10-9-2023 Weekly Market Update

The very Big Picture

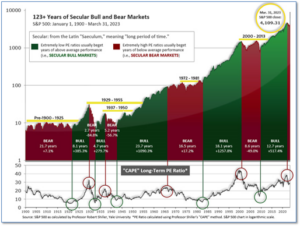

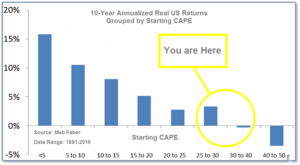

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.45, down from the prior week’s 29.48. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

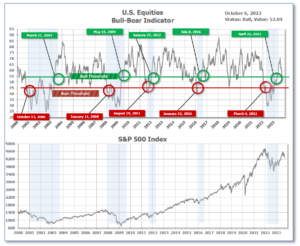

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 52.04 down from the prior week’s 54.27. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on August 10, and ended the week at 3, unchanged from the prior week.

In the Markets:

U.S. Markets: The major indexes finished the week mixed after a week of heavy trading in which large-cap growth stocks and mega-cap tech stocks outpaced the rest of the market. The Dow Jones Industrial Average shed -0.3% ending the week at 33,408, while the technology-heavy NASDAQ Composite rose 1.6% to 13,431. By market cap, the large cap S&P 500 gained 0.5%, while the mid cap S&P 400 retreated -1.9%. The small cap Russell 2000 finished the week down -2.2%.

International Markets: International indexes finished the week solidly to the downside. Canada’s TSX and the United Kingdom’s FTSE 100 each pulled back -1.5%, while France and Germany each shed -1%. In Asia, China’s Shanghai Composite declined -0.7%. Japan’s Nikkei fared the worst falling -2.7%. As grouped by Morgan Stanley Capital International, developed markets finished the week down -0.6%. Emerging markets declined -0.3%.

Commodities: Precious metals finished the week down as well. Gold pulled back -1.1% to $1845.20 per ounce, while Silver declined -3.2% to $21.72. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -2.9%. Oil plunged last week with West Texas Intermediate crude oil retreating -8.8% to $82.79 per barrel.

U.S. Economic News: The U.S. labor market remained robust as September came to a close, with weekly jobless claims holding near recent lows. The Labor Department reported initial filings for unemployment benefits totaled 207,000 for the week ended September 30th. Economists had expected new claims to total 210,000. Continuing claims, which count the number of people already receiving benefits, remained little changed at 1.664 million. The report comes at a critical time for the economy as the Federal Reserve considers the future of monetary policy. Central bank officials worry that continued tightness in the labor market could exert upward pressure on inflation and necessitate additional interest rate hikes.

The economy added 336,000 new jobs in September, much more than economists had expected, in a sign that businesses still have a strong appetite for labor. In the details, government employment shot up 73,000, its third big increase in hiring. The private sector created 234,000 new jobs. Bars, restaurants, and hotels led the way again in hiring, adding nearly 100,000 jobs last month. Health-care providers also boosted employment by 41,000. The unemployment rate remained unchanged at 3.8%. Chief economist Brian Coulton of Fitch Ratings noted, “The labor market is not going to cool with job growth continuing at this rapid pace.”

The number of job openings snapped back in August according to the Labor Department. Job listings rose by 700,000 to 9.6 million reflecting a robust appetite for labor in the economy. The number of job openings is seen as a sign of the health of the labor market and the broader U.S. economy. Economists had expected listings to total just 8.8 million. Job openings surged at white-collar professional businesses (509,000). They also increased in finance and insurance, public education, and manufacturing. Economists and senior Fed officials are increasingly convinced they can slow inflation through higher interest rates without triggering a major surge in unemployment. Nancy Vanden Houten, lead U.S. economists at Oxford Economics wrote, “The Fed won’t make policy decisions based on one [job-openings] report, but it doesn’t keep the risks tilted toward another rate hike.”

Manufacturing activity improved slightly last month, but still faces difficulties. The Institute for Supply Management reported its manufacturing index rose 1.2 points to 49.0 in September as there were some signs of improvement and many companies even added workers. It was the third increase in a row. Economists had expected a reading of just 48. Still, the index has been in contraction (below 50) for 11 months in a row—the first time since the 2007-2009 financial crisis. In the report, new orders rose 2.4 points to 49.2, while the employment gauge climbed 2.7 points to 51.2. Notably, the prices index, a measure of inflation, fell 4.6 points to 43.8. However, survey Chairman Timothy Fiore said inflation pressures are likely to intensify due to higher oil prices.

A barometer of business conditions at the vast services-side of the U.S. economy fell slightly in September indicating some softening in the economy. The Institute for Supply Management reported its services index fell 0.9 points to 53.6, matching forecasts. The new-orders index fell 5.7 points to a nine-month low of 51.8, a potential warning sign of future weakness. Furthermore, the employment barometer slid 1.3 points to 53.4. Anthony Nieves, chairman of the survey stated, “The majority of respondents remain positive about business conditions,” he added, but “some respondents indicated concern about potential headwinds.” CIBC economics wrote in a note to clients, “Overall, the signal from today’s data is that sentiment around the service sector remains positive but momentum appears to be gradually fading.”

