3-22-21 Weekly Market Update

The very Big Picture

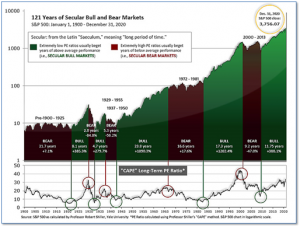

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 35.20, down from the prior week’s 35.47. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 67.52 down from the prior week’s 68.32.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering January, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on March 10 and ended the week at 26, up from the prior week’s 18.

In the Markets:

U.S. Markets: The major indexes continued to hit record highs early in the week, but lost ground as bond yields reached their highest levels in over a year. The Dow Jones Industrial Average shed 150 points finishing the week at 32,627—a decline of -0.5%. The technology-heavy NASDAQ Composite declined a slightly steeper -0.8%. By market cap, the large cap S&P 500 retreated -0.8%, while the S&P 400 mid cap index and Russell 2000 small cap index declined -1.2% and -2.8%, respectively.

International Markets: International equity markets were mixed for the week. Canada’s TSX ended the week essentially flat, while the United Kingdom’s FTSE 100 ended down -0.8%. On Europe’s mainland, France’s CAC 40 also finished down -0.8%, while Germany’s DAX rose 0.8%. In Asia, China’s Shanghai Composite fell for a fourth consecutive week giving up -1.4%. Japan’s Nikkei ticked up 0.2%. As grouped by Morgan Stanley Capital International, developed markets and emerging markets each added 0.2%.

Commodities: Precious metals had a second consecutive week of gains with Gold rising 1.3% to $1741.70 per ounce and Silver adding 1.6% to $26.32 per ounce. Crude oil declined for a second week. West Texas Intermediate crude oil retreated -6.4% to $61.44 per barrel. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, finished down -0.7%.

U.S. Economic News: The number of Americans filing first-time unemployment benefits rose to a one-month high last week, according to the Labor Department. Initial jobless claims increased by 45,000 to 770,000 in the week ended March 13. Economists had forecast new claims would fall to a seasonally-adjusted 700,000. Combined state and federal jobless claims totaled 1.02 million last week. They’ve yet to fall below 1 million since the onset of the pandemic last year, underscoring the massive damage to the U.S. economy caused by the coronavirus. The number of people already collecting traditional unemployment benefits, meanwhile, slipped a mild 18,000 to a seasonally adjusted 4.12 million. That’s the lowest level since last spring.

Sales at U.S. retailers fell 3% in February the Census Bureau reported, but analysts expect the decline to be short-lived as the government begins sending stimulus checks to most Americans. Economists had forecast a small decline of just -0.1% in retail sales. In the report, sales fell in every major retail group except for groceries and gasoline, two major household staples. Sales at gas stations climbed 3.6% last month, largely due to higher prices at the pump. U.S. economist Andrew Hunter of Capital Economics wrote in a note, “With the next round of even larger stimulus checks already being sent out, we expect spending to see a renewed surge in March.”

Confidence among the nation’s home builders dipped to its lowest level since late last summer as concerns grow about the rising cost of building materials and higher interest rates. The National Association of Home Builders (NAHB) reported its monthly confidence index dropped two points to 82 in March—its lowest reading since August. Robert Dietz, chief economist at the NAHB said in the report, “Builder confidence peaked at a level of 90 last November and has trended lower as supply-side and demand-side factors have trimmed housing affordability.” Sentiment declined across most parts of the country. The index fell in the West, Midwest, and Northeast, but remained flat in the South.

Manufacturing activity in the New York region hit an eight-month high this month, according to the latest data from the New York Federal Reserve. The New York Fed reported its Empire State Manufacturing Index rose 5.3 points to a reading of 17.4 in March. The result beat the consensus forecast of 15. The index sits at its highest level since last July and recorded its ninth consecutive reading above zero. In the details, the new orders index slipped 1.7 points to 9.1, while shipments surged 17.1 points to 21.2. Of note, the prices paid index rose 6.6 points to 64.4 in March—its second consecutive month of hitting a 10-year high.

The Federal Reserve announced its intention to remain in a holding pattern this week, saying it didn’t anticipate raising interest rates until the end of 2023—despite signs of stronger economic growth and a pick-up in inflation. In its forecasts, the Fed sees GDP growth this year of 6.5% annual rate and said core inflation would rise slightly above its 2% target. In its assessment of appropriate monetary policy, seven of 18 Fed officials have penciled in a rate hike in 2023, up from 5 at the last “dot-plot” in December. Four officials expect a rate hike in 2022, up from one member in the December forecast. The Fed projections see inflation slowing to 2% in 2022 before picking up slightly to 2.1% in 2023. The central bank has said it will tolerate inflation slightly above target to make up for the years inflation has been below 2%.

