7-16-18 Market Update

The very big picture:

In the “decades” timeframe, the current Secular Bull Market could turn out to be among the shorter Secular Bull markets on record. This is because of the long-term valuation of the market which, after only eight years, has reached the upper end of its normal range.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 32.57, down slightly from the prior week’s 32.80, and exceeds the level reached at the pre-crash high in October, 2007. This value is in the lower end of the “mania” range. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In the big picture:

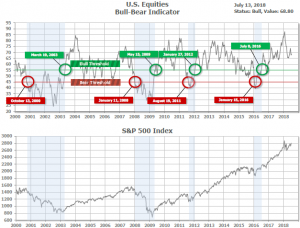

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 68.80, up from the prior week’s 67.85.

In the intermediate and Shorter-term picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned positive on April 3rd. The indicator ended the week at 25, up from the prior week’s 24. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was positive entering July, indicating positive prospects for equities in the third quarter of 2018.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns – but the market has entered the low end of the “mania” range, and all bets are off in a mania. The only thing certain in a mania is that it will end badly…someday. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is positive for Q3, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with all three indicators positive, the U.S. equity markets are rated as Positive.

In the markets:

U.S. Markets: Most of the major U.S. benchmarks finished the week with gains, despite substantial volatility. Large cap indexes widely outperformed the smaller cap indexes, and the narrowly focused Dow Jones Industrial Average performed the best of all. The Dow Jones Industrial Average added 2.3% to last week’s gain rising over 560 points to close at 25,019. The NASDAQ Composite added 137 points finishing the week at 7,825, a gain of 1.8%. By market cap, the large cap S&P 500 added 1.5% and the mid cap S&P 400 index gained 0.3%, but the small cap Russell 2000 index dropped -0.4% – the lone loser of the week.

International Markets: Canada’s TSX finished up for a second week, adding 1.2%. Across the Atlantic, the United Kingdom’s FTSE rebounded from last week’s loss by rising 0.6%. On Europe’s mainland, France’s CAC 40 rose 1%, Germany’s DAX gained 0.4%, but Italy’s Milan FTSE was off -0.2%. In Asia, China’s Shanghai Composite surged over 3% after plunging -3.5% the prior week. Likewise, Japan’s Nikkei added 3.7%. As grouped by Morgan Stanley Capital International, developed markets added 0.3%, while emerging markets rose 1%.

Commodities: Precious metals continued to sell off. Gold retreated -1.2% to end the week at $1241.20, while Silver was off for a fifth consecutive week, losing -1.6% to close at $15.81 an ounce. Crude oil retreated from recent highs. West Texas Intermediate crude oil ended down -3.8% at $71.01 a barrel. In a development that is beginning to concern some analysts, copper has now sold off for a fifth consecutive week. Copper, sometimes known as “Dr. Copper” for its ability to precede worldwide economic weakness, finished the week down -1.7%. Copper has given up almost 16% over the last 5 weeks.

U.S. Economic News: After a small spike last week, the number of Americans seeking new unemployment benefits fell by 18,000 to 214,000, back near 49-year lows, according to the Labor Department. The reading also came in lower than expectations as economists had forecast a smaller decline to 226,000. The more stable monthly average of new claims slipped by 1,750 to 223,000. Continuing claims, which counts the number of people already receiving benefits, also declined by 3,000 to 1.74 million. That number is reported with a one-week delay. Overall, the number of claims was the third lowest of the nine-year old economic expansion that began in mid-2009. The last time jobless claims were consistently lower was at the height of the Vietnam War in 1969.

In what may sound like a paradox, Americans are quitting their jobs at the fastest rate since 2001, yet economists say that’s a good thing! Economists state that, for the most part, workers only leave a job if they are confident of getting a better, higher paying one. The percentage of people in the private sector who left their jobs by choice rose to 2.7% in May, up 0.2%, while the so-called “quits rate” among all workers ticked up to 2.4% – both hit their highest levels in 17 years. Senior U.S. economist Michael Pearce at Capital Economics noted that rising pay for workers could spur inflation higher. Pearce wrote in a research note, ”The rise in the job quits rate points to wage growth accelerating to 3% by the end of the year.” In addition, the Labor Department reported the number of job openings retreated slightly from a record high to 6.64 million as companies continued to fill open positions. Over 5.7 million people were hired in May, up 170,000 from April and the biggest gain in 17 years.

