 points to 72, while the component that measures expectations over the next six months ticked up a point to 72. The NAHB’s index of buyer traffic rose 2 points to 49. Economists use the NAHB’s confidence index as a gauge of likely home building industry activity. If builders are more confident in market conditions, they’re more likely to break ground on more houses, leading to more jobs and overall economic activity.

Construction on new homes climbed almost 6% last month, but the reading remained below last year’s pace. The Commerce Department reported housing starts increased to an annualized rate of 1.24 million last month, exceeding forecasts of a 1.21 million pace. Meanwhile permits to build new homes rose less than 1% last month to a 1.3 million annual rate. That suggests builders are unlikely to increase construction beyond current plans. Both housing starts and permits are running below last year’s pace. In the details, single-family homes, which represent the bulk of new homes being built and sold, advanced 6.2% to an 854,000 annual rate. Work on multi-dwelling units, such as apartments, rose a smaller 2.3% to a 359,000 annual rate.

Sentiment among the nation’s consumers jumped to a 15-year high this month according to the University of Michigan’s Consumer Sentiment index. The index surged 5.2 points to 102.4, blowing away economists’ expectations of a reading of 97.1. In the details, the index for consumer expectations shot higher, rising to 96 from 87.4 in April. In addition, the measure of current economic conditions ticked up a tenth of a point of 112.4. In its release, the University of Michigan pointed out the tight jobs market fueled the increase in confidence. In addition, they noted, the readings were recorded before the trade negotiations with China broke down. Richard Curtin, chief economist of the survey noted, “Those who held negative views about the impact of tariffs on the economy and pricing had values on the expectations index that were 25 points lower, and expected the year-ahead inflation rate to be 0.6 percentage points higher.” That suggests the index is set up for weaker readings ahead.

The trade dispute with China doesn’t appear to have added much to U.S. inflation (at least not yet), according to the Bureau of Labor Statistics (BLS). The BLS reported import prices rose 0.2% in April, predominantly due to an increase in the cost of oil. Ex-energy there was little evidence of rising inflation. The increase was well below Wall Street forecasts of a 0.7% increase. Excluding fuel, import prices actually fell 0.1% – their fourth consecutive decline. Over the past 12 months, import prices have fallen 0.2% despite the higher cost of oil. In contrast, import prices were rising at a 3.5% annual rate a year earlier. The decline stems mainly from a stronger U.S. dollar that has made foreign goods less expensive for Americans.

Sales at the nation’s retailers fell last month for the second time, a sign that Americans are pulling back on spending in an economy facing increasing headwinds. The Commerce Department reported retail sales dropped 0.2% last month, missing expectations of an increase of 0.1%. Sales declined across most major segments including automobiles, home improvement centers, and internet retailers. In the details, sales fell 1.1% at car dealers, slid 1.3% at electronic stores, and were down 1.9% at home and garden centers. This report suggests Americans are showing more restraint with their spending this year than last. Some letup was expected following last month’s 1.7% surge, but the drop is a caution sign for the broader U.S. economy – after all, consumer outlays account for more than two-thirds of the nation’s economic activity.

In the New York region, the Empire State manufacturing index rose to a 6-month high of 17.8 in May, following a reading of 10.1 in April. The improvement was predominantly due to a decline in inventories that suggests that some of the buildup in stockpiles amid rising global trade tensions may have unwound this quarter. The inventories index plunged 12.5 points to -4.1. Furthermore, the new-orders index and shipments index rose 2.2 points and 7.7 points, respectively. Analysts note that manufacturing has been one of the weak points of the economy this year, so this report could either indicate that the economy is improving—or perhaps be an outlier.

The Philadelphia Fed reported its manufacturing index also improved, rising to a four-month high of 16.6. The reading was up 8.1 points from April, but lagged economists’ estimates of a 10.1 increase. In the details, readings were mixed. The shipments index rose while the new-orders index declined. The index for inventories fell into negative territory. Of note, the employment index increased 4 points to 18.2—its highest reading in five months. Ian Shepherdson, chief economist at Pantheon Macroeconomics summed up both the New York and Philadelphia manufacturing reports stating, “In short, the industrial economy is weak, but it probably is no longer weakening. The re-escalation of the trade war is a wild card, but China’s stimulus means that the global manufacturing story is beginning to turn around.”

