3-29-21 Weekly Market Update

The very Big Picture

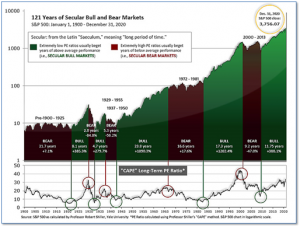

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 35.75, up from the prior week’s 35.20. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Big Picture:

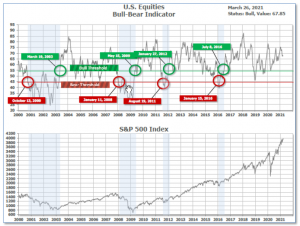

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 67.85 up from the prior week’s 67.52.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering January, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on March 10 and ended the week at 26, up from the prior week’s 18.

In the Markets:

U.S. Markets: The major indexes finished the week mixed, as investors seemed to continue weighing optimism over a full economic reopening against inflation and interest rate concerns. Small-cap stocks lagged for a second consecutive week, signaling a potential pause in their recent market leadership. The Dow Jones Industrial Average added 445 points finishing the week at 33,072, a gain of 1.4%. The technology-heavy NASDAQ Composite shed -0.6% to 13,138. By market cap, the large cap S&P 500 and mid cap S&P 400 added 1.6% and 0.5%, respectively, while the small cap Russell 2000 ended down -2.9%.

International Markets: International markets finished the week mixed as well. Canada’s TSX gave up -0.5%, while the United Kingdom’s FTSE added 0.5%. On Europe’s mainland, France’s CAC 40 ticked down -0.2%, while Germany’s DAX rose 0.9%. In Asia, China’s Shanghai Composite rebounded 0.4% following four weeks of consecutive declines. Japan’s Nikkei closed down -2.1%. As grouped by Morgan Stanley Capital International, developed markets rose 0.2%, while emerging markets ended the week down -1.5%.

Commodities: Precious metals saw their first down week in three, with Gold falling -0.5% to $1732.30 an ounce, while Silver declined -4.6% to $25.11. Crude oil declined for a third consecutive week giving up -0.8% to $60.97 per barrel of West Texas Intermediate crude oil. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -1.1%.

U.S. Economic News: The number of Americans filing for first-time unemployment benefits fell last week hitting its lowest level since the pandemic began. The Labor Department reported initial jobless claims fell by 97,000 to 684,000 in the week ended March 20. Economists had forecast new claims would fall to 735,000. New claims fell the most in Illinois, Ohio, and California. Massachusetts. The only states with notable increases were Virginia and Nevada. Meanwhile, the number of people already collecting benefits fell by 264,000 to 3.87 million. That’s the lowest level since last spring.

Sales of existing homes fell in February following two consecutive months of gains. The National Association of Realtors (NAR) reported existing-home sales dropped 6.6% from January to a seasonally-adjusted annual rate of 6.22 million. Still, home sales were up 9.1% from the same time last year. Lawrence Yun, chief economist at the National Association of Realtors, noted “Despite the drop in home sales for February — which I would attribute to historically-low inventory — the market is still outperforming pre-pandemic levels.” By region, home sales decreased the most in the Midwest (-14.4%), followed by the Northeast (-11.5%). Sales increased in the West by 4.6%. The median existing-home price in February was $313,000—nearly 16% higher than the same time last year.

Spending at the consumer level posted its biggest decline in almost a year in February, predominantly due to a bout of harsh winter weather and a delay in government stimulus payments. The Bureau of Economic Analysis reported consumer spending sank 1% last month—the biggest drop since the onset of the coronavirus pandemic. The reading matched economists’ forecasts. Americans reduced spending on an array of goods and services in February, particularly drugs, recreational items and takeout food, more than offsetting increases in outlays on housing, health care, utilities and gasoline.

Orders for goods expected to last at least three years, so-called ‘durable goods’, fell in February for the first time since last spring. The Census Bureau reported orders for durable goods fell 1.1%, far below economists’ estimates for a 0.6% increase. The decline in orders last month was broad based. Orders in every major category fell except for commercial passenger planes. Auto makers reported the biggest drop in orders—down -8.7%. If transportation is excluded, durable-goods orders slipped a smaller 0.9% in February. One major concern is the shortages of many key materials used in the production of goods ranging from lumber to computer chips. Stephen Stanley, chief economist at Amherst Pierpont Securities stated, “The primary driver of the drop was the disruptions in the auto industry, as chip shortages have sharply curtailed production.”

The U.S. economy contracted in February for the first time since the worst phase of the coronavirus pandemic, according to a nationwide economic survey. The Chicago Federal Reserve reported its National Activity Index fell to -1.09 from a revised 0.75 in January. The Chicago Fed index is a weighted average of 85 economic indicators. In the details, only 34 of the 85 indicators made positive contributions. Production-related indicators dragged the index down the most, subtracting -0.85 from the index, down from a positive 0.37 in January. The personal consumption and housing categories also contributed -0.29, down from positive 0.27 in January.

