10-22-18 Weekly Market Update

The very big picture:

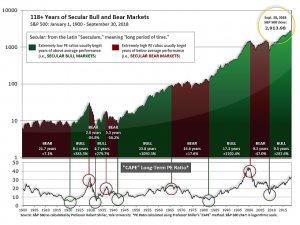

In the “decades” timeframe, the current Secular Bull Market could turn out to be among the shorter Secular Bull markets on record. This is because of the long-term valuation of the market which, after only eight years, has reached the upper end of its normal range.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 31.24, virtually unchanged from the prior week’s 31.23, and exceeds the level reached at the pre-crash high in October, 2007. This value is in the lower end of the “mania” range. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In the big picture:

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 62.74, down from the prior week’s 66.94.

In the intermediate and Shorter-term picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned positive on October 16th. The indicator ended the week at 4, down from the prior week’s 7. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was positive entering October, indicating positive prospects for equities in the fourth quarter of 2018.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns – but the market has entered the low end of the “mania” range, and all bets are off in a mania. The only thing certain in a mania is that it will end badly…someday. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is positive for Q4, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with three indicators positive and none negative, the U.S. equity markets are rated as Positive.

In the markets:

U.S. Markets: The major U.S. stock indexes produced mixed results for the week as a strong rally on Tuesday was offset by a sell-off Thursday and, for much of the market, Friday. The Dow Jones Industrial Average rose 104 points last week to close at 25,444, while the technology-heavy Nasdaq Composite retreated a third consecutive week, down -0.6%. Stocks were mixed by market cap. The large cap S&P 500 was little changed, up 0.02%, while the mid cap S&P 400 rose 0.05%, but the small cap Russell 2000 fell -0.3%.

International Markets: Canada’s TSX rose 0.4%, and the United Kingdom’s FTSE added 0.8%. On Europe’s mainland, France’s CAC 40 fell -0.2%, while Germany’s DAX added 0.3%. In Asia, China’s Shanghai Composite followed last week’s -8% plunge with a further -2.2% drop this week. Japan’s Nikkei finished down -0.7%. As grouped by Morgan Stanley Capital International, emerging markets retreated -1.5%, while developed markets were off just -0.2%.

Commodities: Precious metals were bid up, with Gold rising 0.6%, or $6.70, to end the week at $1228.70 per ounce. Silver finished up 0.1% at $14.65 an ounce. Energy was weak with West Texas Intermediate crude oil falling -2.9% to $69.28 per barrel and North Sea Brent off -0.7% at $80.06 per barrel. Copper, viewed by some analysts as a barometer of world economic health due to its variety of uses, finished down -0.8%.

U.S. Economic News: The Labor Department reported that the number of Americans applying for new unemployment benefits remained near a 50-year low, dropping by 5,000 to 210,000. The monthly average of new claims edged up by 2,000 to 211,750. New jobless claims have remained under 220,000 since early July, an occurrence that hasn’t happened since 1969 and further evidence of a tight labor market. Meanwhile, the number of people already receiving unemployment benefits, known as “continuing claims”, fell by 13,000 to 1.64 million. That number is reported with a one-week delay.

The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) report revealed that the number of job openings in the U.S. hit a record high of 7.1 million, exceeding the number of Americans who are unemployed. The number of job openings first exceeded the number of unemployed in March, and that gap has now widened to a record 900,000. The number of available jobs increased in government, construction, financial services, health care, and professional services, while the number in retail, manufacturing, and restaurants declined slightly. The quits rate, a number widely believed to be watched by the Federal Reserve, remained unchanged at a 17-year high of 2.7%. A high quits rate is seen as an especially positive employment indicator as it is assumed that people only quit jobs if they have confidence in finding even more lucrative ones.

