7-19-21 Weekly Market Update

The very Big Picture

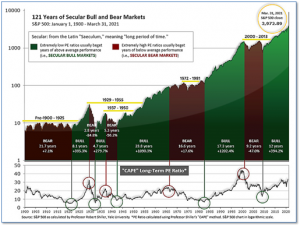

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently at that level.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 37.99, down from the prior week’s 38.36. Since 1881, the average annual return for all ten-year periods that began with a CAPE in the 30-40 range has been slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether current one, or one that may be ‘coming soon’!

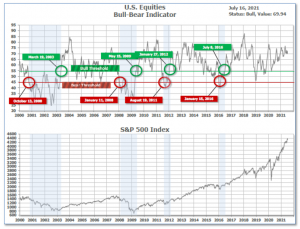

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator is in Cyclical Bull territory at 69.94 down from the prior week’s 72.37.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Positive on June 30, indicating positive prospects for equities in the first quarter of 2021.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on July 1 and ended the week at 15, unchanged from the prior week.

In the Markets:

U.S. Markets: The major U.S. indexes finished the week lower, but the large cap S&P 500 and NASDAQ Composite hit new intraday highs mid-week before falling back. The small-cap Russell 2000 underperformed for a third consecutive week. The Dow Jones Industrial Average shed 182 points finishing the week at 34,688—a decline of -0.5%. The technology-heavy NASDAQ retraced all of last week’s gain ending the week down -1.9%. By market cap, the large cap S&P 500 retreated -1.0%, while the mid cap S&P 400 and small cap Russell 2000 indexes experienced much larger declines of -3.3% and -5.1%, respectively.

International Markets: Canada’s TSX finished the week down -1.3%, while the United Kingdom’s FTSE 100 gave up ‑1.6%. On Europe’s mainland, France’s CAC 40 declined -1.1% and Germany’s DAX retreated -0.9%. In Asia, China’s Shanghai Composite rose 0.4% along with Japan’s Nikkei which added 0.2%. As grouped by Morgan Stanley Capital International, developed markets declined -1.6% while emerging markets ticked up 0.1%.

Commodities: Precious metals finished the week mixed. Gold rose for a fourth consecutive week by rising 0.2% to $1815.00, while Silver retreated -1.7% or $25.80 per ounce. Energy retreated for a second week. West Texas Intermediate crude oil pulled back -4.0% to $71.56 per barrel. The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, finished the week down -0.5%.

U.S. Economic News: The number of Americans filing first time unemployment benefits dropped to a new pandemic low of 360,000, but businesses still report difficulty finding qualified workers. The Labor Department reported initial jobless claims fell by 26,000 to 360,000 last week—matching forecasts. Claims had been running in the low 200,000’s before the viral outbreak early last year. New jobless claims fell the most in Georgia, Rhode Island, Alabama and Maryland. The only states to report big increases were New York and Texas. Meanwhile, continuing claims, which counts the number of Americans already receiving benefits, fell by 126,000 to 3.24 million. Continuing claims also fell to new pandemic lows.

Across the country the nation’s small business owners are raising wages, but skilled worked remain hard to find. The National Federation of Independent Businesses (NFIB), the nation’s most prominent small business lobbying group, reports small businesses are more bullish on the U.S. economy, but continue to struggle to hire enough qualified workers to keep up with booming sales. The closely-watched NFIB index of small business confidence rose last month to its highest level in eight months. The index climbed 2.9 points to 102.5, topping 100 for the first time since November. It had pulled back in May for the first time this year. Some 46% of small businesses said they could not fill open jobs, down slightly from a record high in May. A record number of firms raised wages and benefits in an effort to lure new hires and to retain valued employees, but even that wasn’t enough. Businesses say their biggest problem is a lack of qualified workers and higher labor costs.

