4-19-26 Weekly Market Update

The very Big Picture

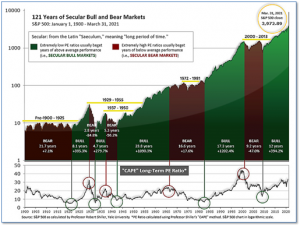

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 37.60, up from the prior week’s 37.09. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The big Picture

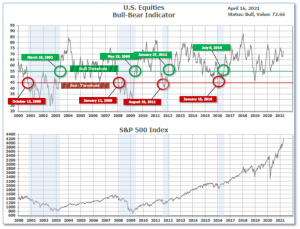

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 72.66 up from the prior week’s 70.83.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive on March 31, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on March 31 and ended the week at 22, unchanged from the prior week.

In the Markets:

U.S. Markets: Most of the major U.S. benchmarks recorded their fourth consecutive week of gains and some moved to new record highs. The Dow Jones Industrial Average added 400 points and finished the week at 34,200, a gain of 1.2%. The technology-heavy NASDAQ Composite gained 1.1%. By market cap, the large cap S&P 500 rose 1.4%, while the mid cap S&P 400 and small cap Russell 2000 gained 1.9% and 0.9%, respectively.

International Markets: European markets were mostly up while major Asian markets declined. Canada’s TSX rose 0.6%, while the United Kingdom’s FTSE 100 added 1.5%. France’s CAC 40 and Germany’s DAX gained 1.9% and 1.5%, respectively. In Asia, Japan’s Nikkei gave up -0.3%, while China’s Shanghai Composite declined -0.7%. As grouped by Morgan Stanley Capital International, emerging markets finished the week up 1.5%, while developed markets gained 1.7%.

Commodities: Precious metals had a second week of gains. Gold rose 2% to finish the week at $1780.20 per ounce, while Silver rose 3.1% to $26.10 an ounce. Energy reversed last week’s entire decline and then some. West Texas Intermediate crude oil rose 6.5% to $63.19 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished up for a second week rising 3.2%.

U.S. Economic News: The number of Americans filing first-time unemployment benefits fell by 193,000 to a pandemic low of 576,000 last week—its largest decline since August. Economists had forecast new claims would total 710,000. However, the number of layoffs still has a lot further to decline to return to pre-crisis levels. New claims had been running in the low 200,000s before the pandemic. Continuing claims, which counts the number of Americans already receiving benefits, fell by 87,991 to 3.94 million. That number is also a pandemic low.

Small business owners are growing more optimistic as more states continue to lift restrictions, although hiring remains a big problem. The National Federation of Independent Businesses (NFIB) reported its sentiment survey for March climbed 2.4 points to 98.2 – a pandemic high – but owners remain cautious about the future. The index remains well below its pre-pandemic levels. The NFIB index had hit an all-time high of 104.5 in February 2020, just a month before the pandemic took hold. The biggest reported problem is finding suitable workers. A record 42% of small businesses surveyed said they could not fill open positions. More than a quarter of companies said they increased pay to lure workers–the highest number in the past year.

Prices at the consumer level surged last month, according to the latest data from the government. The Bureau of Labor Statistics reported the ‘consumer price index’ (CPI) jumped 0.6% last month, spearheaded by the rising cost of oil. Economists had forecast a 0.5% increase. The rate of inflation over the trailing year shot up to 2.6% from 1.7% in the prior month, marking the highest level since the fall of 2018. Prices increased for the fourth month in a row. A sharp drop in coronavirus cases coupled with an economic recovery fueled by massive fiscal stimulus boosted demand for a wide variety of goods and services. Meanwhile, many key materials remain in short supply. This squeezes supply and demand from both sides. Federal Reserve policymakers insist any increase in inflation is likely to be mild and temporary.

Two regional gauges of manufacturing sentiment showed strength in April, according to data released this week. The Philadelphia Federal Reserve manufacturing index jumped to a reading of 50.2 in April from a revised 44.5 in the prior month. This is highest level in almost 50 years. Economists had expected a reading of 42 after the initial reading for March of 51.8, according to a survey of economists. Meanwhile, the New York Federal Reserve’s Empire State Index rose to a reading of 26.3 in April from 17.4 in March. That’s the highest reading since October 2017. Economists had expected a reading of 20. Manufacturing remains a bright spot in the pandemic. The two regional Fed surveys are used by economists to gauge the strength of the upcoming national ISM factory index, which will be released in early May. Last month, the ISM index jumped to 64.7%–its highest level since December 1983.

Sales at U.S. retailers jumped by almost 10% in March thanks to $1,400 government stimulus checks to the majority of Americans. The Census Bureau reported sales climbed by 9.8% last month, easily beating the consensus forecast of a 6.1% increase. The sales gain was the second largest on record, exceeded only by an 18% spike last May when a U.S. lockdown was lifted. The snapback in sales was widely expected after Washington approved a massive $1.9 trillion stimulus in early March. Sales revved up 15% at car dealers even as automakers struggled to procure enough computer chips to maintain production (auto sales account for about 20% of all retail sales). Sales at gas stations also surged nearly 11%, reflecting rising oil prices and more Americans taking to the road as government coronavirus restrictions are lifted. “All in all, a very strong first half of the year for growth looks to be in the bag,” said chief economist Joshua Shapiro of MFR Inc. following the release.