International Economic News: Canada’s response to the COVID-19 pandemic earned praise from the International Monetary Fund. The Canadian government and Bank of Canada’s response to the pandemic was “timely, decisive and well-coordinated,” the IMF said in a new report. In particular, the organization said Canada’s economy would have had a “harmful,” “even larger collapse” without emergency benefit spending from the government. Furthermore, the Bank of Canada helped avoid major disruptions in financial markets and is striking the right balance on interest rates, the report stated. However, the report also noted areas that needed improvement. The IMF report suggested Canada should do a broader review of its employment insurance system to address gaps in eligibility. “The crisis exposed gaps in Canada’s social safety net that should be addressed,” the report said.

Across the Atlantic, the Bank of England upgraded its outlook for the United Kingdom’s economy, but stressed it was in no hurry to reduce its support to boost the recovery. In the minutes of March’s Monetary Policy Committee (MPC) meeting, the Bank of England followed the footsteps of the United States Federal Reserve in not taking any action to return interest rates to their levels before the pandemic. The MPC said the news “on near-term economic activity had been positive”, adding that “recent plans for the easing of restrictions on activity may be consistent with a slightly stronger outlook for consumption growth in 2021 Q2 than was anticipated in the February report”.

On Europe’s mainland, French President Emmanuel Macron has put Paris and other regions under strict lockdown for a third time as hospitals run out of intensive-care beds for COVID-19 patients. Most stores will be required to close other than those selling food and other necessities. Furthermore, travel between regions will be banned. “The pandemic is accelerating,” said Prime Minister Jean Castex. “The situation is worsening, and it is our responsibility to act so it does not get out of hand.” New daily infections have risen to above 30,000 nationally in recent days, up more than 20% in a week. That is worse than the daily rates of new infections being logged in other countries like Germany at 10,000, Italy at 22,000, and Spain and the UK around 5,000.

The German government’s council of economic advisers said it expects Europe’s largest economy to shrink by roughly 2% in the first quarter of this year due to lockdown measures to contain the coronavirus. The council cut its full-year 2021 gross domestic product growth forecast to 3.1% from 3.7% previously. It expects the economy to reach its pre-crisis level at the end of 2021 and to grow by 4% next year. “The biggest downside risk remains the development of the coronavirus pandemic. The question how quickly the economy can get to normal mainly hinges on the vaccination progress,” the council said in a statement, giving the first official forecast for the impact in the first three months of the year.

In Asia, China’s central bank is stepping up liquidity support for domestic businesses and increasing its monitoring of cross-border capital flows as concerns grow over the side effects of Washington’s massive new fiscal stimulus. The moves by the People’s Bank of China come amid a growing divergence in the economic policy responses by the United States and China—with Washington boosting stimulus while Beijing has already started to taper its support. Beijing officials and policy advisers have been highly critical of US President Joe Biden’s newly signed $1.9 trillion American Rescue Plan, warning that it could cause massive capital flows and imported inflation that could exacerbate domestic financial risks. “The [US Treasury bond] yield hike driven by inflation expectations will lead to a revaluation of asset prices, or even turmoil in financial markets. Domestic markets are unlikely to remain unresponsive,” Zhang Xiaohui, former assistant governor of the central bank, stated.

Japan made it official: due to coronavirus concerns, no overseas spectators will be allowed at this summer’s Tokyo Olympics. The organizers came to the decision during a high-level meeting just five days before the 121-day Olympic torch relay starts in Fukushima Prefecture. The government had already concluded that welcoming overseas spectators for the global sporting event is not feasible, given that the threat from the virus is far from over and fears that foreign travelers could lead to the spread of more contagious variants. About 1 million tickets are believed to have already been sold abroad.

Finally: If you are in the market for a new home, you may want to close the deal sooner rather than later. Construction costs are soaring and appear only to be going higher. Lumber prices hit $1000 per thousand board feet, an all-time high in recent weeks, and has risen more than 300% since the pandemic low last spring. Paul Jannke, Forest Economic Advisors LLC.’s principal of lumber said, “Production is going to have a hard time keeping up with demand growth as the world economy bounces back from Covid-19 in 2021-22.” So how much are these rising costs adding to a new home’s construction cost? The National Association of Home Builders estimates rising lumber prices have added a stunning $24,400 to the cost of a home over the past ten months. Now don’t forget to add in the rising price of copper, which has gone up 87% in the trailing year…well, you get the picture. (Chart from zerohedge.com)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.