3-8-21 Weekly Market Update

The very Big Picture

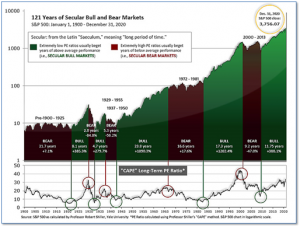

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 34.79, up from the prior week’s 34.51. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Big Picture:

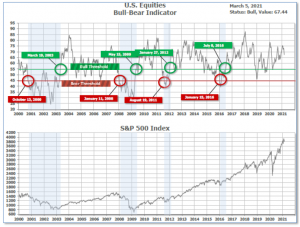

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 67.44 down from the prior week’s 69.71.

In the Quarterly- and Shorter-term Pictures

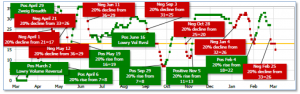

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering January, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on February 25 and ended the week at 11, down from the prior week’s 18.

In the Markets:

U.S. Markets: The major U.S. benchmark indexes finished the week mixed as longer-term interest rates continued to climb. The rise in rates weighed on growth stocks, while value stocks managed gains. The Dow Jones Industrial Average climbed 564 points finishing the week at 31,496—a gain of 1.8%. The technology-heavy NASDAQ Composite declined a third consecutive week giving up -2.1%. By market cap, the large cap S&P 500 added 0.8%, while the mid cap S&P 400 rose 0.7% and the small cap Russell 2000 declined -0.4%.

International Markets: Like the U.S., international markets were mixed on the week. Canada’s TSX finished the week up 1.8%, while the United Kingdom’s FTSE rose 2.3%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX added 1.4% and 1.0%, respectively. In Asia, China’s Shanghai Composite ticked down -0.2%, while Japan’s Nikkei retreated -0.4%. As grouped by Morgan Stanley Capital International, developed markets rose 0.8% while emerging markets added 0.2%.

Commodities: Precious metals continued their descent. Gold declined -1.75% to $1698.50 per ounce, while Silver fell a further -4.4% to $25.29 per ounce. Oil, on the other hand, continued its ascent, now up four out of the last five weeks. West Texas Intermediate crude oil surged 7.5% to $66.09 per barrel. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, finished the week down -0.4%.

U.S. Economic News: The number of Americans filing for first-time unemployment benefits rose slightly last week signaling the economy is still a long way from recovering all the jobs lost during the pandemic. The Labor Department reported initial jobless claims rose by 9,000 to 745,000 in the week ended February 27th. Economists had forecast claims would total 750,000. For perspective, new claims were running in the low 200,000’s before the pandemic took hold in late February of last year. New applications for jobless benefits rose the most in Texas, Ohio and New York. Missouri was the only state to report a big decline.

The U.S. economy added 379,000 jobs in February – the biggest gain in four months – in what is hoped to be a preview of the surge in hiring in the months ahead as the economy fully reopens. The increase in hiring last month was concentrated at businesses such as restaurants, retailers, hotels and entertainment venues as states eased restrictions on customer limits and public gatherings. Most other industries also added workers. The official unemployment rate, meanwhile, slipped to 6.2% from 6.3%. Analysts believe warmer weather, falling coronavirus cases, rising vaccinations, and another massive increase in federal stimulus are all likely to contribute to a strong labor market in the spring and summer. The increase exceeded Wall Street expectations. Economists had expected just 210,000 new jobs. New jobs in leisure and hospitality — restaurants, hotels, casinos, theaters and the like — accounted for almost all of the gains.

Manufacturing activity grew last month at its fastest pace since the onset of the pandemic a recent survey found. The Institute for Supply Management (ISM) reported its manufacturing survey climbed 2.1 points to 60.8—a three-year high. Readings over 50 indicate growth, while readings over 55 are considered exceptional. The increase surpassed Wall Street expectations. Economists had expected a reading of just 58.9. In the report, new orders, production, and employment all improved last month. Of concern, the biggest worry of the ISM survey respondents was shortages of key materials such as lumber and semiconductors which are pushing prices higher and in some cases restricting production. That could lead to an increase in inflation and hinder the recovery. A senior executive at a maker of wood products stated, “Prices are rising so rapidly that many are wondering if [the situation] is sustainable.”

A similar survey of the vast services side of the U.S. economy showed the economy grew more slowly in February—but not because of lack of demand. Again, shortages of key supplies hurt many service providers’ ability to run their businesses at full tilt. ISM reported its services index, a survey of business leaders at service-oriented firms such as banks, retailers, and restaurants slipped 3.4 points to 55.3. The reading indicates the ninth straight month of growth for the services sector which has expanded for all but two of the last 133 months. Still, the survey fell short of Wall Street expectations. Economists had expected the index to remain at 58.7. The biggest worry in the report was the increase in prices. The price gauge component of the ISM survey soared to 71.8—its highest level in 10 years.

