1-21-19 Weekly Market Update

The very big picture:

In the “decades” timeframe, the current Secular Bull Market could turn out to be among the shorter Secular Bull markets on record. This is because of the long-term valuation of the market which, after nine years, has reached the upper end of its normal range.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 29.36, up from the prior week’s 28.53, about the level reached at the pre-crash high in October 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In the big picture:

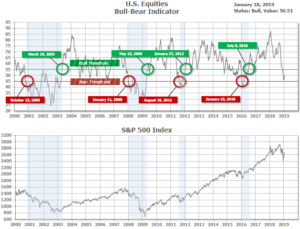

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 50.51, up from the prior week’s 48.19.

In the intermediate and Shorter-term picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned positive on November 28th. The indicator ended the week at 25, up from the prior week’s 21. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was negative entering January, indicating negative prospects for equities in the first quarter of 2019.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns. The Bull-Bear Indicator (months to years) remains positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is negative for Q1, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two indicators positive and one negative, the U.S. equity markets are rated as Neutral.

In the Markets:

U.S. Markets: U.S. stocks recorded their fourth consecutive week of positive returns, continuing to build on their very strong start to 2019. The gains pulled most of the large-cap benchmarks out of correction territory, back to within 10% of their recent highs. However, the NASDAQ Composite and the smaller-cap benchmarks remained below that threshold. The Dow Jones Industrial Average surged 710 points, or 3.0%, last week closing at 24,706. The technology-heavy NASDAQ Composite rallied 2.7% ending the week at 7,157. By market cap, the large cap S&P 500 rose 2.9%, while the mid cap S&P 400 added 3.0% and the small cap Russell 2000 gained 2.4%.

International Markets: Like the U.S., major international markets were also in the green across the board. Canada’s TSX Composite rose 2.4% while the UK’s FTSE managed a 0.7% gain despite Prime Minister Theresa May’s Brexit deal failing to gain approval. On Europe’s mainland, France’s CAC 40 rose 2.0%, Germany’s DAX added 2.9%, and Italy’s Milan FTSE gained 2.2%. In Asia, China’s Shanghai Composite rose 1.7%, while Japan’s Nikkei gained 1.5%. As grouped by Morgan Stanley Capital International, emerging markets rose 2.0% last week and developed markets gained 1.7%.

Commodities: Given that precious metals are traditionally a “safe-haven” in times of market weakness, it comes as no surprise that they finished down for the week in which equities were strong. Gold retreated 0.5%, closing at $1282.60 an ounce, while Silver fell -1.6% to $15.40 an ounce. Oil continued its sharp rebound, rising 4.8% to $54.04 per barrel of West Texas Intermediate crude—its third consecutive weekly gain. Copper, viewed by some analysts as a gauge of world economic health due to its variety of industrial uses, finished the week up 2.1%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits fell slightly last week to a five-week low, though more federal workers sought financial assistance due to the government shutdown. The Labor Department reported initial jobless claims declined by 3,000 to 213,000, lower than the consensus forecast of a 220,000 reading. New claims fell to their lowest level since early December and are nearing the 50-year low of 202,000 reached last September. The less-volatile monthly moving average of new claims declined by 1,000 to 220,750. Continuing claims, which counts the number of people already receiving unemployment benefits, rose by 18,000 to 1.74 million. That number is reported with a one-week delay.

Confidence among the nation’s home builders rebounded from a 3-year low as builders were buoyed by lower mortgage rates that have boosted housing demand. The National Association of Home Builders (NAHB) Housing Market Index rebounded two points to 58 this month, exceeding expectations of just a one point rise. In the details, the index component that tracks current sales conditions rose 2 points to 63 while the index of conditions over the next 6 months rose 3 points to 64. The gauge of buyer traffic ticked up 1 point to 44. Concerns remain over the affordability of housing, particularly among new buyers. In its release, the NAHB stated, “Builders need to continue to manage rising construction costs to keep home prices affordable, particularly for young buyers at the entry-level of the market.”