Consumer credit growth accelerated sharply in May as borrowing among the nation’s consumers increased by $24.6 billion, the Federal Reserve reported. The increase was more than double economists’ forecasts and the fastest pace in six months. The annual growth rate is up to 7.6%, which is the fastest pace of credit growth since November. Economists had been expecting just a $12.4 billion gain. In the details, revolving credit (like credit cards) surged in May by rising by 11.4% – also the biggest increase since November. Non-revolving credit (like auto and student loans) rose 6.3%. Michael Faroli, chief U.S. economist at JP Morgan Chase released a note stating most of the acceleration in economic growth in the second quarter was due to consumer spending “snapping out of its brief first quarter funk” and that recent data suggests that consumers were using their credit cards to fuel that spending.

Prices of imported goods sank in June on lower food and energy costs, but the drop is not expected to last as trade and tariff tensions continue to mount. The Bureau of Labor Statistics reported U.S. import prices decreased 0.4% in June, following a 0.9 increase in May. Despite the downturn, overall import prices advanced 4.3% over the past year. Excluding fuel, import prices were up just 1.5% over the same period. Analysts note the decline could have been the result of foreign suppliers trying to ship more goods to the U.S. before looming tariffs took effect, or they could have lowered prices ahead of the tariffs to keep costs down for end-use customers. Also influencing import prices is a stronger dollar, as Gregory Daco, chief U.S. economist at Oxford Economics notes, “A stronger dollar has a depressing effect on imports prices, especially for consumer goods.”

Sentiment among the nation’s small business owners dampened just slightly last month, according to the National Federation of Independent Business’ (NFIB) small-business sentiment index, but remained at historically high levels. The NFIB reported its index fell a slight 0.6 point to 107.2, its sixth highest reading in the history of the survey. NFIB President Juanita Duggan stated, “Small business owners continue to report astounding optimism as they celebrate strong sales, the creation of jobs, and more profits. The first six months of the year have been very good to small business thanks to tax cuts, regulatory reform, and policies that help them grow.”

At the wholesale level, the cost of goods and services rose in June at their highest yearly rate in almost seven years. The Labor Department reported its Producer Price Index (PPI) for final demand rose 0.3%, lifted by gains in services, motor vehicles, and gasoline prices. In the 12 months through June, the PPI advanced 3.4%, its largest gain since November 2011. Economists had forecast a 0.2% gain and a 3.2% annual increase. Core PPI, which excludes the often-volatile food, energy, and trade services categories, rose 0.3% last month. Core PPI has risen 2.7% over the past year. Analysts note that the Federal Reserve will be taking note of the report as it shows that inflation is rising amid the backdrop of a labor market that is at or very near full employment.

At the consumer level, inflation hit a 6-year high according to the Bureau of Labor Statistics’ Consumer Price Index (CPI). Consumer prices rose last month to their highest annual rate since 2012, a sign that the economy is running hotter than at any time since the Great Recession. The increase in the cost of living rose 0.1% to an annualized 2.9% – its highest level in more than six years. Economists had expected a 0.2% gain. Last year at this time, the index stood at just 1.6%. Core CPI, which strips out food and energy, advanced 0.2% last month. Core CPI was up a more modest 2.3% over the past year—its highest reading in a year and a half. Overall, inflation shot up over the past year owing to rising oil prices, higher rents, more expensive medical care and growing bottlenecks in the economy for skilled workers and shortages of certain key materials.

Sentiment among the nation’s consumers hit a six-month low as concerns over tariffs and the possibility of a global trade war weighed. The University of Michigan’s consumer sentiment index fell 1.1 points to 97.1 this month, missing forecasts for a reading of 98.9. The reading was its lowest since January. In the details, the biggest drop came in the index for current conditions, which fell 2.6 points to 113.9. The University of Michigan reported that negative concerns over the impact of tariffs have accelerated, with those concerns coming particularly from households in the top third of incomes. Among those who expressed negative views of the tariffs, the expectations index was 30.5 points below those who didn’t mention tariffs as a concern at all.

International Economic News: As widely anticipated by economists, the Bank of Canada raised its key benchmark interest rate a quarter point to 1.5% this week. The predominant factors in the decision were said to be an unexpected jump in business investment and export growth this year, two growth engines that Bank of Canada Governor Stephen Poloz said would drive Canada’s economy back to better days. The Bank of Canada said in its policy statement, “The composition of growth is shifting. Exports are being buoyed by strong global demand and higher commodity prices. Business investment is growing in response to solid demand growth and capacity pressures, although trade tensions are weighing on investment in some sectors.” While the move didn’t come as a surprise, some economists continued to insist that the central bank should have left borrowing costs unchanged to create a cushion against escalating global trade tensions.