The Federal Reserve’s ‘Beige Book’, a collection of anecdotal reports from each of the Fed’s regional member banks, reported the U.S. economy grew faster in the early spring and more companies sought to hire new workers. However, the report also showed inflation has picked up. Companies paid more for lots of key supplies such as metals, fuel, food and lumber. In some cases, supply shortages were also holding back production. “Businesses also expressed concern about rising inflation over the rest of the year,” the Boston Fed said. Senior economist Sal Guatieri of BMO Capital Markets stated, “The U.S. economy is accelerating, but also starting to fan prices.”

International Economic News: The Bank of Nova Scotia’s chief executive says Canada must strive to avoid the pre-pandemic “trap” of middling economic growth once the COVID-19 pandemic is over. He suggests more financial assistance for child care, investment-boosting grants for businesses, and fewer obstacles to trade between provinces to help expand the economy. CEO Brian Porter said Canada had been seeing slower growth even before the pandemic, as Canada’s gross domestic product grew at an average annual rate over the past 20 years of less than 2%. “As a country, we should not accept the ‘two-per-cent growth trap,’” the Scotiabank CEO said during a speech at the lender’s virtual annual shareholders meeting. “We have an opportunity today to pursue policies that ensure that Canada does not just go back to pre-pandemic growth but achieves an even higher and better growth for a sustained period.”

Across the Atlantic, the U.K. economy rebounded in February as a mass vaccination program and the prospect of loosened coronavirus restrictions lifted consumer confidence. Gross domestic product rose 0.4% following a revised 2.2% decline in January, the Office for National Statistics said. All the main sectors of the economy saw output rise. Still, however, the economy remains 7.8% smaller than it was before the pandemic took hold in February of 2020. Britain is emerging from its third national lockdown with consumers and businesses increasingly optimistic about a rapid recovery from the UK’s worst recession in three centuries. A recent Reuters poll of around 70% economists forecast the UK’s economy would expand 5.0% this year and 5.5% in 2022.

On Europe’s mainland, Bank of France governor Francois Villeroy de Galhau said France could return to pre-COVID normal economic growth levels by the middle of 2022. The French central bank said it did not anticipate a significant revision of its 2021 growth forecast of 5.5% if the new COVID-19 restrictions do not extend beyond April. “We will gradually climb back to the altitude we had prior to COVID,” Villeroy told France Culture radio.

Germany’s top five economic institutes cut their growth forecast for the county this year, warning that the third wave of COVID-19 has killed off any chance of a recovery until the summer. Germany’s economic institutes will cut their joint 2021 growth forecast to 3.7% from 4.7%; however, they will also lift their GDP growth estimate for 2022 to 3.9% from 2.7% previously. The figures are the latest sign that the economy will need longer than initially thought to reach its pre-crisis level. The institutes’ estimates form the basis for the government’s own growth forecast which the economy ministry will present later this month.

Unlike the rest of the world, China is booming. China’s economy likely grew at a record pace of 19% in the first quarter, according to a Reuters poll. While the reading will be heavily skewed by the plunge in activity a year earlier, the expected jump would be the strongest since at least 1992. It would also signal the world’s second-largest economy has continued to gain momentum, after a 6.5% expansion in the last quarter of 2020. China seemingly managed to bring the COVID-19 pandemic under control much earlier than most other countries as authorities imposed stringent anti-virus curbs and lockdowns in the early phase of the outbreak.

Cancelling or postponing the Tokyo Olympics Games probably will not hurt Japan’s economy much but may require the government to offer tailored support for hard-hit small firms, a senior International Monetary Fund (IMF) official has said. While the government plans to proceed as scheduled, a renewed spike in coronavirus infections and slow vaccine distribution schemes have added to worries about the fate of the Olympics, set to start in July after being postponed last year. “A change to the plans for the Olympics would have a limited impact on overall near-term growth prospects, given that Japan is a large and diversified economy,” said Odd Per Brekk, the deputy director of the IMF’s Asia and Pacific department. Most of the infrastructure needed for the Games is already in place and the hit to growth from an evaporation of inbound tourism would be small, he added.

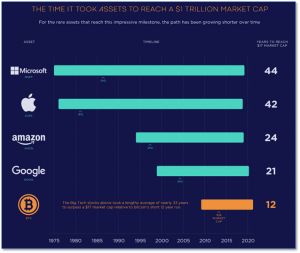

Finally: What took Microsoft 44 years, Apple 42 years, Amazon 24 years and Google 21? The answer: achieving a trillion dollar market capitalization. However, it took the Bitcoin cryptocurrency just 12 – the fastest ever. At the beginning of 2021, Bitcoin had a market capitalization of $500 billion, but in just four months it has gained another $500 billion as tech CEO’s like Elon Musk and Jack Dorsey have made sizable investments, multiple exchange-traded funds are preparing to launch, the CoinBase cryptocurrency exchange has gone public, and many legacy financial institutions like PayPal, MasterCard, Visa, JP Morgan and the Bank of New York Mellon have come on board. The only question now seems to be, “How long till the next trillion?” As they say on the WallStreetBets Reddit message board, “To the Moon!” (Chart from visualcapitalist.com)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.