10-16-2023 Weekly Market Update

The very Big Picture

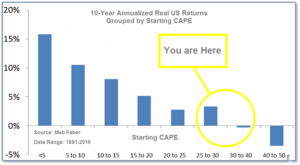

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

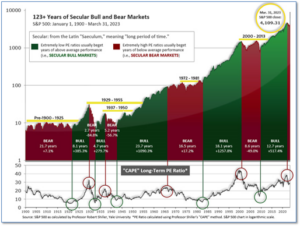

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.58, up from the prior week’s 29.45. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

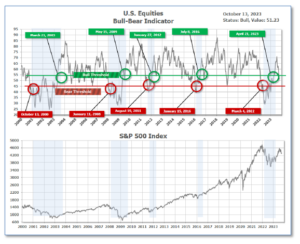

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bull territory at 51.23 down from the prior week’s 52.04. (see Fig. 3)

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive entering July, indicating positive prospects for equities in the third quarter.

Next, the short-term(weeks to months) Indicator for US Equities turned negative on August 10, and ended the week at 3, unchanged from the prior week.

In the Markets:

U.S. Markets: The major indexes finished the week mixed as investors weighed inflation data against dovish signals from Federal Reserve officials. Large-cap value stocks outperformed, helped by earnings beats from some of the nation’s largest banks. The banking giants kicked off the third-quarter earnings report season on a positive note, as their profits got a boost from higher interest rates. The Dow Jones Industrial Average rose 263 points finishing the week at 33,670—a gain of 0.8%. The technology-heavy NASDAQ Composite ticked down -0.2% to 13,407. By market cap, the large cap S&P 500 rose 0.4%, while the mid cap S&P 400 retreated -0.5%. The small cap Russell 2000 ended the week down -1.5%.

International Markets: International indexes finished the week mixed as well. Canada’s TSX rose 1.1%, while the United Kingdom’s FTSE 100 gained 1.4%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX pulled back -0.8% and -0.3% respectively. In Asia, China’s Shanghai Composite fell -0.7%. Japan’s Nikkei surged 4.3%. As grouped by Morgan Stanley Capital International, developed markets ticked down -0.1%. Emerging markets rose 0.1%.

Commodities: Precious metals finished the week in the green as Gold rose 5.2% to $1941.50 per ounce and Silver rose 5.4% to $22.90 per ounce. Oil finished the week to the upside as well, as tensions in the Mideast continued to rise. West Texas Intermediate crude oil closed up 5.9% to $87.69 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, ended the week down -1.6%.

U.S. Economic News: The number of Americans filing first-time claims for unemployment benefits remained near historic lows, signifying strength in the labor market. The Labor Department reported initial jobless claims remained unchanged last week at 209,000. When the Federal Reserve began raising its benchmark interest rate last year to rein in surging consumer prices, many economists expected the United States to sink into recession. But the economy and the job market have remained sturdy even as higher rates have brought inflation down steadily from the four-decade highs reached in 2022. Rubeela Farooqi, chief U.S. economist at High Frequency Economics stated, ”Even as the Fed has taken aggressive action to soften labor market conditions, businesses are not shedding workers at a rapid pace.”

The NFIB Small Business Optimism Index decreased half of a point in September to 90.8. September’s reading marks the 21st consecutive month below the 49-year average of 98. Twenty-three percent of owners reported that inflation was their single most important problem in operating their business, unchanged from last month and tied with labor quality as the top concern. Furthermore, the percentage of small business owners expecting better business conditions over the next six months deteriorated six points from August to a net -43% and the percentage of owners that reported job vacancies that were difficult to fill rose 3% to 43%. “Owners remain pessimistic about future business conditions, which has contributed to the low optimism they have regarding the economy,” said Bill Dunkelberg, NFIB Chief Economist. “Sales growth among small businesses have slowed and the bottom line is being squeezed, leaving owners few options beyond raising selling prices for financial relief,” he added.

