3-20-2023 Weekly Market Update

The very big picture

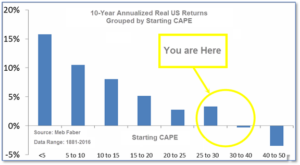

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

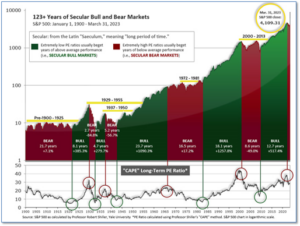

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 27.97, down from the prior week’s 28.05. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

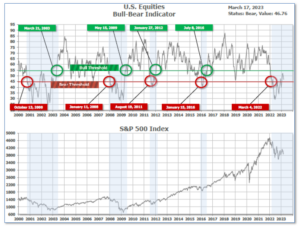

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 46.76, down from the prior week’s 47.79.

In the Quarterly- and Shorter-term Pictures

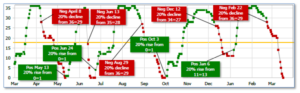

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering January, indicating positive prospects for equities in the first quarter of 2023.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on February 22, and ended the week at 0, down from the prior week’s 14.

In the Markets:

U.S. Markets: The major U.S. indexes finished the week mixed reflecting the stresses in the banking sector, worries over an impending recession, and hopes that the Federal Reserve would now be forced to moderate or pause its rate-hiking cycle. The Dow Jones Industrial Average ended the week down just 48 points to 31,862—a decline of -0.1%. The technology-heavy NASDAQ Composite retraced most of last week’s decline by rallying 4.4% to close at 11,631. By market cap, the large cap S&P 500 rose 1.4%, while the mid cap S&P 400 pulled back -3.2% and the small cap Russell 2000 finished the week down -2.6%.

International Markets: A majority of major international markets finished the week to the downside. Canada’s TSX and the United Kingdom’s FTSE 100 pulled back -2.0% and -5.3%, respectively. France’s CAC 40 declined -4.1% while Germany’s DAX ended down -4.3%. In Asia, China’s Shanghai Composite finished up 0.6%, while Japan’s Nikkei retreated -2.9%. As grouped by Morgan Stanley Capital International, developed markets ended the week down -2.1%. Emerging markets declined -0.6%.

Commodities: Precious metals rallied this week with Gold rising 5.7% to $1973.50 per ounce and Silver surging 9.5% to $22.46. West Texas Intermediate crude oil declined for a second week, falling -12.7% to $66.93 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -3.4%.

U.S. Economic News: The number of Americans filing first-time unemployment benefits fell last week, returning to near historic lows. The Labor Department reported initial jobless claims totaled 192,000, suggesting layoffs remain quite low despite the stress on the economy. In early March, new unemployment filings topped the 200,000 mark for the first time in two months. Economists had forecast new claims to total 205,000 in the seven days ending March 11. Thirty-five of the 53 U.S. states and territories that report jobless claims showed a decrease last week. Eighteen posted an increase.

New residential construction bounced back in February for the first time in six months, but it remains unclear whether the bounce will translate into a recovery for the housing market. Construction on new homes rose 9.8% in February to 1.45 million units. The increase was larger than expected. However, analysts were quick to point out the bulk of the recovery was in apartment buildings, up 24.1%. The construction of single-family homes rose just 1.1%. Single-family construction in the West led the jump with a 28.5% increase. The Midwest and South regions reported a drop in single-family construction. Meanwhile, building permits, which give an indication of future construction activity, surged 13.8% to 1.52 million.

Confidence among the nation’s small business owners improved last month, but remained subdued as high inflation and concerns over an economic downturn weighed on sentiment. The National Federation of Independent Business (NFIB) reported that its small-business optimism index increased to 90.9 in February from 90.3 in January, slightly exceeding the 90.0 consensus forecast from economists. The reading is the highest since November, but it remains below its historical average of 98. The uptick in confidence was driven by an increasing number of firms expecting higher sales and improving earnings trends but the outlook for the general economy deteriorated, the data showed. “Small-business owners remain doubtful that business conditions will get better in the coming months,” NFIB chief economist Bill Dunkelberg said.

Consumer prices rose again in February, albeit at a slower rate bringing the annualized rate of inflation down to 6%. The Labor Department reported the consumer-price index rose 0.4% last month, matching forecasts. The annual rate, meanwhile, slowed to its lowest level since September 2021. Core inflation, which omits food and energy prices, rose a sharper 0.5%. Rising costs of renting and homeownership accounted for more than 70% of the increase in consumer prices last month. Housing is the single biggest category of the CPI. Despite high-profile bank failures like Silicon Valley Bank, many economists expect the Fed to remain on its rate-hiking trajectory. Ryan Sweet, chief economist at Oxford Economics stated, “Though stress has spiked in the banking system, the Fed is still highly focused on taming inflation.”

Prices at the wholesale level declined for a second time in three months, possibly hinting at some easing in stubbornly high inflation. The Producer Price index fell 0.1% in February—economists had expected a 0.3% increase. A separate measure of wholesale prices that strips out volatile food and energy costs rose a mild 0.2% last month, the government said. That was also below Wall Street’s forecast. The decline was led by a third straight decline in food prices. Notably, wholesale egg prices declined 41%. The cost of eggs had soared since last fall, doubling in some parts of the country. “The downward surprise to February’s PPI report is good news for the Fed,” said Matthew Martin, U.S. economist at Oxford Economics.