The cost of living for Americans jumped by the largest amount in 13 years as price increases spread more widely across the U.S. economy. The government reported its Consumer Price Index climbed 0.9% last month. The increase easily blew away economists’ expectations for just a 0.5% advance. The rate of inflation in the 12 months ended in June climbed to 5.4% from 5%. The last time prices rose that fast was in 2008, when oil hit a record $150 a barrel. Furthermore, core inflation, which measures price increases that omit the often-volatile food and energy categories, also rose 0.9% in June. The 12-month core rate increased to 4.5% from 3.8%–a 29-year high. So is the “it’s transitory” debate over? Jennifer Lee, senior economist at BMO Capital Markets stated, “The answer is no, the transitory debate is far from over. In fact, it got a little hotter.”

Prices surged at the wholesale level again in June, further evidence that inflation at the consumer level is unlikely to subside anytime soon. The Labor Department reported its Producer Price Index (PPI) jumped 1% last month, almost double the consensus forecast of 0.6%. The annualized pace of wholesale inflation surged to 7.3% from 6.6% in May. That’s the highest level since the index was overhauled in 2010, and one of the highest readings since the early 1980s. About 60% of the increase in wholesale inflation reflected the higher cost of services, a volatile category that can swing sharply from month to month. The cost of goods also rose sharply last month. Wholesale food prices increased 0.8% in June, led by higher costs of beef, pork and chicken. The core rate of wholesale inflation, meanwhile, increased 0.5% last month. The core rate is a less volatile measure that strips out food, energy and trade margins. The increase in the core rate over the past 12 months edged up to 5.5% from 5.3%. That’s the largest advance since the government first began reporting it in 2014.

A preliminary reading of sentiment among the nation’s consumers fell to a 6-month low amid record concerns over inflation. The University of Michigan reported its preliminary reading of its consumer sentiment index fell to 80.8 in July from a final reading of 85.5 in June. The result missed economists’ expectations of 86.3 by a significant margin. The sub-index that measures how consumers feel about the economy right now dipped to 84.5 from 88.6 in June, as consumers worried about the current pace of job gains. Consumer optimism about the next six months fell more sharply to 78.4 in July from 83.5 in June, as Americans have become more concerned about the effect of rising prices. Richard Curtin, the survey’s chief economist noted that “Consumers’ complaints about rising prices on homes, vehicles, and household durables have reached an all-time record.”

The New York Fed’s regional business conditions index surged to a record-high reading in July. The NY Fed’s Empire State index shot up 25.6 points to 43. Economists had expected a reading of just 17.3. In the details of the report, the subcomponents were also strong. The new-orders index rose 16.9 points to 33.2 in July while shipments rose 29.6 points to 43.8. The index for number of employees rose 8 points to 20.6. Inflation pressures remained. The prices received index rose 6 points to 39.4, a new record. The prices paid index slipped slightly but also remained near a record high.

The Federal Reserve’s “Beige Book”, a collection of anecdotal reports from each of the Fed’s member banks, stated the “robust” U.S. economy is “strengthening”—but it’s also grappling with shortages and higher inflation. “The U.S. economy strengthened further from late May to early July, displaying moderate to robust growth,” the Beige Book said. Furthermore, “Supply-side disruptions became more widespread, including shortages of materials and labor, delivery delays, and low inventories of many consumer goods,” it said. Businesses told the Fed they’re not sure when they’ll be able to ramp up production to satisfy the demand. They still can’t get many supplies on time and many open jobs are going unfilled. “The outlook for demand improved further, but many contacts expressed uncertainty or pessimism over the easing of supply constraints,” the survey said.

International Economic News: The Bank of Canada stated it was willing to let inflation run hot on the road to “complete” recovery. Bank of Canada Governor Tiff Macklem stated he plans keep the bank’s benchmark interest rate pinned near zero until at least the second half of next year. Canada’s central bank published new forecasts this week predicting the country is on the verge of an impressive burst of economic growth that will offset a disappointing start to the year. The projections weren’t strong enough to alter Macklem’s plan to adjust its benchmark rate, but evidence of gathering momentum prompted policy-makers to pare their weekly purchases of Government of Canada bonds to $2 billion, from $3 billion previously.