At the wholesale level, prices rose a little more than expected last month. The Producer Price Index rose 0.5% in September, the Labor Department reported. The reading was down slightly from August’s 0.7% increase, but 0.2% more than economists’ forecasts. The “core” producer price index, which strips out the volatile food, energy, and trade services categories rose 0.2% in September. Over the past year, headline PPI is up 2.2%, up from 2% in August. For the second straight month, goods prices outpaced service costs, a break in the recent trend. The cost of goods rose 0.9% in September after a 2% gain in the prior month. The cost of services rose 0.3% last month, up slightly from 0.2% in August. Energy prices rose 3.3% in September, down from a 10.3% gain in the prior month but still a strong gain. Rubeela Farooqi, chief U.S. economist at High Frequency Economics wrote in a note, “Overall, these data likely do not change the outlook for Fed policy. Our baseline remains that rates are at a peak. For the Fed, geopolitical developments will be an additional risk factor which will likely keep policymakers proceeding cautiously going forward.”

At the consumer level, prices rose 0.4% in September. While the pace is softer than the 0.6% gain in the prior month, it was hotter than the 0.3% economists had forecast. The rate of inflation over the past year remained steady at 3.7% from August, 0.1% above forecasts. The closely-watched “core” measure of inflation that omits volatile food and energy rose 0.3% in September for the second straight month. That was in line with forecasts. The 12-month core rate decelerated to 4.1% from 4.3% matching expectations. Gregory Daco, chief economist at EY stated, “This CPI report will undoubtedly keep Fed officials on high inflation alert, but it won’t tilt the FOMC toward another fed funds rate hike at the upcoming meeting. Fed policymakers are now shifting their focus from “how high” to raise the policy rate to “how long” to maintain it at restrictive levels.”

Minutes of the Federal Reserve’s September policy meeting show that officials were “highly uncertain” about the future path of the economy and decided to proceed in a careful meeting-by-meeting approach to interest-rate policy. “A vast majority of participants continued to judge the future path of the economy as highly uncertain,” the minutes said. Volatile data and uncertainty about how much downward pressure the Fed’s prior interest rate hikes were putting on the economy “supported the case for proceeding carefully,” according to the minutes. Although data suggested inflation was slowing, most Fed officials continued to see upside risks to inflation. Global oil markets and the potential for upside surprises in food prices were among the risks discussed. On the other hand, even with the economy expanding at a solid pace, some officials saw continued downside risks to growth and upside risks to the unemployment rate. They pointed to the auto workers strike as a factor that could dampen growth.

International Economic News: In Canada, commercial real estate owners are getting “battered” by higher interest rates, according to a report by Altus Group Ltd. Altus notes commercial properties are taxed at more than three times the rate of residential ones in Canada’s largest cities, Toronto, Montreal, and Vancouver. Furthermore, the average tax gap across the country’s eleven major cities has expanded this year. Montreal, the business and financial capital of Quebec, has seen the greatest tax inequity between commercial and residential properties. Only in Saskatoon and Regina, Saskatchewan’s two largest cities, has the relative tax burden decreased for commercial property. “The higher the assessment base, the lower the tax rate needed to raise the same amount of tax,” the report says. Altus executive Ryan Fagan said that next to debt payments, property taxes are the highest operating cost for many commercial owners.

The UK is expected to hold interest rates steady after mild economic growth. In August, the economy grew marginally by 0.2%. Rates were held at 5.25% in September, ending a streak of fourteen consecutive rises after inflation began to slow. “We still haven’t felt the full effect of previous rate hikes, and so the prospects of recession are still looming on the horizon with so little respite expected on sideswiped budgets,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown. She added that the Bank of England looked “set to keep the pause button held on interest rate hikes.” The Office of National Statistics said that overall, the economy had grown “modestly” over the past three months due to a boost from car manufacturing and sales as well as construction. Chancellor Jeremy Hunt said the latest data showed that the economy “is more resilient than expected”.