The number of houses under construction fell a seasonally-adjusted 5.3% in September to an annual 1.201 million rate, the Commerce Department reported. The number missed consensus expectations of a 4.8% pullback to a 1.221 million annual rate. In the details, multifamily starts such as apartments and condominium complexes pulled back 12.9%, while single-family home starts edged down just 0.9%. Results were mixed by region. In a concerning development for future building activity, builder permits slipped 0.6% to a 1.241 million unit annual rate. Analysts had forecast permits would increase by 3.3%. The decline in permits was driven by a 7.6% drop in multifamily units, its sixth consecutive monthly decline. Single-family permits, though, were up in three of the four regions.

Confidence among the nation’s home builders increased this month, beating forecasts of a flat reading. The National Association of Home Builders’ (NAHB) monthly confidence index rose 1 point to 68 (readings over 50 signal improvement). In the details, the current sales conditions reading was at 74, while the expectations for sales over the next six months came in at 75. While builders continued to complain of scarce labor, expensive lots, and higher costs for building materials, the NAHB remained positive motivated by solid housing demand “fueled by a growing economy and a generational low for unemployment.”

Sales of existing homes dropped 3.4% last month, far exceeding consensus expectations of a 0.9% decline. The National Association of Realtors reported existing-home sales ran at a seasonally adjusted annual rate of 5.15 million in September, its sixth decline in a row. Furthermore, sales were down 4.1% from the same time last year. The weakness was widespread with three of the four regions declining and one remaining flat. Both single-family and condo/co-op sales fell 3.4% for the month. Existing housing inventory increased from a 4.3 month to a 4.4 month supply, with a 6 month supply generally indicating a “balanced” housing market. The median sales price in September was $258,100, which was 4.2% higher than a year earlier.

Despite the strong economy, sales at U.S. retailers barely grew last month as Americans cut their spending at restaurants, grocery stores, and gas stations. The Commerce Department reported retail sales rose 0.1%, far below forecasts of a 0.7% increase. Bars and restaurants saw their biggest decline in sales since the end of 2016, down -1.8%. Economists at CIBC World Markets noted that the hurricane in the Carolinas may have been responsible for some of the headline weakness, while Jim Baird, chief investment officer at Plante Moran Financial Advisers remained optimistic stating, “The underlying strength and confidence in the consumer still appear to have legs, and consumer spending should remain robust in the coming quarters.”

Manufacturing activity in the New York region increased, according to the latest data from the New York Federal Reserve. The New York Fed’s Empire State Manufacturing Index rose 2.1 points to 21.1 this month, exceeding forecasts for a reading of 20. In the details, the new orders and shipments indexes both picked up, with the new orders index rising 6 points to its highest in more than a year. The shipments index rose 12 points to 26.3. In its survey, firms remained “moderately optimistic” about the six-month outlook. The survey’s labor market indicators also showed a modest increase.

According to the Conference Board’s Leading Economic Indicators (LEI) index, the U.S. economy is still on a strong growth path, though dangers lurk. The LEI rose 0.5% last month, matching consensus expectations, with eight of its ten components making positive contributions. Year-over-year, the LEI advanced 7%, the most since September 2010 and more than three times the historical average year-over-year gain, indicating strong momentum. The LEI is a weighted gauge of 10 indicators designed to signal peaks and valleys in the business cycle.

A majority of senior Federal Reserve officials believe that interest rates will have to continue to rise until policy becomes restrictive, according to minutes of the central bank’s September meeting released this week. A “few” officials thought policy would have to remain “modestly restrictive for a time” while an additional “number” thought policy would need to be restrictive “temporarily.” According to the minutes, there were reports from contacts of a “firming” in inflationary pressures. Fed officials agreed there had been some signs of acceleration in labor costs. “Several” Fed officials said they now expected inflation to “modestly exceed” the Fed’s 2% annual inflation target “for a period of time.”

International Economic News: The annual inflation rate for Canada dipped to 2.2% in September, according to Statistics Canada. The reading was down 0.6% from last month’s 2.8% as price pressures from gas and air travel eased. Analysts had forecast a drop of just 0.1%. But, September marked the eighth consecutive month that the overall inflation rate has exceeded the Bank of Canada’s 2.0 percent target. Despite the lower inflation reading and a weaker than expected retail sales report, analysts still expect the Bank of Canada to hike interest rates at its meeting next week to keep Canada’s booming economy from overheating. Andrew Kelvin, senior rates strategist at TD Securities stated, “We always knew we were going to see headline CPI inflation trend back down towards 2 per cent … the hike next week is going to happen.”

