10/14/19 Weekly Market Update

The Very Big Picture:

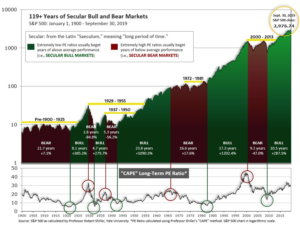

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”). The market is currently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

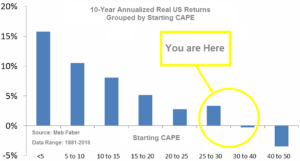

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.33, down from the prior week’s 29.59, above the level reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In The Big Picture:

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 52.66, up from the prior week’s 52.53.

In the Intermediate and Shorter-term Picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) is positive. The indicator ended the week at 17, down from the prior week’s 24. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was positive entering October, indicating positive prospects for equities in the fourth quarter of 2019.

Timeframe Summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is historically too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) remains positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is positive for Q4, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with three indicators positive and none negative, the U.S. equity markets are rated as Positive.

In the Markets:

U.S. Markets: Reports of progress in U.S.-China trade negotiations sent stocks soaring higher on Friday, lifting the S&P 500 to its best daily gain in two months. All of the major U.S. indexes recorded gains for the week with the technology-heavy NASDAQ Composite faring the best. The NASDAQ regained the 8,000-level rising 74 points, or 0.93%, to end the week at 8,057. The Dow Jones Industrial added 242 points finishing the week at 26,816, also a gain of 0.9%. By market cap, the large cap S&P 500 added 0.6%, the midcap S&P 400 rose 0.7%, and the small cap Russell 2000 rebounded the most, up 0.8%.

International Markets: Canada’s TSX was the only major international market to finish down, giving up -0.2%. Across the Atlantic, the United Kingdom’s FTSE rebounded 1.3%, while France’s CAC 40 rose 3.2%, Germany’s DAX added 4.2%, and Italy’s Milan FTSE gained 3.2%. In Asia, China’s Shanghai Composite added 2.4% while Japan’s Nikkei added 1.8%. As grouped by Morgan Stanley Capital International, developed markets rose 2.2% last week, while emerging markets added 1.9%.

Commodities: Precious metals sold off as equity markets rallied. Gold retreated -1.6%, or $24.20, ending the week at $1488.70 an ounce. Silver gave up -0.5%, closing at $17.54 an ounce. Following two consecutive down weeks, West Texas Intermediate crude oil rebounded 3.6% finishing the week at $54.70 per barrel. The industrial metal copper, viewed by many analysts as a barometer of global economic health due to its variety of uses, finished the week up 2.6%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits fell last week, remaining near a 50-year low. The Labor Department reported applications for U.S. unemployment benefits declined by 10,000 to 210,000. Economists had expected new claims would total a seasonally-adjusted 220,000. The reading showed that layoffs still haven’t risen despite signs that hiring and the economy have slowed. In the report, claims remained elevated in Ohio and Michigan—two states with large auto industries. Some 250,000 workers have been on strike for nearly a month and the prolonged standoff has forced parts suppliers to idle workers as well. The more stable monthly average of new claims, meanwhile, edged up by 1,000 to 213,750 nationwide. Continuing claims, which counts the number of people already collecting unemployment benefits, increased by 29,000 to 1.68 million. These claims have remained below 2 million since early 2017.

The number of job openings fell to an 18-month low in August as hiring and the economy continue to slow. The Labor Department’s JOLTS (Job Openings and Labor Turnover Survey) report showed that job openings slipped to 7.05 million from 7.17 million in July—its third consecutive decline. Although the number of job openings still far exceeded the number of Americans officially classified as unemployed (5.8 million), they’ve declined almost 8% since the beginning of the year. In the details, openings fell the most in manufacturing and information services such as media and public relations, while more jobs were available in trade, transportation, and construction. The closely-watched “quits rate”, which counts the number of people leaving their jobs voluntarily (presumably for a better paying one) slipped to 2.6% from 2.7% among private-sector employees. The quit rate for private-sector workers bottomed out at 1.4% at the end of the 2007-2009 Great Recession and has hovered at or near a cycle peak of 2.6% for the past year.

Despite fears of a looming recession, the sentiment of the nation’s consumers rebounded to a three-month high, according to preliminary data released by the University of Michigan. U of M’s October print on consumer sentiment rose 2.8 points to 96, while its current economic conditions reading also rose 4.9 points to 113.4. Although the U.S.-China trade dispute has yet to be resolved and concerns over Britain’s exit from the European Union remain, the data overall indicates that consumer spending will be strong enough to keep the record-long expansion alive. However, most consumers expect to see a slowdown next year. “A slower pace of overall economic growth is still anticipated, including some modest increases in the national unemployment rate during the year ahead,” the report said.

Sentiment among the nation’s small business owners fell to near the lowest level of Donald Trump’s presidency, as tariffs and economic uncertainty continued to weigh on the outlook of owners across the country. The National Federation of Independent Business (NFIB) optimism index declined 1.3 points to 101.8 in September. The reading was its third drop in four months. While the gauge remains elevated by historical standards, the reading is its lowest since March and close to January’s 101.2, which was the weakest reading since Trump’s term began in early 2017. Analysts expected a reading of 102. The report adds to signs that the economy is cooling but not yet sliding into recession.

At the consumer level, inflation in the U.S. remained in check last month, led by falling prices in gasoline and vehicles. The Bureau of Labor Statistics reported consumer-price inflation remained flat in September—its smallest change since the beginning of the year. Economists had expected a 0.1% advance. Over the past 12 months, the increase in the cost of living remained unchanged at 1.7%. The low rate of inflation, reflected in the CPI as well as other price barometers, may give the Federal Reserve the freedom to trim rates if growth in the economy continues to slow. Core CPI, which strips out the volatile food and energy components, ticked up 0.1% in September. The yearly increase in the core rate remained unchanged at 2.4%.