Governor of the Banque de France, François Villeroy de Galhau, said ECB interest rates are appropriate for the time being. At the Institute of International Finance conference in Marrakech, the Banque de France Governor said that there are encouraging signs on consumer prices and the ECB is more confident in its commitment to get inflation back toward 2% by 2025. According to the central bank governor, “We need to balance the risk of doing too little against the risk of doing too much — I would say these risks are now at least symmetric.” He added that, “in the euro area, monetary patience is now more important than activism.” François Villeroy de Galhau insisted that the ECB should attempt to ensure a soft economic landing as well, if it does not interfere with its primary inflation objective. “If we can follow a monetary path which ensures a soft landing toward destination — which means avoiding recession and keeping positive growth — rather than a hard landing, it’s a much better route for our fellow citizens,” Villeroy said.

Bundesbank President Joachim Nagel said Germany is not “the sick man of Europe”, but growth is “not good for this year.” At the IMF World Bank annual meeting, Nagel said Germany’s current economic situation is not comparable to the last period it was named “the sick man.” The Bundesbank president said, “It’s a completely different, different situation.” He added that, “There are some structural changes necessary, but if you take, for example the labor market, we are still running the economy on full employment, more or less.” Germany’s central bank forecasts the country’s economy will grow by 1.2% in 2024, up from the 0.3% it forecasts for this year. The International Monetary Fund estimates that Germany will experience “continued weakness” in its growth, expanding by 0.9% in 2024. Price rises slowed more than expected last month, the Federal Statistics office said. The inflation rate remains above the 2% target and will hold at 3.1% and 2.7% over the next two years, the Bundesbank statement said. “The inflation story is going in the right direction,” Nagel said. “The beast is still there, but, to a certain extent, we have tamed the beast.”

China’s largest wealth fund, Central Huijin Investment, increased its stake in four of the country’s prominent banks. The move was intended to boost China’s stock market after turmoil in the real estate sector has shaken investor confidence. Shares for the Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China, and China Construction Bank rose between 2.43% and 4.73% this week, while the CSI 300 index increased by 0.69%. Over the course of this year, the CSI 300 is down by nearly 5%. Chief economist of Grow Investment Group Hao Hong said, “Huijin’s buying sends a strong signal of the top-down view and tends to help shore up market confidence.”

A BOJ survey showed that Japan’s business sentiment improved in the third quarter. The survey reported that the manufacturers’ confidence index increased from 5 in June to 9 in September, exceeding the BOJ’s forecast for a reading of 6. “The stronger-than-expected improvement in the latest tankan survey suggests that the economy will continue to expand at an above-trend pace, which is contributing to mounting staff shortages and persistent price pressures,” said Marcel Thieliant, head of Asia-Pacific at Capital Economics. A rebound in auto output and falling raw material costs lifted overall sentiment, but smaller firms reported they struggled to hike prices. Larger firms intend to increase capital expenditure by 13.6% next year, according to the survey. “The tankan showed Japan is on track for a domestic demand led growth. But the overseas outlook is a source of concern, such as whether the U.S. economy can achieve a soft landing” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities.

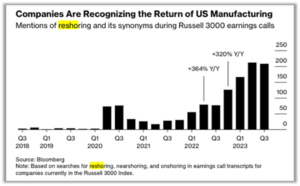

Finally: Geopolitical shifts are rerouting trade routes and capital flows worldwide. China’s exports are shifting away from Western countries, while Mexico is gaining a higher market share of U.S. imports. In the latest round of earnings report calls, data from Bloomberg shows the number of times corporate executives mentioned the terms, “nearshoring”, “reshoring”, and “onshoring”. The mentions jumped an average of 216% year-over-year since the start of 2022. Already, private companies have announced $516 billion of investments in domestic projects since President Biden took office, according to the latest figures from the White House.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.