In the latest assessment by the UK’s Office for National Statistics (ONS), the UK economy grew 0.3% in May helped by the royal wedding and warm weather. The ONS’s head of national accounts Rob Kent-Smith stated the latest rolling estimates of GDP show “a mixed picture of the UK economy with modest growth driven by the services sector, partly offset by falling construction and industrial output. Services, in particular, grew robustly in May, with retailers enjoying a double boost from the warm weather and the royal wedding.” With the upturn in May, chief U.K. economist at Pantheon Macroeconomics said the upturn in May was “just strong enough to tip the balance” in favor of an August rate rise.

On Europe’s mainland, French President Emmanuel Macron summoned both chambers of parliament to the Palace of Versailles to defend criticism of his first year in office and reject claims that his agenda is pro-business favoring the wealthy. In a 90-minute address, Macron dismissed opponents who have labeled him “president of the rich”, and stated his tax cuts and labor market overhauls aim to encourage investment and open up France’s heavily-regulated economy to a new generation of workers. “I don’t like elites, unearned income or privilege,” Mr. Macron said. “But the prosperity of a nation is the bedrock of any plan for justice and equality. If we want to share the cake, it is first necessary to have a cake.” The cake reference, as you may recall, comes from Queen Marie Antoinette’s reply of “Let them eat cake,” after hearing the French people had no bread to eat.

The International Monetary Fund (IMF) cut Germany’s 2018 economic growth forecast to 2.2% saying rising protectionism and threat of a hard Brexit had exposes Germany’s economy to significant short-term risks. In its report, the IMF stated, “Short-term risks are substantial, as a significant rise in global protectionism, a hard Brexit, or a reassessment of sovereign risk in the euro area, leading to renewed financial stress, could affect Germany’s exports and investment.” In addition, given Germany’s rapidly aging society, IMF directors recommended further expanding public investment in infrastructure and education as well as setting more incentives for private investments. “Such measures would bolster productivity growth, further lift long-term output, and reduce Germany’s large current account surplus,” it said.

According to analysts surveyed by Agence France-Presse, Chinese growth had slowed only slightly in the second quarter as the impact of a deepening trade conflict with the United States had yet to kick in. China is expected to announce that the world’s second-largest economy expanded 6.7% in April-June when it releases gross domestic product figures on Monday, a survey of 13 economists found. That would be a 0.1% decline from the previous three quarters. Economists estimated the recent threats of tariffs on the billions of dollars of trade goods between the world’s two biggest economies would not have a significant impact until next year. Washington, having already imposed tariffs on $34 billion worth of Chinese goods, raised the stakes this week by threatening to impose fresh tariffs on an additional $200 billion worth of Chinese exports to the US.

The government of Japan hosted a session highlighting how the Japan-European Union Economic Partnership Agreement (EPA) will not only increase and modernize free, fair, and open trade, but will also open up tremendous business opportunities between Japan and the EU. In the keynote address by Ambassador Kazuo Kodama, the message was that with its highly favorable business climate, global-leading innovation, and one of the largest economic agreements in the world to be signed shortly, Japan is in a better position to attract business investment than ever before. M. Hosuk Lee-Makiyama, Senior Fellow in the Department of International Relations at the London School of Economics stated, “Japan and the European Union are opening a critical new stage of partnership, and the EPA should be a milestone in their relationship. One should not forget that still now, European companies are underinvesting in Japan, compared with their US peers.”

Finally: The homeownership rate among millennials ages 25-34 is around 8% lower than when both Generation X and the baby boomers were when in the same age range. A new report by the policy research group Urban Institute, looked to explain why. What they found was a variety of reasons, some of them financial and some of them lifestyle in character. Delayed marriages were a primary cause, as millennials are marrying later and marrying less than their older counterparts. Today the median age for a first marriage is closer to 30, while in 1960, the average age was in the early 20’s. In addition, today’s millennials are in no hurry to reproduce. The share of married households with children, aged 18-34 dropped to 25% in 2015, down from 37% in 1990. In addition, the unprecedented amount of student debt millennials have taken on also reduces their chances of owning a home of their own. The researchers at the Urban Institute found that if a person’s education debt went from $50,000 to $100,000, their chance of home ownership declines by 15 percentage points. The following chart (from CNBC.com) reports the reasons millennials themselves give for not participating in home ownership.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

These are the opinions of WE Sherman and Co and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.