International Economic News: The Bank of Canada said the pricing behavior of Canadian businesses could stoke inflation. Since the pandemic, Canadian businesses have made frequently larger price changes, leading to consumers paying higher costs, which could increase the inflation rate. Last month, the BoC held its key interest rate at 5% in observance that the economy had entered a period of weaker growth. However, the central bank said it may raise borrowing costs again should the pressure from inflation persist. Deputy Governor Nicolas Vincent said that Canadian firms still expect their price changes will remain larger and more frequent than they were before the pandemic. Vincent said that because “the business environment during the pandemic recovery was conducive to higher pass-through,” companies in the food sector passed on nearly all higher costs to consumers. “It remains to be seen whether the recent declines in some input costs will be passed through to prices as quickly and fully as cost increases were over the past two years,” Vincent said.

A less severe downturn in British services companies reflected an unexpected decline in inflation. The final reading of S&P Global UK Services Purchasing Managers’ Index (PMI) fell slightly in September from 49.5 to 49.3, remaining below the 50-threshold for growth. The preliminary “flash” reading had been at 47.2. The composite PMI, which combines the manufacturing survey with the services PMI, inched down from 48.6 in August to 48.5 in September, but still surpassed the initial flash reading of 46.8. Economics Director at S&P Global Market Intelligence, Tim Moore, said the services sector remained on a negative trajectory. However, he noted that companies were gaining more optimism about cooling price pressures. “Positive sentiment was attributed to hopes of a sustained easing of inflationary pressures and a turnaround in customer demand, as well as new product launches and business investment plans,” Moore said.

French authorities raided the offices of technology-firm Nvidia. This is among a string of such actions by European regulators checking the dominance of Big-Tech companies potentially thwarting competition. The French competition authority (FCA) said it conducted the raid on a company in the “graphics cards sector.” Nvidia has a near-monopoly of the graphics processing units (GPUs) market with 84% market share and market valuation of $1 trillion, while also becoming a crucial component to fast-developing artificial intelligence (AI) technology. The FCA issued a report on the competitive functioning of the cloud computing sector. The FCA carried out an unannounced visit and seizure with authorization from a judge. “In terms of next steps after the initial raid, there will most likely be court proceedings against the raid itself and the order of the judge having authorized the raid,” said Charlotte Colin-Dubuisson, antitrust and foreign investment partner at law firm Linklaters.

Germany’s manufacturing sector, which accounts for nearly a fifth of its economy, remained in a downturn last month. Weak demand and falling output continue to strain Germany’s manufacturers. The HCOB final Purchasing Managers’ Index (PMI) for manufacturing rose mildly from 39.1 in August to 39.6 in September, remaining below the 50-level distinguishing growth from contraction. Reports from surveyed businesses emphasized numerous headwinds to demand. Customer uncertainty, widespread efforts to reduce stocks, and weakness in construction activity remained high on the list. Last month, input costs, alongside output charges, declined further as weaker demand across the sector fed through to lower prices. “The HCOB Manufacturing PMI of Germany is still signaling a quick slide downhill in terms of output. Nevertheless, we see glimmers of hope that the sector is starting to turn the corner,” said Cyrus de la Rubia, Hamburg Commercial Bank (HCOB) chief economist.

China and Germany agreed to strengthen economic cooperation. According to the Chinese Finance Ministry, Vice-Premier He Lifeng and German Finance Minister Christian Lindner decided to strengthen policy coordination, defend global financial security, and global trade rules. The Chinese Finance Ministry said both sides agreed to “ensure smooth supply chains.” He Lifeng said, “China is ready to work with Germany… to deepen mutual benefit and win-win cooperation so as to inject more positivity in the China-German comprehensive strategic partnership.” Chinese ambassador Wu Ken acknowledged Germany’s contribution to China’s development over the decades and emphasized that his country will continue to open up. This progress would also benefit Europe, the ambassador added. “Reform and opening up, which began 45 years ago, is the institutional code for China’s great achievements, and China’s future high-quality economic development will also take place under more open conditions,” Wu said.

Business sentiment among major Japanese manufacturers improved, according to the BoJ’s quarterly survey. The Bank of Japan’s tankan survey reported a positive four-point increase in business sentiment among major manufactures for Q3. Sentiment among major non-manufacturers rose to +27, marking its most positive result in approximately three decades. Toshihiro Nagahama, chief economist at Dai-ichi Life Group, said that the return of foreign tourists and healthy domestic tourism over the summer holidays likely boosted sentiments. The weak yen, which has been trading at about 149 against the dollar, has boosted the value of overseas earnings by exporters, such as Toyota and Nintendo. “The recent cheap yen that came on top of the gradually improving supply chain is believed to have worked as a factor to brighten sentiments among big manufacturers,” said Toshihiro.

Finally: The World Intellectual Property Organization (WIPO) has released its 2023 Global Innovation Index ranking Switzerland at number one. WIPO evaluated innovation levels across 132 economies focusing on a long list of criteria such as human capital, institutions, technology, and creative output as well as market and business sophistication, among others. As Statista’s Katharina Buchholz reports, the 2023 index has found that while innovation is still blossoming, the coronavirus pandemic and the war in Ukraine have had their effect on the ranking as a range of economies and industries were severely affected. Switzerland topped the rankings once with a score of 67.6 out of 100, the 13th time it has been named the world leader in innovation.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.