Sentiment among the nation’s consumers plunged to the lowest level since Donald Trump was elected president, according to the University of Michigan. U of M’s Consumer Sentiment Index plunged 7.6 points in the preliminary January survey to 90.7—its lowest level since October of 2016. The reading was far below the consensus forecast of just a 1.9 point decline. Both current conditions and expectations readings declined with expectations falling 8.7 points and current conditions losing 6.1 points. The report noted that the government shutdown, tariffs, financial market volatility, the global slowdown, and uncertain monetary policy all weighed on sentiment.

The cost of goods and services at the wholesale level posted its biggest decline in almost half a year last month, as lower gas prices pulled down overall inflation. The Bureau of Labor Statistics reported its Producer Price Index dropped 0.2% in December. Economists had expected just a 0.1% decline. Over the past year, wholesale inflation remained unchanged at 2.5%. The 12-month rate had hit a seven-year high of 3.4% last July. In the details, a 13.1% plunge in gasoline prices pulled the wholesale cost of goods down 0.4% while the cost of services also slipped 0.1%–its first decline in four months. However, the wholesale price of food rose 2.6%. Stripping out the often-volatile food, energy, and trade margins, the core rate of inflation was flat. In the 12 months ended December, the core rate rose 2.8%, which was unchanged from the prior month.

The Fed’s “Beige Book”, published eight times a year, is a collection of anecdotal information on current economic conditions in each of its districts through reports from banks and interviews with key business contacts, economists, market experts, and other sources. In the latest release, several of Fed districts reported concerns over future growth. Eight of the twelve Federal Reserve districts reported modest to moderate growth in December, two reported flat or slight growth, and two reported a slower pace of growth. “Many” districts reported that contacts “had become less optimistic” in response to a variety of headwinds: increased financial-market volatility, rising short-term interest rates, falling energy prices and elevated trade and political uncertainty, the report said. Overall, the relatively subdued report should give the Fed more reason to be “patient” as it contemplates additional interest-rate hikes.

In the New York-region, manufacturing activity slowed to a crawl this month according to the latest data from the New York Federal Reserve. The NY Fed’s Empire State General Business Conditions Index fell 7.6 points to 3.9—its lowest reading since May of 2017. The consensus was for a 0.1 point gain to 11.0. The headline index has fallen 18 points just since November. Nearly all of the individual indicators posted slower growth rates, including shipments, new orders, and employment. Furthermore, firms were less optimistic in their six-month outlooks. Business sentiment has slumped as global trade tensions have escalated and the partial government shutdown isn’t helping. Consistent with manufacturers’ outlooks, Ian Shepherdson, chief economist as Pantheon Macroeconomics stated, “Overall, the message is that manufacturing activity is still rising, but only just, and we expect a substantial further weakening over the next few months.”

The Philadelphia Federal Reserve reported manufacturing activity in its Mid-Atlantic region rose modestly this month. The Philly Fed General Business Activity Index rebounded 7.9 points to 17.0—its highest level in three months. The consensus forecast was for a 1.1-point decline to 8.0. In the details, new orders grew at their fastest pace in six months, but shipments growth eased to its slowest rate since September of 2016. Optimism about the near-term growth outlook picked up. Nearly 2/3’s of firms surveyed indicated they plan to increase production in the first quarter and about 1/3 of those planned to hire more workers.

International Economic News: Canada’s Finance Minister Bill Morneau delivered a surprisingly upbeat assessment of Canada’s economic future as he arrived for the start of a three-day cabinet retreat. The retreat was the first meeting of Prime Minister Justin Trudeau’s cabinet since he conducted a small shuffle earlier this week. Morneau acknowledged “there are certainly headwinds with global trade tensions.” But he shrugged off predictions that the world may be teetering on the edge of another global recession. The International Monetary Fund, the World Bank and the Organization for Economic Co-operation and Development are all forecasting “positive global growth expectations,” he said. And in Canada, private sector economists “are all looking toward a period of sustained growth…so we’re not actually looking right now with any expectation of difficult times.”