The World Economic Forum (WEF), which runs the annual Davos gathering of business and political leaders, said that the United Kingdom had been overtaken by Hong Kong and Japan in its annual ranking of the world’s 140 most competitive economies. The report noted that Britain’s exit from the European Union could make it slip further behind because it would damage Britain’s attractiveness to international buyers and sellers of goods and services. The WEF said Britain had slipped in the 2018 ranking due to a deterioration in domestic labor mobility, which measures the extent to which people move between the different regions of a country to find work.

Protestors took to the streets in France to protest President Emmanuel Macron’s budget choices and the latest increase in the generalized social contribution (CSG). The protest was led by a coalition of nine union and pensioner associations. Macron announced an adjustment of pensions at the end of August which consisted of just 0.3% increases in 2019 and 2020, despite projections of an increase in inflation of 1.3%. The coalition reported that after 17 months of Macron at the helm of government, the loss in purchasing power is nearly 561 euros annually. The protest was part of a growing popular discontent with the government’s economic policies, which pensioners say are dismantling a solidarity-based system and backtracking on 70 years of labor’s achievements.

The Center for European Economic Research ZEW Institute reported that Germany’s economic outlook is clouded by the escalating global trade tensions and by the growing threat of Britain leaving the European Union without a negotiated deal. ZEW’s measure of investor expectations for the region’s powerhouse plunged to levels recorded at the height of the debt crisis in 2012, highlighting the magnitude of current uncertainty. Achim Wambach, president of the ZEW Center for European Economic Research said in a statement, “Expectations for the German economy are dampening above all due to the intensifying trade dispute between the U.S. and China.”

China’s economy is growing at the slowest pace of growth since the depths of the financial crisis in 2009, according to official data. China’s National Bureau of Statistics reported that gross domestic product rose 6.5% in the third quarter, compared to the same time last year. The result was slightly below the 6.6% consensus estimate. Both the GDP figures and weak industrial output numbers were released as a variety of China’s top officials made a joint media push to boost public confidence in the country’s slumping stock market. Shortly after the economic data was released, the official Xinhua News Agency released a statement from Liu He, President Xi Jinping’s top economic adviser and trade negotiator to the United States, downplaying the real impact of the trade dispute and talking up the chances of a resolution.

Exports from Japan fell for the first time since 2016 as shipments to both the United States and China declined. Japan’s Ministry of Finance reported Japanese exports fell 1.2% in September from the same time a year earlier. The result was far below expectations of a 1.9% increase. It was the first decline since November 2016. Japan’s exports to the United States declined 0.2% in the year to September, dragged down by falling shipments of construction and mining machinery, auto parts and medicines. In addition, a Reuters poll of Japanese companies showed a third have been directly affected by the trade conflict between the U.S. and China, with firms particularly concerned about slower Chinese demand.

Finally: As the stock market appears to be taking a break from setting new highs, an analyst who correctly predicted the 2008 financial crash warned of a bubble brewing in overall household wealth. Jesse Colombo, an analyst at Clarity Financial, pulled no punches flatly stating “The U.S. household wealth boom since the Great Recession is a sham, a farce and a gigantic lie that is tricking everyone into believing that happy days are here again even though the engines that are driving it are bubbles that are going to burst and cause a crisis that will be even worse than the 2008 crash.” Data this summer showed that household wealth topped $100 trillion for the first time, far outpacing the rate of economic expansion. Colombo contends that wealth that gallops past economic growth is a “telltale sign that the boom is artificial and unsustainable.” The last two times the share of household-wealth growth peaked above gross domestic product was during the late 1990s dot-com bubble and the mid-2000 housing bubble, he notes.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet) These are the opinions of WE Sherman and Co and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.