11-13-2023 Weekly Market Update

The very Big Picture

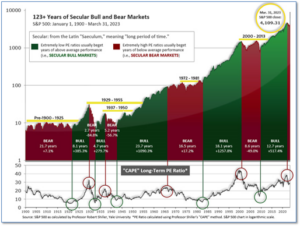

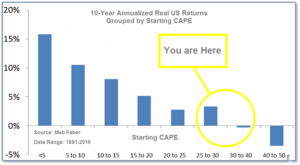

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.89, up from the prior week’s 29.50. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

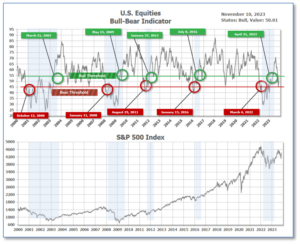

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 50.01 up from the prior week’s 48.05. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on November 2, and ended the week at 11, up 6 from the prior week.

In the Markets:

U.S. Markets: The major indexes finished the week mixed but not before the S&P 500 index came close to matching its longest winning streak in almost two decades. On Wednesday, the S&P 500 notched its eighth consecutive gain, while the NASDAQ Composite marked its ninth. The Dow Jones Industrial Average rose 222 points finishing the week at 34,283—an increase of 0.7%. The technology-heavy NASDAQ outperformed the other benchmarks finishing up 2.4%. By market cap, the large cap S&P 500 added 1.3%, while the mid cap S&P 400 retreated -1.6%. The small cap Russell 2000 fared the worst finishing the week down -3.1%.

International Markets: International indexes finished the week mixed as well. Canada’s TSX fell -0.9%, while the UK’s FTSE 100 gave up -0.8%. France’s CAC 40 closed essentially unchanged, while Germany’s DAX ticked up 0.3%. In Asia, China’s Shanghai Composite added 0.3%. Japan’s Nikkei finished the week up 1.9%. As grouped by Morgan Stanley Capital International, developed markets ended down -0.8%. Emerging markets declined -0.3%.

Commodities: Precious metals ended the week down with gold pulling back -3.1% to $1937.70 an ounce and Silver retreating -4.3% to $22.28. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, closed down -2.6%. West Texas Intermediate crude oil closed down for a third consecutive week giving up -4.2% to $77.17 per barrel.

U.S. Economic News:

The U.S. labor market showed signs of strength as initial jobless claims dropped to 217,000. The number of Americans who applied for unemployment benefits last week remained at low levels. Job losses remained in low numbers as well. The government said that new jobless claims declined by 3,000 from a revised 220,000 the week before last, which was in line with economists’ expectations. New jobless claims increased slightly in 34 of the 53 states and territories reporting to the federal government. The number of actual claims, before seasonal adjustments, reached 200,000 for the first time in two months. However, this number remains well below the 300,000 level that often signals a recession. The number of American citizens who collected unemployment benefits rose to 1.83 million. While the overall labor market remained strong and the unemployment rate is low, a few companies are laying off workers. “Initial claims still support a jobs market typical of an expansion,” said corporate economist Robert Frick of Navy Federal Credit Union. “Average weekly claims this year are about 227,000, and given the booming third quarter GDP, claims are unlikely to rise much this year,” Frick added.

Credit card balances hit a $1.08 trillion record in the third quarter. According to the Federal Reserve Bank of New York, credit card balances spiked by $154 billion year over year, it’s largest increase since 1999. Credit card delinquency rates rose across the board, but especially among millennials burdened by student loan debt. The Consumer Financial Protection Bureau found that nearly one-tenth of credit card users find themselves strained by higher prices and carrying debt from month to month. “It’s a big deal,” said Ted Rossman, senior industry analyst at Bankrate. “Your credit card is probably your highest cost debt by a wide margin,” Rossman said. Chief credit analyst at LendingTree, Matt Schulz, said that consumers often turn to credit cards for accessible loans, but that comes at the expense of other long-term financial goals. “That’s money that doesn’t go to a college fund or down payment on a home purchase or Roth IRA,” Schulz added. As consumers gradually spent their excess savings from the pandemic years, cardholders struggled to keep their credit card balances in check. Mike Townsend, a spokesperson for the American Bankers Association recommended that consumers should pay as much of their balance as they can as soon as they can to avoid ongoing debt. “Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, the New York Fed’s economic research advisor.

Federal Reserve Chairman Jerome Powell and his fellow policymakers are unsure whether they’ve done enough to keep inflation down. “The Federal Open Market Committee is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time; we are not confident that we have achieved such a stance,” Powell said. The Fed is focused on whether rates need to go higher and for what duration they need to remain elevated, Powell added. Meanwhile, GDP accelerated at a 4.9% annualized pace in the third quarter, but Powell expects growth to “moderate in coming quarters.” He described the economy as “just remarkable” against the consensus that a recession was inevitable. The Fed Chairman pointed out that improvements in supply chains have assisted in easing inflation pressures, however “it is not clear how much more will be achieved by additional supply-side improvements. Going forward, it may be that a greater share of the progress in reducing inflation will have to come from tight monetary policy restraining the growth of aggregate demand.”

