2-15-21 Weekly Market Update

The very Big Picture

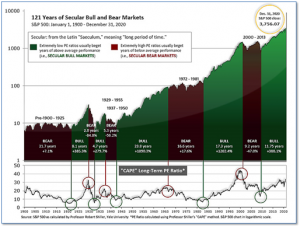

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 35.83, up from the prior week’s 35.39. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

The Big Picture:

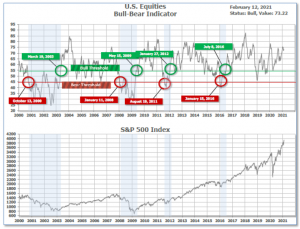

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 73.22 up from the prior week’s 72.44.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering January, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on January 4 and ended the week at 20, down sharply from the prior week’s 32.

In the Markets:

U.S. Markets: The major U.S. indexes notched a second week of gains and reached record highs as the rollout of coronavirus vaccines continued and case trends extended their decline. The Dow Jones Industrial Average added 310 points to close at 31,458, a gain of 1.0%. The technology-heavy NASDAQ Composite gained 1.7% finishing at 14,095. By market cap, the large cap S&P 500 rose 1.2%, while the mid cap S&P 400 and small cap Russell 2000 extended their lead over large caps, adding 2.7% and 2.5%, respectively.

International Markets: International markets finished the week predominantly to the upside. Canada’s TSX rose 1.8%, while the United Kingdom’s FTSE added 1.5%. On Europe’s mainland, France’s CAC 40 rose 0.8% and Germany’s DAX remained essentially unchanged. In Asia, China’s Shanghai Composite surged 4.5%, while Japan’s Nikkei finished the week up 2.6%. As grouped by Morgan Stanley Capital International, developed markets rose 2.1% and emerging markets finished the week up 2.8%.

Commodities: Precious metals finished the week to the upside. Gold added $10.20 to finish the week at $1823.20 an ounce, a gain of 0.6%. Silver gained 1.1% and closed at $27.33 per ounce. Energy had a second week of strong gains. West Texas Intermediate crude oil finished the week up 4.6% to $59.47 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, continued its recent run and surged 4.5%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits fell slightly last week, down three of the past four weeks. The Labor Department reported initial jobless claims fell by 19,000 to 793,000. The reading was higher than economists’ forecasts of 760,000 new claims. The level has remained below one million since August, but remains several times higher than before the coronavirus pandemic took hold. Continuing claims, which counts the number of Americans already receiving benefits, fell by 145,000 to 4.545 million. Both indicators are showing slow but steady improvement.

A new survey showed that businesses cut back sharply on the number of people hired at the end of last year. The Bureau of Labor Statistics reported its Job Opening and Labor Turnover Survey (JOLTS) showed hiring shrank by 6.7% (almost 400,000 people) in December to 5.5 million, its lowest level since last April. Most of the declines came as restaurants and hotels shutdown as the COVID resurgence in the fall resulted in new restrictions on travel and gatherings. However, on a positive note, the number of job openings ticked up 1.1% to 6.646 million—a five-month high. Job openings were led by professional and business services. Nick Bunker, director of research at Indeed Hiring Lab summed up the report writing, “The new data show that the decline in employment in December was more a product of reduced hiring than a pick-up in layoffs.”

The nation’s small-business owners have become more pessimistic about business conditions, despite the continued roll-out of COVID vaccinations. The National Federation of Independent Business (NFIB) reported its confidence index fell 0.9 point to 95.0—its lowest level since the onset of the pandemic last spring. However, more disturbing is that the percent of small-business owners who expect conditions to improve in the next six months dropped to a seven-year low, according to the NFIB report. Pessimism has increased sharply over the past four months, coinciding with the resurgence in coronavirus cases. The coronavirus pandemic has hit small-business owners particularly hard as many deal directly with customers and most don’t have the financial cushion of larger businesses.

Consumer level inflation climbed at its fastest pace in five months, driven by a sharp increase in energy prices. The Consumer Price Index increased by 0.3% in January, matching economists’ forecasts. The increase was driven by a 3.5% gain in energy prices, including a 7.4% increase in the price of gasoline. Food prices ticked up 0.1%. Core CPI, which excludes food and energy, remained unchanged from the previous month. In the details, apparel prices rose for the third consecutive month, and medical care, vehicle insurance, and rent all picked up. Those were offset by declines in recreation, airline fares, and vehicle prices. Year-over-year, the CPI remained steady at 1.4%, while core CPI eased to 1.4% from 1.6% the previous month. More analysts are now expecting inflation to increase as the economy recovers, fueled by trillions of dollars in fresh coronavirus aid. Economist Andrew Hunter at Capital Economics stated, “We still think inflation will be much stronger over the rest of this year than most others currently expect.”

