3-14-2022 Weekly Market Update

The very Big Picture

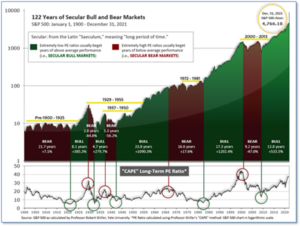

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market is now above at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 34.31, down from the prior week’s 35.43. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

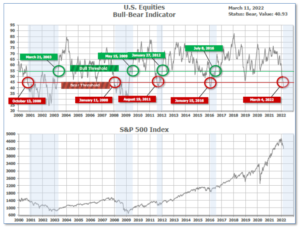

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 40.93, down from the prior week’s 43.76.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering January, indicating positive prospects for equities in the fourth quarter of 2021.

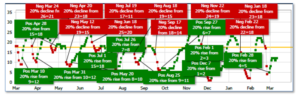

Next, the short-term(weeks to months) Indicator for US Equities turned negative on February 22, and ended the week at 12, unchanged from the prior week.

In the Markets:

U.S. Markets: The major U.S. equity benchmarks moved lower for a second week in extremely volatile trading. The Dow Jones Industrial Average shed 671 points finishing the week at 32,944, a decline of -2%. At its low point this week, the large cap S&P 500 was roughly 14% off its high. At its intraday low on Tuesday, the technology-heavy NASDAQ Composite fell into “bear market” territory, defined as a 20% decline below its recent peak. The NASDAQ fell a further -3.5% last week, following a -2.8% decline the week before. By market cap, the large cap S&P 500 declined ‑2.9%, the mid cap S&P 400 ended the week down -1.7%, and the small cap Russell 2000 closed down ‑1.1%.

International Markets: International markets finished the week mixed. Canada’s TSX gained 0.3% while the United Kingdom’s FTSE 100 rebounded 2.4%. France’s CAC 40 and Germany’s DAX retraced some of last week’s plunge with the CAC rising 3.3% and the DAX gaining 4.1%. In Asia, China’s Shanghai Composite retreated 4%. Japan’s Nikkei ended down -3.2%. As grouped by Morgan Stanley Capital International, developed markets declined -0.6%. Emerging markets ended the week down -4.6%.

Commodities: Commodities prices continued their surge from the beginning of the year, due in part to the conflict in Ukraine, dominated much of the sentiment during the week. The escalation was most visible to consumers in oil prices, which momentarily reached $139 per barrel—a 14-year high. However, Brent crude oil ultimately finished the week down ‑4.2% to $112.67 per barrel. Gold and Silver finished the week to the upside, with Gold rising 0.9% to $1985.00 per ounce and Silver rising 1.4% to $26.16. The industrial metal copper, viewed by some analysts as a barometer of world economic health, ended the week down -6.3%.

U.S. Economic News: The number of Americans filing first-time unemployment benefits climbed again after unusually large increases in New York and California. The Labor Department reported initial jobless claims rose by 11,000 to 227,000 last week. Economists had forecast initial claims would total 216,000. Aside from the big increases in New York and California, new filings were little changed in almost every other state. Companies are still reporting a very tight labor market, however some headwinds are developing. The war in Ukraine, inflation, and rising oil prices all threaten to undermine growth. Meanwhile, “continuing claims”, which counts the number of people already receiving benefits rose by 25,000 to 1.49 million. That number is reported with a one-week delay.

The number of job openings in the U.S. fell slightly at the beginning of the year after setting a record at the end of 2021. The Labor Department reported the number of open positions slipped by 200,000 to 11.3 million. Most of the decline in job openings was concentrated at hotels and restaurants. Job listings also fell in transportation, warehousing and government. Also in the report, some 4.3 million people quit their jobs in January. Over the last several months, millions of people have quit their jobs in what’s become known as “The Great Resignation”. The closely-watched “quits rate” dropped 0.2% to 2.8% in January. Analysts view the “quits rate” as a valuable measure of the health of the labor market as it is assumed as one would only leave a job in favor of a more lucrative one.

The largest number of businesses in over 40 years reported “high inflation” was their number one worry—and many are increasing prices to offset their own rising costs. The National Federation of Independent Businesses (NFIB) reported optimism among small businesses fell in February to a one-year low, falling 1.4 points to 95.7. Economists had expected a reading of 97.2. Just last summer, the index had topped at 102. In the release, NFIB chief economist Bill Dunkelberg stated, “Inflation continues to be a problem on Main Street, leading more owners to raise selling prices again in February.” A net 68% of business owners said they were increasing prices—the highest reading in the history of the 48-year-old survey. In addition, small business owners stated they don’t expect much improvement anytime soon. The percentage of respondents who think business conditions will be better six months from now fell to a net negative 35%.