International Economic News: In Canada, a major retailer scaled back its staffing levels due to economic pressures. Consumers tightened their spending on non-essential goods, particularly in regions with high housing costs. In its third quarter earnings release, retail giant Canadian Tire Corporation announced a pullback in hiring and reduced the number of its full-time employees by 3%. “Suffice to say, the future is increasingly murky given the Bank of Canada’s pause was couched in a hawkish tone around risks of further inflation and the potential of more policy rate moves down the road,” President and CEO Greg Hicks said in the release. “In a more challenging economic environment, we are accelerating efficiency initiatives, prioritizing investments within our Better-Connected strategy, and actively managing our resource allocation,” Hicks added.

Across the Atlantic, the UK economy had a flat GDP reading in the third quarter but avoided the start of a recession. According to the Office for National Statistics, Britain’s economy had a 0% change in gross domestic product. Britain’s services sector fell by 0.1%, industrial production was relatively unchanged, and construction grew by 0.1%, the statistics office said. The Bank of England had expected a flat reading for GDP between July and September. Finance Minister Jeremy Hunt stated, “The Autumn Statement focuses on how we get the economy growing healthily again by unlocking investment, getting people back into work and reforming our public services.” Paul Dales, chief economist with consultancy Capital Economics, said the key point is that “the economy is not weak enough to reduce core inflation and wage growth quickly.” Dales added, “As such, we don’t expect the Bank of England will be able to cut interest rates until late in 2024 rather than in mid-2024 as widely expected.”

On Europe’s mainland, German industrial output continued to fall in September. According to its federal statistics office, production fell by 1.4% from August to September, due to a slump in incoming orders. The statistics office stated that production in the third quarter was 2.1% lower than in the second quarter of this year. Chief economist at VP Bank, Thomas Gitzel, said there are few figures that summarize the state of the German economy as well as industrial production. “The industry-heavy German economy is dependent on production in order to achieve reasonable economic growth rates,” Gitzel added. Global head of macro at ING, Carsten Brzeski, said the recent data release in industrial production suggested that a technical recession is likely to weigh down the country in the fourth quarter. “Even though there isn’t any hard data for the fourth quarter yet, recent developments have clearly increased the risk that the German economy will end the year in recession,” Brzeski said.

French Finance Minister Bruno Le Maire said the government will do more on spending if economic growth is weaker than expected. France’s government intends to cut its public sector budget deficit from 4.9% of output this year to 4.4% by 2024. The International Monetary Fund and France’s public audit office have questioned the pace of reduction, even if growth meets the 1.4% rate the government built its budget plans on. Le Maire had asked ministries to come up with billions of euros in unplanned budget savings to keep France’s deficit-reduction plans on course. He said the necessary decisions were in place to stay on course for next year’s 4.4% deficit target if there was an economic slowdown or if a geopolitical crisis impacted French growth. “I am prepared to take new and further decisions on the public expenses if the level of growth is not the one that we are expecting. This is my responsibility,” Le Maire said.

The International Monetary Fund upgraded China’s GDP growth forecast for 2023. The IMF expects China’s economy to grow 5.4% this year, but that the downturn in the property sector and local government debt could weigh down China’s long-term growth potential. The IMF’s GDP revision followed after China’s approval of a 1 trillion yuan ($137 billion) sovereign bond issue in an effort to support the economy. “The central government should implement coordinated fiscal framework reforms and balance-sheet restructuring to address local government debt strains, including closing local government fiscal gaps and controlling the flow of debt,” said Gita Gopinath, IMF’s First Deputy Managing Director. “For the real estate sector, such a policy package will require accelerating the exit of non-viable property developers, removing impediments to housing price adjustment, and increasing central government funding for housing completion, among other measures,” Gopinath added.

Japan’s current-account surplus hit a record high, marking a potentially positive development for the country’s economic recovery and weakened currency. According to the Finance Ministry, Japan’s current-account surplus reached a record of 12.7 trillion yen for the first half of this year. The surplus rose to an annualized 2.72 trillion yen in the third quarter. The cost of energy imports decreased while eased supply chain constraints boosted the exports of cars. Economists had expected Japan’s real economy to turn to contraction in the third quarter, but the recent data suggests there are underlying elements supporting the economy. The current account results are “probably due to inbound spending, and the impact of the weaker yen,” said Shungo Akimoto, market economist at Mizuho Securities. “Each tourist is spending more, while the number of visitors is clearly jumping, reducing the service balance,” Akimoto added.

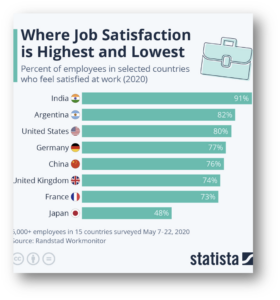

Finally: According to the Randstad Workmonitor, out of fifteen surveyed countries, Indians are the most satisfied at work while Japanese are the least satisfied. Statista’s Katharina Buchholz reported that only 48% of Japanese said they were satisfied with their job. A law passed by the Japanese government in 2020 shines a light on the austere problems of workplace harassment, which have persisted in the country. India and Latin America had higher satisfaction levels recorded. In Southern and Eastern Europe satisfaction levels were ranked below the world average. The unhappiness of Japanese employees has been highlighted on international workplace surveys from the defunct Edenred-Ipsos Barometer to recent surveys by Universum. Randstad found that Japanese were also the least likely to expect a pay raise or bonus.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.