The Federal Reserve’s ‘Beige Book’ found only modest improvement in the economy. Overall, the survey noted, business contacts were optimistic about the rest of the year as COVID-19 vaccinations continue, but things were improving slower than desired. On the crucial question of inflation, the report found a mixed picture. Some retailers and manufacturers were able to raise prices to consumers, but many others were not. Most districts reported that nonfinancial services, a key sector badly damaged by the pandemic, saw only modest growth.

In a Wall Street Journal webinar, Federal Reserve Chairman Jerome Powell reiterated that the current fiscal policy is appropriate despite worries over inflation and troubling signs in the bond market. Powell said the bond market sell-off over the past few weeks has his attention and the central bank would not sit back and let financial conditions tighten broadly. However, Powell offered no concrete guidance on his plan to counter such events. In addition, Powell said the Fed would be “patient” with higher inflation, saying it will likely be a “one time” effect and not price increases that continue year-after-year. Powell repeated that the Fed was a “long way” from its goals of maximum employment and stable 2% inflation.

International Economic News: After its worst year on record the Canadian economy entered 2021 with nearly double-digit growth in 2020’s fourth quarter. Statistics Canada reported Canada’s economy grew at an annualized rate of 9.6% in the final quarter of 2020. Though impressive, it was down from the 40.6% annualized growth in the third quarter when the country fully emerged from its near-shutdown. Looking to January, Statistics Canada said its early estimate was for growth in the economy of 0.5%.

Across the Atlantic, the United Kingdom says the biggest companies must pay more tax. Britain will hike taxes on its biggest companies in 2023 as it works to repair government finances in the wake of the pandemic. Speaking in parliament, UK Finance Minister Rishi Sunak pledged another 65 billion pounds ($91 billion USD) to extend emergency support measures for workers and businesses, while making the case that taxes will need to rise once the economic effects of the pandemic have eased. “Just as it would be irresponsible to withdraw support too soon it would also be irresponsible to allow future borrowing and debt to be left unchecked,” he said.

On Europe’s mainland, the French government is accelerating the rollout of its economic stimulus plan by infusing 100 billion euros into support for its industrial sector, Finance Minister Bruno Le Maire said. The recovery plan aims to pull France out of its economic crisis by the end of 2022. Le Maire said there was no need to increase the overall amount of stimulus funds as the extra money for the industrial sector would be redirected from other programs within the recovery plan where take-up was slower. The wide-ranging plan gives a special focus to boosting the industrial sector, which has long struggled to be competitive and is heavily dependent on a small handful of industries such as aerospace, food processing, pharmaceuticals, and luxury brands.

German business groups expressed dismay this week after Chancellor Angela Merkel and state leaders agreed the government would only allow a gradual easing of coronavirus restrictions. The agreement dashed any hopes of a swift reopening of the economy and its associated rebound in consumer spending. “The results of the coronavirus summit are a disaster for the retail sector,” said Stefan Genth, chief executive of the HDE retail association. HDE noted that German retailers were likely to lose another 10 billion euros ($12.1 billion USD) in sales by the end of March compared to 2019.

In Asia, China’s Premier Li Keqiang announced the country is aiming for an economic growth rate above 6% in 2021. The target marks a return to strong growth after the COVID-19 pandemic weighed on the world’s second largest economy. Despite the pandemic, China still managed growth of 2.3% last year – even so, it was the weakest annual growth in decades. The new target highlights the Chinese economy’s strong rebound after the pandemic shutdowns led to a sharp 6.8% contraction in the first quarter of 2020. “A target of over 6% will enable all of us to devote full energy to promoting reform, innovation, and high-quality development,” Premier Li Keqiang said. By some measures, the target appears modest. For example, the International Monetary Fund (IMF) estimates growth of 8.1% for China’s economy this year.

Bank of Japan Governor Haruhiko Kuroda stressed the need to keep long-term borrowing costs “stably low” to support its economy, still weighed down by the coronavirus pandemic. Recently, there has been rampant speculation that the Bank of Japan would widen the bands the BOJ allows the 10-year bond yield to move around its 0% target to 60 bps from 40 bps. Kuroda said the BOJ has not reached a conclusion yet on whether it will widen the band, saying “much more debate” was needed before deciding at the March review of its policy tools. “It’s a difficult decision. The economy remains under pressure from the COVID-19 pandemic,” Kuroda told parliament. “While we need to enhance bond market functions, it’s also important to keep the yield curve stably low for the time being,” he said.

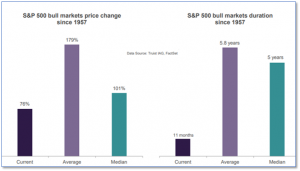

Finally: It has been a little over a year since the coronavirus pandemic blindsided the U.S. economy and crashed the stock market into a short-lived bear market. The new bull market that began at the end of March / start of April is thus now about 11 months old. That’s one of the key reasons why analysts at Truist Wealth think the upswing in the S&P 500 still has plenty of room to run. Looking at data over the past six decades, Truist asserts that the current bull-market may be both too young and too limited in terms of price gains to be over anytime soon. The current gains are much lower than the average gain since 1957, and the age of this bull is not even close to the average duration of 5 years.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.