Prices sank at the wholesale level in September, indicating lower inflation ahead. The Producer Price Index (PPI) posted its steepest decline last month since the beginning of the year, falling -0.3%. Economists had expected a gain of 0.1%. The decline lowered the annual rate of wholesale inflation to 1.4% from 1.8% – its lowest level in almost three years. Similarly, the “core” measure that strips out the volatile food, energy, and trade-margin categories remained flat in September. The annual rate of the core PPI dropped to 1.7% from 1.9%. In the details, wholesale prices for goods fell -0.4%, with three-quarters of the decline reflecting the lower cost of gasoline. Wholesale food prices rose 0.3%, however. Overall, the report signals there doesn’t appear to be any inflation building up at earlier stages of the production process.

Federal Reserve Chairman Jerome Powell stated the consensus among his colleagues at the Federal Open Market Committee (FOMC) of the U.S. central bank is that the record-long U.S. economic expansion can continue, but there are risks. “FOMC participants continue to see a sustained expansion of economic activity, strong labor market conditions, and inflation near our symmetric 2 percent objective as most likely. Many outside forecasters agree,” Powell told the National Association for Business Economics annual meeting in Denver. Acknowledging recent economic data Powell stated, “Clearly things are slowing a bit,” but he added this might be another pause that refreshes the expansion. These slowdowns have occurred a few times in this expansion, he noted. Officials will meet again on Oct. 29-30; investors see an 80% chance the Fed will trim rates at that meeting by another quarter point to a range of 1.5-1.75% according to the CME Group’s FedWatch tool.

International Economic News: Canada’s job market is on track for one of its best years on record, according to the latest data from Statistics Canada. Canada’s economy gained 53,700 jobs last month, blowing away economists’ expectations of just 7,500 jobs. The reading followed a gain of 81,100 in August. Canada has now added 358,100 new jobs since December, the most in the first 9 months of a year since 2002. The strong print reaffirmed the Bank of Canada’s stance that the country has developed a bit of resilience to trade headwinds and global economic uncertainties. Avery Shenfeld, chief economist at CIBC World Markets said in a note to investors, “Canada’s labor market seems to have been vaccinated against the global economic flu going around.”

Despite mounting Brexit uncertainty Britain is on track to avoid a recession, according to official figures from the United Kingdom’s Office for National Statistics (ONS). The ONS said gross domestic product had jumped an unexpected 0.3% in the three months prior to the end of August, beating economists’ forecasts. Amid a backdrop of mounting political chaos, economists said the latest data showed that while the economy remained weak, Britain was likely to avoid its first recession since the financial crisis. Fears of a technical recession – two consecutive quarters of contraction – had been raised when data published in August showed the economy had unexpectedly contracted in the second quarter, by 0.2%

The Bank of France maintained on Wednesday its earlier forecasts for third-quarter French economic growth at 0.3%, as the Eurozone’s second-biggest economy continued to show relative resilience amid signs of a recession in the broader region. The Bank of France said its measure of sentiment in the country’s manufacturing industry fell to 96 points in September from 99 in August, while sentiment in the services sector dipped to 99 points in September from 100 in August.

German industrial output unexpectedly rose in August, but analysts state Europe’s biggest economy remains at risk of recession after months of contraction in manufacturing. Germany’s Statistics Office reported industrial output rose 0.3% after two successive monthly drops. The reading exceeded expectations of a 0.1% decline. The rise was driven primarily by production of intermediate and capital goods, the Economy Ministry said. Despite the positive reading, not everyone is convinced Germany’s problems are over. Thomas Gitzel of VP Bank wrote in a note, “Unfortunately one must consider the industrial production data for August as a flash in the pan. We expect production in September to be negative. This means that GDP will contract at least slightly in the third quarter.”

On Friday, U.S. President Trump announced he has reached a “phase 1” deal with China that would forestall a tariff increase slated for next week. If completed, the agreement would provide relief to American farmers and businesses. Trump stated the “substantial” agreement would involve China buying $40 billion to $50 billion worth of American agricultural products annually, along with guidelines on how it manages its currency. In addition, the deal would also strengthen protections for American intellectual property and open up China’s market to financial services companies. In exchange, the United States will not move ahead next week with plans to raise tariffs on $250 billion worth of Chinese goods to 30%.

Japan’s government pledged that it will act swiftly if the economy shows signs of slowing after its planned tax hike. The Council on Economic and Fiscal Policy, headed by Prime Minister Shinzo Abe, reviewed economic trends both domestically and internationally since the hike in the consumption tax took effect on October 1st. Abe told reporters, “It’s vital for us to act without delay while carefully examining macroeconomic conditions. If downside risks become evident, we should implement full-fledged measures in a timely manner without hesitation in order to ensure that Japan’s economy is firmly on a growth track.” Private-sector members of the council said there were concerns over a slowdown in trade and business investment across the globe. They also urged the government to keep a close eye on consumption trends and the number of tourists coming to Japan from overseas.

Finally: “The tariffs are a tax on American consumers!” “The tariffs will drive up the prices of everything!” Those were the cries of the critics of President Trump’s tariffs on Chinese goods. But it seems, as noted above, that prices at the consumer level are flat and prices at the wholesale level actually declined in the most recent reports. Perhaps there is some truth to the assertion by the Administration that Chinese producers are absorbing the tariffs themselves in order to maintain their competitiveness. The chart below, by Marketwatch.com using Federal Reserve data, shows the decline in year-over-year producer price change to go along with decline in prices in the most recent month.

(Sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.