On a national level, industrial production declined 0.5% in April the Federal Reserve reported. The decline was much deeper than the 0.1% economists expected. Most major market groups reported worse production in April, the Fed said. Ex-autos, manufacturing production was down -0.3%. Stephen Stanley, chief economist at Amherst Pierpont Securities noted that manufacturers have been negatively affected by both the imposition of tariffs by China and on a rising dollar writing, “Manufacturers have without question borne the brunt of the negative impacts from the imposition of tariffs, the retaliation from China, and the uncertainty regarding the outlook for trade policy. Factories have also been hit by the strengthening in the dollar last year.”

International Economic News: The Bank of Canada released a report noting that high household debt and shocks to the housing market are the main risks to the Canadian economy. In its annual financial system review, the central bank identified the main factors that could have negative consequences on the economy. Bank of Canada governor Stephen Poloz said that progress has been made to address both issues. “New measures have curbed borrowing, reduced speculative behavior in housing markets and made the financial system more resilient,” he said in the report. In a news conference with reporters, Poloz shared the bank’s overall take on the economy. “Overall risk to the Canadian financial system has increased slightly since a year ago,” he said. “That’s due to a slowdown to overall growth in Canada and abroad, though we do expect economic growth to pick up in Canada later this year.”

Despite the uncertainty surrounding the United Kingdom’s “Brexit” decision, the unemployment rate in the UK nonetheless dropped this week to its lowest level since 1974. The Office for National Statistics reported Britain’s unemployment rate ticked down to 3.8% in the first quarter, with the employment rate hitting a record high of 76.1%. Stephen Clarke, senior economic analyst at the Resolution Foundation stated, “Britain’s job market continues to defy wider economic uncertainty.”

According to the French national statistics office Insee, joblessness in France – the Eurozone’s second-largest economy – fell 0.1% in the first quarter of 2019 to 8.7%, its lowest level since 2009. The reading comes as a boost to French president Emmanuel Macron, who has continued to push forward his economic reform program in the face of popular unrest. Mr. Macron’s ministers were quick to celebrate: “The decline continues. Our reforms have effects,” tweeted labor minister Muriel Pénicaud. However, even given the improvement, the unemployment numbers are still relatively high. The French unemployment rate is more than double that of Germany and the difference rises to nearly four times for youth unemployment.

Despite a darkening global trade outlook, Europe’s industrial powerhouse Germany rebounded in the first quarter of 2019. The German economy expanded 0.4% in the first quarter of 2019, ending the slowdown that took place the second half of last year and dispelled fears of a deeper economic stagnation. Germany’s Federal Statistics Office reported the growth came predominantly due to strong consumer spending and a boom in the construction industry. Expectations for growth in 2019 had been lowered to 0.5%, from 1%, but the first quarter could suggest a slightly more optimistic year ahead for Europe’s largest economy.

China’s escalating trade dispute with the U.S. could not only impact its economy but also negatively affect its credit standing, according to ratings agencies. While China’s credit rating is currently strong, should the impasse linger on the damages could start to have deeper impacts. At ratings agency DBRS, analysts wrote, “The tariff war is negative for China, especially at a time when its policy makers are battling problems of rising debt and increasing leverage in its economy.” DBRS, the fourth-largest ratings agency in the world, has China rated “A,” which is its third-highest classification. However, it recently changed the outlook to negative as the tariff issues continue to escalate. Moody’s analyst Madhavi Bokil said in a note, “An abrupt breakdown in trade talks, if that were to occur, will inject considerable policy uncertainty, increase risk aversion and lead to an abrupt repricing of risk assets globally.”

Japan’s economy was “worsening” for the first time in more than six years, a key composite index of economic indicators showed. Japan’s Cabinet Office coincident index of business conditions for March fell 0.9 point from the previous month to 99.6, according to a government survey. The lowered assessment came after a recent spate of sluggish economic data, including a 0.9% drop in industrial output and slowing demand for exports of automobiles and manufacturing equipment. An economic downturn would be a major setback for Prime Minister Shinzo Abe as his government is planning to raise the consumption tax to 10% from the current 8% in October. Economists anticipate the move could further dampen consumer spending and weigh on the economy.

Finally: If the percentage of your wealth tied up in individual stocks isn’t particularly significant, you’re not alone. In fact, researchers at the Visual Capitalist noted that there is a wide disparity between where those in the top 1% invest their wealth versus those in the bottom 80%. For the bottom 80%, their principal residence, or home, make up the majority of their net worth with stocks comprising just 6.8% of their wealth. However, the richest 1% has over 40% of their wealth invested in stocks, with their principal residence making up a mere 7.6% of their assets. As well, this tiny group of ultra-wealthy households earns 22% of total income, up from 8% in the 1970s. (Source: VisualCapitalist.com)

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet) These are the opinions of WE Sherman and Co and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.