International Economic News: Canada has the world’s longest coastline and is connected to three oceans. The government believes Canada is well positioned to be a global leader in the so-called “Blue Economy”. A “Blue Economy Strategy” is intended to be ocean-oriented, hopefully will create good, middle-class jobs, all the while ensuring healthy oceans and sustainable ocean industries, says Canada’s Minister of Fisheries and Oceans. The specific goals are to enhance sustainability in commercial fishing, explore offshore renewable energy, encourage sustainable tourism in coastal regions, and enhance international trade. Bernadette Jordan, Minister of Fisheries and Oceans stated, “A Blue Economy Strategy means long-term prosperity for coastal and Indigenous communities. A comprehensive strategy will reflect the input of all Canadians, further protect our ocean-based resources while increasing our competitiveness.”

Across the Atlantic, the United Kingdom’s economy just suffered its biggest slump in more than 300 years, with 2020 GDP falling nearly 10%. The COVID-19 pandemic has effectively wiped out all growth in the UK over the last 7 years. Still, the 9.9% slump was less severe than expected, but surpassed the 9.7% collapse experienced during the Great Depression in 1921 making it the worst annual drop since 1709. There were some signs of improvement in the final months of 2020, with GDP estimated to have increased by 1% in the fourth quarter, following record growth in the third, according to the Office for National Statistics. In sum, the United Kingdom suffered one of the worst recessions among major economies last year.

On Europe’s mainland, French economic activity is running at 5% below pre-crisis levels. The government held off from imposing a full COVID-19 lockdown beyond the current curfew and closures in some specific sectors, the Bank of France stated. Following November’s 7% slide, the economy improved somewhat in December and is expected to remain steady through February, according to the central bank’s monthly survey of 8,500 companies. The stability comes despite the introduction of slightly tighter restrictions in recent weeks. Bank of France Governor Francois Villeroy de Galhau stated, “This resilience is both a good surprise concerning the end of 2020, and a source of reassurance for 2021.”

The German business community expressed consternation after Chancellor Angela Merkel and regional leaders agreed to extend the coronavirus lockdown until March 7th. Under the agreement reached on Wednesday, hair salons will be allowed to reopen from March 1 but the threshold for a gradual re-opening of the rest of the economy has been tightened. Peter Wollseifer, president of the organization representing skilled trades, said it was disappointing that leaders had not been able to agree on a detailed plan for openings to help business plan to ramp up again. “Many companies want and need to finally get going again, and they need to know when and how this will be possible again,” he said.

A Chinese priority and hot political and economic issue this year is self-reliance regarding its food supply. The Chinese Communist Party has announced it will switch to paying more attention to improving its domestic production, after having relied on record import levels last year. At least for now, that trend appears to have carried over into the new year. Chinese buyers bought 5.86 million tons of American corn at the end of January, marking the highest weekly purchase since records began in 1999. Despite the record imports, China remains far short of meeting the lofty purchasing targets of its phase-one trade deal with the United States in 2020 – and self-reliance would slash those imports theoretically to zero.

A survey of 37 economists showed Japan’s economy is likely to suffer a much bigger contraction than initially expected in the first quarter of 2021 as an extended state of emergency to contain the coronavirus pandemic weighs on corporate and household spending. A firm majority of the respondents also agreed that whether or not Tokyo proceeds with the Olympic Games this year would have little impact on the economy either way, as most big construction projects are completed and spectator numbers are likely to be limited. The world’s third-largest economy is expected to have shrunk an annualized 5.0% in the current quarter, the poll of economists showed, double the 2.4% contraction projected just last month.

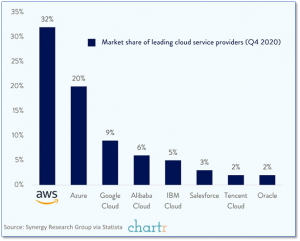

Finally: Jeff Bezos announced he is stepping down as CEO of Amazon, and that his replacement will be Andy Jassy, currently CEO of Amazon’s Web Services (AWS) division. Although all consumers know Amazon is THE behemoth in global e‑commerce, it would no doubt be shocking to most to learn that AWS is the biggest profit center of the entire company. Amazon’s most recent numbers revealed 2020 revenue of $386 billion. While AWS made up only 12% of that revenue number, AWS’ very comfortable profit margins meant it made up almost 60% of Amazon’s total operating profit! Under Jassy’s leadership AWS has become the clear global market leader, having captured almost one-third of the entire cloud computing market, and is more than 50% larger than second place Azure from Microsoft. (Chart from chartr.co)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, CNBC, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.