Across the Atlantic, a Reuters poll of economists showed they expect the United Kingdom’s economic recovery to continue, although new strains of COVID-19 may threaten the rebound. Gross domestic product will grow 2.5% this quarter, the poll found, a touch better than the 2.4% predicted last month. But median forecasts showed that pace was expected to slow to 1.4% next quarter and then to 0.9% in early 2022, unchanged from last month’s forecasts. Holger Schmieding, chief economist at Berenberg stated, “So far, the UK data look promising in two respects. First, vaccines seem to have significantly reduced the health risks from the virus. Second, the UK’s GDP estimate for May shows that activity has rebounded with the easing of restrictions.” UK GDP expanded a monthly 0.8% in May, much faster than its typical pre-pandemic pace but down from April’s 2.0% surge, official data showed last week.

On Europe’s mainland, French President Emmanuel Macron stated that vaccination would not be compulsory for the public “for now”, but stressed that restrictions would focus on those who remain unvaccinated. The president said health workers had to get vaccinated by Sept. 15 or face unspecified consequences. France has given nearly 53% of its population at least one dose of the vaccine and 37% are fully vaccinated. Macron said on Monday that a health pass required to attend large-scale events would now be used much more widely, including gaining entry to restaurants, cinemas and theatres. It will also be required to board long-distance trains and planes from the beginning of August.

Germany’s economic recovery from the COVID-19 crisis is at full swing, and the outlook for German industry remains positive despite supply bottlenecks for intermediate products, the German Economy Ministry said. In its monthly report the Ministry said, “The supply bottlenecks for intermediate products…have a dampening effect, however they do not impair the positive underlying dynamic of the overall economy.” The ministry said it expects inflation to reach 3% or more in the second half of 2021 due to a base effect from a temporary VAT cut last year that was part of the government’s stimulus program to help the economy recover from the coronavirus shock. Inflation will ease significantly in 2022, it added.

Following a record start to the year, China’s economic growth slowed in the second quarter. China’s National Bureau of Statistics announced China’s economy grew by 7.9% in the second quarter of 2021 compared to the same time a year earlier. That was just below expectations of analysts which had predicted 8% growth in the second quarter. China’s first quarter growth rate was 18.3%. Overall, China’s government has set an economic growth target of “above 6 per cent” for 2021 after it grew by 2.3 per cent last year overall. Economists cautioned that China’s actual economy is not quite as strong as the numbers released might suggest. Inflation means that some of the statistics, like retail sales in June, overstate what is actually happening. Rising prices also suggest that the Chinese economy’s performance in the spring might not be sustainable.

A top government spokesman in Japan stated the country is ready to pump more money into its economy to ease the pain of the country’s prolonged pandemic. Less than two weeks before hosting the Olympics, Tokyo goes into its fourth COVID-19 state of emergency through Aug. 22, fueling fears of extended pain for restaurants hit by shorter hours and a ban on alcohol consumption. Lawmakers from Prime Minister Yoshihide Suga’s Liberal Democratic Party have escalated calls for a new relief package, with party heavyweight Toshihiro Nikai saying an extra budget of around 30 trillion yen ($270 billion) is needed. The world’s third-largest economy is expected to rebound from its annualized 3.9% contraction in the first quarter, but analysts expect the recovery to be gradual, with service sector consumption a particular weak spot.

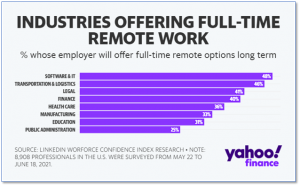

Finally: With the worst of the coronavirus epidemic in the rear view mirror, many employers have begun pushing employees to return to the office. Surprising to perhaps no one, it turns out many workers would rather continue working from home. According to LinkedIn’s Workforce Confidence Index, employers in the Software & IT, Transportation & Logistics and Legal sectors were most likely to allow employees to continue working from home. But workers in Public Administration and Education are most likely to be forced to return to the in-person daily grind. (Chart from Yahoo! Finance)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.