12-20-2021 Weekly Market Update

The very Big Picture

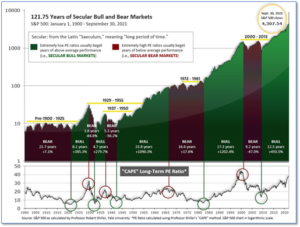

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market is now above at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 38.76, down from the prior week’s 39.53. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 59.74, down from the prior week’s 61.25.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering October, indicating positive prospects for equities in the fourth quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on December 7 and ended the week at 7, unchanged from the prior week.

In the Markets:

U.S. Markets: U.S. stocks ended the week to the downside as global inflationary pressures forced central banks to either reduce their stimulus or begin tightening. Furthermore, fears over the impact of the latest ‘Omicron’ variant of the coronavirus weighed on sentiment. Volatility to end the week was partly due to “quadruple witching,” or the expiration of four types of options and futures contracts on Friday. The technology-heavy NASDAQ Composite led the way to the downside, declining -2.9% on the week to 15,170. The Dow Jones Industrial Average shed 606 points finishing at 35,365 – a -1.7% decline. By market cap, the large cap S&P 500 and mid cap S&P 400 each gave up -1.9%, while the small cap Russell 2000 ended the week down -1.7%.

International Markets: International markets ended the week mostly down as well. Canada’s TSX ended down ‑0.7%, while the United Kingdom’s FTSE 100 retreated -0.3%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX gave up -0.9% and -0.6%, respectively. In Asia, China’s Shanghai Composite finished down -0.9%. Japan’s Nikkei was the sole major international market to finish in the green, adding 0.4% for the week. As grouped by Morgan Stanley Capital International, developed markets finished the week down -1.4%, while emerging markets fell a steeper -2.5%.

Commodities: Precious metals made gains in opposition to the weakness in the equities markets. Gold rose 1.1% to $1804.90 per ounce, while Silver added 1.5% and finished at $22.53. The rebound in crude oil faltered as it ended the week in the red. West Texas Intermediate crude oil declined -1.3% to $70.72 per barrel. The industrial metal copper, viewed by some analysts as barometer of world economic health due to its wide variety of uses, finished up 0.2% last week.

U.S. Economic News: The number of Americans filing for first-time unemployment benefits rose modestly last week, but remained near their lowest levels since the 1960’s. The Labor Department reported initial claims climbed by 18,000 to 206,000, but analysts believe the increase is likely tied to “statistical quirks” of hiring temporary workers during the holiday shopping season. Still, even with the increase, claims remain near their lowest level since 1969. Economists had expected new claims to total 195,000. New jobless claims rose the most in California, New York, and Michigan. New filings declined the most in Virginia and North Carolina. Meanwhile, the number of people already collecting benefits, known as ‘continuing claims’, declined by 154,000 to 1.85 million. That number has now returned to pre-pandemic levels.

The nation’s homebuilders grew more confident for a fourth consecutive month, reflecting their positive outlook amid a continued shortage of existing homes for sale. The National Association of Home Builders (NAHB) reported its monthly confidence index rose 1 point to a reading of 84 this month. The reading is at its highest level since February. Two of the three gauges that make up the index also experience one point increases—current sales conditions and buyer traffic. The gauge that assesses sales expectations over the next six months remained unchanged. Regionally, it was quite mixed. The confidence index for the Northeast rose 10 points, while the South increased 2 points. However, the index ticked down 1 point in both the Midwest and the West. Analysts note that home builders are surely enjoying the current sales environment, but with the Federal Reserve increasing its tapering of stimulus measures, which have included mortgage-backed securities, mortgage rates are expected to increase.