Across the Atlantic, the British Parliament rejected (by a very lopsided margin) a proposed Brexit deal put forth by Prime Minister Theresa May’s government. That proposed deal had been previously approved by the European Union. The deal’s defeat now throws the exit process into even more chaos as the United Kingdom now has until January 21st to push through a new agreement. The defeat also led to a vote of no confidence in the government, but it failed to pass. Mrs. May will hold a series of meetings with some of her top ministers to discuss the way forward after her deal with Brussels was rejected by parliament, her spokeswoman said.

On Europe’s mainland, France’s credit rating has been affirmed by ratings agency Fitch, with the agency noting that the fiscal easing aimed at appeasing the “gilets jaunes”, or “yellow vest”, protesters will have a limited effect on France’s longer-term debt trajectory. The demonstrations were initially triggered by rising fuel taxes instituted by President Macron, but then widened to a larger movement against his economic policies overall. To calm tensions President Macron offered minimum wage increases and extra help for pensioners, which will mean that France’s budget deficit will balloon past the EU’s 3%-of-GDP ceiling, only two years after it “finally corrected its decade-long excessive deficit”, Fitch noted. Yet the rating agency noted that France’s strengths — its big, diversified and wealthy economy and a record of macroeconomic stability — and pointed out the fiscal easing only amounts to 0.4% of GDP and would be partly offset elsewhere. As a result, Fitch kept France’s rating at double-A with a stable outlook.

According to flash data released this week, Germany’s economy posted its weakest growth in five years last year. Germany’s Federal Statistics Office, Destatis, reported German gross domestic product grew 1.5% in 2018, down from 2.2% in 2017. The reading was in line with expectations. Destatis noted that the German economy had grown for the ninth year in a row, “although growth has lost momentum”. “In the previous two years, the price adjusted GDP had increased by 2.2% each. A longer-term view shows that German economic growth in 2018 exceeded the average growth rate of the last ten years (+1.2%).” The country’s economy ministry said reasons for slower growth in 2018 included a globally weaker economy, sales problems in the car industry as a result of tougher pollution standards, and special effects including an outbreak of flu and strikes.

In Asia, China’s National Bureau of Statistics revised down China’s 2017 economic growth ahead of its announcement of 2018’s GDP figures. China’s economic growth rate was revised down 0.1% to 6.8% as part of “annual data revisions”. The adjustment announced on Friday created a lower base for computing the growth rate for 2018. It is unclear if the lower base will have any effect on the growth rate calculation. China’s economy is expected to cool further this year as domestic demand weakens and exports are hit by US tariffs. China’s economic growth is expected to slow to 6.3% this year, which would be the weakest in 29 years, from an expected 6.6% in 2018.

A simple statistical error has put much of Japan’s economic data in doubt, according to the chief overseer of official data. Kiyohiko Nishimura, a former deputy governor of the Bank of Japan, said Japan’s economic statistics are in a “state of crisis”, after he discovered a basic mistake that caused a mass understatement in national wage data going all the way back to 2004. The error was discovered when Mr. Nishimura spotted oddities in the monthly labor survey produced by the health ministry. The extent and simplicity of the problem has cast doubt on all of Japan’s most fundamental economic statistics, including gross domestic product, making it hard to judge the state of the business cycle and the impact of government policies. The revelations have cast further doubts on Japan’s official statistics agencies already under attack for the diminishing reliability of its revision-prone data.

Finally: Companies with small market capitalization’s, so-called “small caps”, have traditionally acted as a “canary in the coal mine” for the larger market since they tend to be more domestically focused and more sensitive to growth worries than their larger cap counterparts. Given that, Andrew Lapthorne, analyst at Societe Generale, is concerned that small cap companies have been taking on a massive amount of debt over the last few years, far outstripping their earnings growth (EBITDA on the chart below) and greatly increasing their balance sheet leverage. Lapthorne notes, “If you have leverage and your share price is weak, that compounds the problem.” And a small company with balance-sheet problems can’t do what the big boys do — raise money by going back to the markets with bond issues, he notes.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5) These are the opinions of WE Sherman and Co and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.