Sentiment among the nation’s consumers is the most upbeat since the onset of the pandemic, a recent survey showed. The University of Michigan reported its consumer sentiment index of March rose 1.9 points to 84.9 in March. Richard Curtin, chief economist of the survey stated, “Consumer sentiment continued to rise in late March, reaching its highest level in a year due to the third disbursement of relief checks and better than anticipated vaccination progress.” However, the index remains about 16 points below its pre-pandemic peak. Still, the attitude of Americans right now about their own personal finances and the broader economy is at a one-year high. Associate economist Mahir Rasheed of Oxford Economics wrote in a note to clients, “We expect attitudes will continue to rebound as the pandemic wanes and economic activity normalizes over the coming months.”

International Economic News: Canada imposed new economic sanctions against four officials and one entity under the new Special Economic Measures (People’s Republic of China) Regulations. The measures were based on Canada’s assessment of China’s gross and systematic human rights violations in the Xinjiang Uyghur Autonomous Region. Implemented in coordination with sanctions imposed by Canada’s allies, the new sanctions follow earlier accusations of China’s repressive surveillance, mass arbitrary detention, torture, and the use of forced labor in Xinjiang. Effective immediately, Canada has imposed a prohibition on dealings and an asset freeze on the persons listed under the new regulations.

Across the Atlantic, rate-setters at the Bank of England played down risks of a sustained surge in inflation when Britain’s economy recovers from its pandemic crash. After weeks of rising government bond yields driven by worries about inflation, Bank of England policymakers Michael Saunders and Silvana Tenreyro said the bank may have more room to stimulate the economy without generating excess price pressures. While inflation has been heading higher, Tenreyro said it was important to differentiate between a sustained increase and temporary pick-ups. Saunders noted that Britain’s economy currently has spare resources that can be used up as the economy grows before cost pressures build, citing rising unemployment and under-utilized companies. The comments from Saunders and Tenreyro contrast with those of BoE Chief Economist Andy Haldane who has warned of an inflation “tiger” fueled by the release of household and corporate savings built up during the pandemic and high government spending.

On Europe’s mainland, the French government now owes more money than at any time since the end of World War II. France’s public debt in 2020 was the equivalent of 116% of annual GDP, and the budget deficit amounted to over 9% of GDP, “the highest level since 1949,” national statistics agency INSEE reported. In 2019, before the Covid-19 pandemic, French government debt was 98% of GDP and the budget deficit slightly more than 3%. The Covid-19 pandemic has battered the French economy which contracted 8.2% in 2020, forcing the government to provide massive support to business to avoid bankruptcies and mass job cuts.

Business sentiment in Germany “improved noticeably” in February to its highest level since June 2019, the Munich-based Ifo Institute for Economic Research reported. Based on its monthly survey of 9,000 German companies, Ifo’s Business Climate Index rose 3.9 points to 96.6 this month. Clemens Faust, President of Ifo wrote, “Despite the rising rate of infections, the German economy is entering the spring with confidence.” Companies are “clearly more satisfied” with their current business situation and “optimism about the coming months has also returned.” In Germany’s manufacturing industry, the business climate continued to recover as demand for industrial goods picked up noticeably. In the service sector, the index also rose markedly.

In Asia, China’s Premier Li Keqiang asserted economic growth could exceed its target of “above 6%” this year in a meeting with foreign business executives. “We need to seek a balance between growth, income, and employment, and we cannot pursue economic growth based on high energy consumption and heavy pollution,” Li said, according to a statement from the State Council. China needs growth in employment and income and will have to work more on boosting domestic demand and consumption, he said. Last year, China had recorded 2.3% growth—its lowest in three decades.

Japan’s government cut its view on exports for the first time in 10 months and stated overall economic conditions were still showing weakness due to the coronavirus pandemic. In its economic report for March the government stated, “The economy shows some weakness, though it continued picking up amid severe conditions due to the coronavirus.” Among key economic elements, the government slashed its assessment of exports, a key driver of Japan’s trade-reliant economy, for the first time since May. Behind the downgrade was a slowdown in car exports, which showed signs of flattening out after manufacturers front-loaded shipments ahead of an expected recovery from the health crisis. On a positive note, analysts expect the decline will be followed by a rebound of an annualized 5.3% in the second quarter as economic activity rebounds following the easing of lockdown measures.

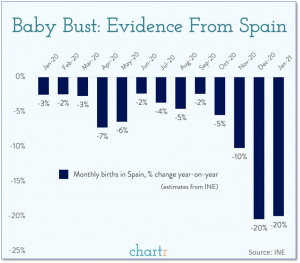

Finally: With everyone locked up in their homes around this time last year, many scientists who study population demographics predicted a subsequent “baby boom”. This, however, does not seem to have been the case. The latest data from Europe suggests advanced economies are almost certainly in for the opposite—a baby bust. Data from Spain estimates the number of babies born between December 2020 and January 2021 was down roughly 20% from the same time the year before. Data from Italy shows a similar pattern. Italy and Spain already have some of the lowest fertility rates in the world – well below the so-called “replacement rate” – and it is not hard to imagine why potential parents may have put off the enormous responsibility of having children over the past year. (Chart from Chartr.co)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.