The greatest number of small businesses in over 40 years raised their prices last month, fueling the continued rise in inflation. The National Federation of Independent Business (NFIB) reported their small business optimism index ticked up 0.2% to 98.4 in November, slightly exceeding the consensus forecast of 98.0. In the report, the NFIB noted 59% of small-business owners increased their prices for goods and/or services last month. That was the highest figure since 1978. Small and large businesses continue to cope with both shortages of materials and qualified workers. NFIB chief economist Bill Dunkelberg stated, “Owners are also pessimistic as many continue managing challenges like rampant inflation and supply chain disruptions that are impacting their businesses right now.” Furthermore, small business owners don’t expect their situation to improve anytime soon. The percentage of owners expecting improvement in the next six months continued its sharp decline.

The Federal Reserve voted to speed up the reduction of its bond purchases to $30 billion per month so that its buying program would end in March instead of the original plan of June. The Fed also added three increases in short-term interest rates for 2022—up from the one projected in September. In its latest forecast, the central bank raised its inflation forecast for next year to 2.6% from 2.2% using its preferred inflation gauge, the Personal Consumption Expenditures index. U.S. economic growth is expected to slow to 4% in 2022 from its original estimate of 5.5% this year. In its policy statement, the Fed finally dropped the word ‘transitory’ to describe inflation.

Prices at the wholesale level rose again in November, signaling there is no relief in sight for inflation at the consumer level. The Labor Department reported the Produce Price Index climbed 0.8% in November, easily surpassing Wall Street expectations of just 0.5%. The latest increase lifted the increase in wholesale prices over the past 12 months 0.8% to 9.6%. In addition, it marked the biggest advance since the index underwent a major adjustment in 2009. The separate measure of wholesale inflation that strips out food, energy, and trade margins rose 0.7% in November. That measure is up 6.9% over the past year. Stephen Stanley, chief economist at Amherst Pierpont Securities wrote in a note to clients, “This is a testament to the fact that inflation continues to broaden out. The Fed should be very concerned.”

Major retailers like Amazon and Home Depot posted small increases in sales last month, but higher inflation numbers suggest consumers spent less than expected at the start of the holiday shopping season. The Census Bureau reported retail sales rose 0.3% last month, far short of the 0.8% economists were expecting. The rise in sales was far outstripped by the higher cost of living. After adjusting for inflation, retail sales were actually down -0.5%. Retail sales are a significant part of overall consumer spending and offer a good view of the strength of the U.S. economy. Sales were held down in large part by a small decline in vehicle purchases, which account for 20% of all retail sales. Yet sales also fell sharply at department stores and were flat at internet retailers. Senior economist Sal Guatieri of BMO Capital Markets wrote in a note, “The strong early start to the holiday shopping season fizzled out pretty fast in November, casting a sour mood heading into year end.”

A pair of surveys from data analytics firm IHS Markit showed the U.S. economy tapped on the brakes in December, but remained robust. Markit’s so-called “flash” reading of U.S. manufacturers pulled back half a point to 57.8 in November. Likewise, its flash reading of services-oriented companied also ticked down, to 57.5 from 58 in the prior month. IHS chief business economist Chris Williamson stated in the release, “The survey data paint a picture of an economy showing encouraging resilience to rising virus infection rates and worries over the Omicron variant.” There was some evidence that price pressures are starting to ease, the survey showed. Yet the spread of the new omicron variant of the coronavirus is raising worries about another setback.

Manufacturing activity in the New York-region remained strong this month, a positive sign for the overall U.S. economy. The New York Federal Reserve reported its Empire State business conditions index rose 1 point to 31.9, far surpassing economists’ expectations for a reading of 25. The Empire State index has been volatile recently and economists had expected it would retreat after surging 11 points in November. Economists use the New York factory data as an early proxy for the closely-watched national factory index released by the Institute for Supply Management.