To no one’s surprise, inflation surged to its highest level since the early 1980’s last month, with little sign of slowing down. The Bureau of Labor Statistics reported its Consumer Price Index (CPI) rose 0.8% in February to 7.9%. Significant increases in the cost of gasoline, food, and housing led the across-the-board rise in prices. The surge in the cost of living over the past 12 months is the biggest since January 1982. Until very recently, Wall Street economists and the Federal Reserve had insisted the increase in inflation was ‘transitory’ and would crest soon after. Now those same economists are reporting the conflict in Ukraine is the trigger of big increases in the cost of oil, wheat, and other commodities. The Fed, for its part, remains on track to raise interest rates this month for the first time in four years. Meanwhile, the CPI “core rate”, which strips out the volatile food and energy categories, also rose 0.5% to an annualized 6.4%. That reading is also the highest since the middle of 1982. Many economists don’t expect inflation to come under control anytime soon. Robert Frick, corporate economist at Navy Federal Credit Union stated, “February’s CPI reading was the highest in 40 years — again — but what was once forecast to be the inflation peak is now the jumping off point for ever higher inflation sparked by the war in Ukraine.”

International Economic News: Canadian employers added 337,000 jobs last month, more than double the median forecast. The latest hiring numbers show the economy quickly righted itself after taking a brief hit from a fifth wave of ‘Omicron’ COVID-19 infections. Some analysts believe the latest reading proves that the COVID-19 recession is over. Furthermore, Statistics Canada reported the unemployment rate fell to 5.5%, dropping below its pre-pandemic level for the first time. Economists had expected the unemployment rate would only fall to 6.2%. Karl Schamotta, chief market strategist at Cambridge Mercantile Corp., said in a note to clients, “The Bank of Canada is widely expected to upgrade its inflation forecasts and announce another interest rate hike at its next meeting on April 13.” Bank of Canada policymakers hiked Canada’s key interest rate a quarter-point on March 2, lifting its benchmark rate to 0.5%.

Across the Atlantic, the United Kingdom’s Office for National Statistics reported Britain’s economy bounced back from the effects of the Omicron-variant faster than expected during January. The ONS said all sectors of the economy returned to growth, helping to lift gross domestic product by 0.8%, fueled by a rise in consumer demand. However, some analysts don’t expect the good times to last. Paul Dales, chief UK economist at the consultancy firm Capital Economics said, “[It’s] as good as it gets for this year.” “The hit to households’ real disposable incomes from the surge in energy prices, the latest chunk of which is due to the war in Ukraine, and higher taxes will start to be felt from March and April. As such, GDP growth will probably slow throughout the year.”

On Europe’s mainland, French president Emmanuel Macron is planning a second attempt at reforming the country’s costly pension system and extending the country’s retirement age from 62 to 65. Gabriel Attal, the government’s spokesman said the move would be one of the “priority reforms” of a second term. Macron’s first attempt to simplify France’s 40+ pension schemes and merge them into a single, fairer, points-based system led to protests from trade unionists and other workers in sectors such as public transport that enjoy the most favorable retirement plans. The planned reforms were suspended during the Covid-19 pandemic. France has one of the highest public sector pension bills among industrialized countries and an early effective retirement age compared with its neighbors. “We can see around us—in Germany, Spain, the UK, Italy—people already retire at 65,” said Attal.

The head of Volkswagen, Europe’s largest carmaker, warned that a prolonged war in Ukraine risks being “very much worse” for the region’s economy than the coronavirus pandemic. Herbert Deiss, chief executive of the German carmaker stated the interruption to global supply chains “could lead to huge price increases, scarcity of energy and inflation.” The warning comes as Western governments ratchet up their economic efforts to punish Russia, a key global supplier of commodities from energy to palladium. Pointing to inflation Diess said “The threat of this war for Germany and Europe is huge.” Eurozone inflation hit a new record of 5.8% in February and is forecast to rise as high as 7% this year.

In Asia, Chinese Premier Li Keqiang said achieving the government’s gross domestic product goal of around 5.5% in 2022 is “not easy” and pledged to implement policy measures that would generate more jobs. Li also noted that China (as of now) opposes sanctions on Russia as they would hurt the overall global economic recovery. At the National People’s Congress, China cut its economic growth target for 2022 from last year’s target of over 6.0%. Li said China would “prioritize employment” this year, and fiscal and monetary policies will be carried out to accomplish the goal of boosting jobs. In 2021, the world’s second-largest economy expanded 8.1% from the previous year. In the October-December period, however, it grew only 4.0% annualized against a backdrop of concern about potential financial market turmoil and another wave of coronavirus infections.

Japan’s households pared back their spending in January as the Omicron-variant of the coronavirus spread rapidly around the world and governments imposed new restrictions on activity. Japan’s Ministry of Internal Affairs reported spending fell 1.2% for the month—its sixth drop over the past nine months. Compared with the low levels of a full state of emergency a year ago, spending rose 6.9%–economists had forecast a 3.4% gain. Given that the weakness in spending occurred prior to Russia’s invasion of Ukraine, analysts are concerned that Japan’s overall recovery could slip back into reverse amid the economic uncertainty. Hiroaki Muto, economist at Sumitomo Life Insurance Co. stated, “It’s not just consumption that’s in danger of falling, overall gross domestic product could also contract in the first quarter.” Household spending accounts for more than half of Japan’s gross domestic product.

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.