Manufacturing activity in New York pulled back sharply this month, the New York Fed reported. Its Empire State Business Conditions index, a gauge of manufacturing activity in the state, fell -18.8 points to -24.6. Economists had expected a pullback to just -5.0. The index is often volatile, but this is the fourth consecutive negative reading. In the details, new orders fell 13.9 points to negative 21.7 in March. Expectations of general business conditions in the foreseeable future fell 11.8 points but remained slightly positive at 2.9. The Empire index is seen as a precursor to the national manufacturing gauge released by the Institute for Supply Management at the start of each month.

The U.S. economy is heading for trouble according to a gauge of 10 indicators known as the Leading Economic Index (LEI). The nonprofit Conference Board reported the LEI fell 0.3% in February—the 11th decline in a row. The economy has slowed due to the end of pandemic stimulus and the resulting high inflation, which has forced the Federal Reserve to raise interest rates. Eight of the 10 indicators tracked by the Conference Board fell in February. The leading economic index still points to risk of recession in the U.S. economy,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators at the Conference Board.

International Economic News: The Royal Bank of Canada forecasts a ‘mild’ recession for the Canadian economy over the middle-quarters of 2023. RBC predicts slower growth throughout the provinces except Newfoundland and Labrador, which are benefiting from offshore oil production. Due to strong commodity prices, the oil-producing provinces of Saskatchewan, Alberta and Newfoundland and Labrador are expected to come out “ahead of the pack.” Higher household debt service costs, and corrections in the housing markets, create a grim outlook for British Columbia, Ontario, and Quebec. “No parts of the country will be sheltered from the stiffer economic headwinds,” RBC’s report said.

Across the Atlantic, Britain’s Officer for Budget Responsibility (OBR) expects it will take over a year for the UK economy to recover pre-pandemic strength. The OBR forecasts UK house prices to fall by 1.1% this year and by 5.7% in 2024, before rising 1.1% in 2025 and 3.4% in 2026. Headline public sector net debt is expected to reach 100.6% of GDP by the end of 2023, 1.2% lower than November’s GDP forecast. Paul Johnson, director of the Institute for Fiscal Studies, described the broad economic outlook for the next five years as largely unchanged. “The OBR expects the economy to grow a bit faster in the short term, and a bit slower in the medium term, combining to produce an economy 0.6% larger in real terms in 2027–28 than under the autumn forecast,” he said.

On Europe’s mainland, France’s fiery protests lead to hundreds detained as the pension reform bill passed the French Senate. According to the Organization for Economic Cooperation and Development, France has one of the lowest retirement ages in the industrialized world at the cost of nearly 14% of economic output. Weeks-long protests became inflamed as the government forced through raising the retirement age from 62 to 64. Around 310 citizens were detained across France, primarily in Paris. Prime Minister Elisabeth Borne announced in the National Assembly that Macron would enact the proposed pension reform bill. Budget Minister Gabriel Attai reiterated President Macron’s claim that the government hadn’t wanted to use its constitutional power to push through the law. “If we don’t do [the reforms] today, it’s much more brutal measures that we will have to do in future,” Attal said. A strike by garbage workers left Paris’ streets full of piling trash. “I respect the strike of the garbage collectors,” said interior minister Darmanin, “however, what is not acceptable is unsanitary conditions.” Darmanin said he would order police to force some back to work.

In response to the demise of Silicon Valley Bank earlier this month, German Chancellor Olaf Scholz said, “I do not see the risk.” Scholz assured the savings of its citizens were safe. “The monetary system is no longer as fragile as it was before the financial crisis,” he said in reference to 2008. Prior to his statements, Switzerland’s central bank loaned Credit Suisse $54 billion to bolster its liquidity and restore investor confidence. “Not only because of the higher resilience of the banking system and stricter regulation, but also because of our economic strength,” Scholz stated.

China’s economic activity is showing gradual improvement through the first quarter of 2023. While consumption and infrastructure investment remained robust, weak global demand and a downturn in the property sector weighed on growth. According to the National Bureau of Statistics (NBS), industrial output is 2.4% higher than at the same time last year. China’s central bank increased its liquidity injections to bolster growth but kept its policy interest rate unchanged. “The economy is gradually recovering this year, but it must be noted that the pandemic damaged corporate and personal balance sheets over several years, and they still need time to repair,” NBS spokesman Fu Linghui said. China’s annual growth target is set around 5% this year. According to Fu, this would be challenging, “but we must be aware that we have the conditions, foundation, and confidence to achieve the growth target.”

Japan’s workers received their largest pay raises in decades as inflation continued to rise in the world’s third-largest economy. Japan’s top companies, including Toyota Motor Corp and Hitachi Ltd, synchronized their largest pay increases in twenty-five years, heeding Kishida’s call for higher wages to offset rising living costs. According to the Bank of Japan, the recent price rises were not from improving domestic demand, but from volatile external factors such as higher import costs. “Rather than a change in the stance of companies, this is more a case of a temporary reaction to unexpected and historically high prices,” said Takahide Kiuchi, an executive economist at Nomura Research Institute and former BOJ member.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.