International Economic News: With inflation surging, analysts believe the Bank of Canada is likely to change its interest rate guidance in the new year to support raising borrowing costs sooner rather than later. Last week, the bank had reiterated its guidance saying it would not raise rates until economic slack has been absorbed “in the middle quarters of 2022.” But it has turned hawkish since then, warning that inflation will run hot for longer than expected. Andrew Kelvin, chief Canada strategist at TD Securities noted as of now, inflation pressures outweigh the threat of the new ‘Omicron’-variant of the coronavirus. “Even if the Bank of Canada wants to be a little bit cautious in front of a potential winter set of shutdowns…, if they think inflation expectations are starting to become unanchored, that will be their primary concern,” he wrote.

Across the Atlantic, the Bank of England (BoE) raised its key interest rate to 0.25% from its historic low of 0.1% in the face of global inflation pressures and a tightening labor market. Inflation hit 5.1% in the 12 months to November, the sharpest annual increase in 10 years and well above the Bank’s 2% target. The BoE now expects consumer price increases to peak at an annual 6% in April 2022. The bank’s Chief Economist Huw Pill said the BoE now needs to proceed cautiously and assess whether omicron is going to lead to some reversal of the dynamics in the British economy over the past six months and beyond, particularly the tightening of the labor market.

On Europe’s mainland, French President Emmanuel Macron said he made France’s economy stronger and sought to show he is not out-of-touch with ordinary people in an interview this week on national television, which appears as a bid to boost his popularity ahead of April’s presidential election. Macron, who is expected to seek a second term, has yet to formally declare his candidacy. “When I was elected, I loved France, and now I can tell you I love it even more madly. I love the French,” Macron said. “These five years have been five years of joy, of hard work, but also of crisis, of periods of doubt.” Macron listed changes his government made to boost job creations and cut taxes on businesses.

Germany’s central bank, the Bundesbank, lowered its growth forecast for 2022 but remained positive on its outlook for 2023. The bank revised its growth forecasts for 2022 on Friday amid constricted supply chains and the spread of the omicron variant. The Bundesbank lowered its expected growth rate to 4.2%, down from the 5.2% it had forecast in June. “The recovery has been somewhat pushed back,” Bundesbank President Jens Weidmann said. This is not the first time that the bank has had to bring down its estimates. Its economists are now expecting GDP growth in 2021 to reach 2.5%, although their earlier prognosis had been 3.7%.

With the U.S.-China phase-one trade deal set to expire, Chinese sources blame supply-side issues as the impediment to China’s meeting its purchasing targets. Multiple sources in China said that the two countries have engaged in phase-one discussions at various levels and with more frequency than has been publicly disclosed. And before the Xi-Biden summit in November, they say, the China side vowed to “buy whatever the US can ship over”. But for now, China continues to lag behind in its commitment to buy at least US$200 billion worth of additional American goods and services from its 2017 level. China’s total purchases of US goods from January 2020 to October 2021 reached only 60 per cent of the pledged total, according to a report by the Peterson Institute for International Economics (PIIE).

In a shocking report, the Japanese government admitted it overstated its economic data for nearly a decade. Prime Minister Fumio Kishida said the government overstated construction orders data received from builders for years, an admission that’s sure to weaken the credibility of official statistics widely used by investors and economists. At this point, it’s not clear why the government started the practice and what the effect has been on official gross domestic product reports. “It is regrettable that such a thing has happened,” Kishida said. He made the admission in a parliamentary session after the Asahi Shimbun newspaper reported the Ministry of Land, Infrastructure, Transport and Tourism had been “rewriting” data received from about 12,000 select companies since 2013 at a pace of about 10,000 entries per year.

Finally: Borrowing money to buy stocks adds buying pressure during a move up, but can be catastrophic on the way down. One of the worst phrases a trader will ever hear is ‘margin call’—when a broker demands more cash to cover a losing position or else have it forcibly liquidated. In down markets, these forced liquidations contribute to the crashes that often occur near bottoms. Adding to the alarm bells already ringing, margin debt for the overall market – the amount of money investors have borrowed to buy stocks – has ballooned over the past 20 months. Despite the slight downtick of $17 billion in November, margin debt remains at a gargantuan $918.6 billion. (Chart from wolfstreet.com)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.