6-18-18 Market Update

The very big picture

In the “decades” timeframe, the current Secular Bull Market could turn out to be among the shorter Secular Bull markets on record. This is because of the long-term valuation of the market which, after only eight years, has reached the upper end of its normal range.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 33.03, little changed from the prior week’s 33.02, and exceeds the level reached at the pre-crash high in October, 2007. This value is in the lower end of the “mania” range. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In the big picture:

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 73.56, up from the prior week’s 71.77.

In the intermediate and Shorter-term picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned positive on April 3rd. The indicator ended the week at 25, up from the prior week’s 20. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was negative entering April, indicating poor prospects for equities in the second quarter of 2018.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns – but the market has entered the low end of the “mania” range, and all bets are off in a mania. The only thing certain in a mania is that it will end badly…someday. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is negative for Q2, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two indicators positive and one negative, the U.S. equity markets are rated as Neutral.

In the markets:

U.S. Markets: The major U.S. indexes finished the week mixed with a drop on Friday erasing the week’s gains for the Dow Jones Industrial Average and the S&P midcap 400 index. The Dow Jones Industrial Average gave up 226 points ending the week at 25,090, a loss of -0.9%. The technology-heavy NASDAQ Composite managed a 100 point gain to close at 7,746, a gain of 1.3%. By market cap, the large cap S&P 500 ended the week essentially flat, up just 0.4 point, the mid cap S&P 400 retreated -0.4% and the small cap Russell 2000 added 0.7%.

International Markets: Canada’s TSX rose a second consecutive week adding 0.7%, but in the United Kingdom the FTSE 100 index ended down -0.6%, its fourth straight weekly decline. On Europe’s mainland, France’s CAC 40 added 0.9%, Germany’s DAX rose 1.9%, and Italy’s Milan FTSE surged 3.9% (recovering all of the prior week’s decline). In Asia, China’s Shanghai Composite retreated for a fourth straight week, down -1.5% while Japan’s Nikkei had a second week of gains, rising 0.7%. As grouped by Morgan Stanley Capital International, developed markets were off -0.6%, while emerging markets declined a steeper -2.4%.

Commodities: Precious metals had a difficult week as Gold plummeted almost $30 an ounce on Friday to $1,278.50 an ounce, down -1.9% for the week. Silver, almost always more volatile than Gold, plunged -4.5% on Friday ending the week at $16.48 an ounce, a loss of -1.6%. Energy had its fourth consecutive week of losses. West Texas Intermediate crude oil ended down -1% closing at $65.06 per barrel. Copper, seen by some analysts as a barometer of global economic health due to its variety of industrial uses, retraced almost all of last week’s rally by retreating -4.7%.

U.S. Economic News: The number of Americans seeking new unemployment benefits dropped by 4,000 to just 218,000 last week, the third consecutive week of declines. Economists had forecast a slightly higher reading of 222,000. The number of workers being laid off is down to levels not seen since the late 1960’s and early 1970’s. Strong job gains and the lowest jobless rate in 18 years has fueled sales of new homes, cars, and other goods and services, keeping the economy on track and headed for its longest expansion ever. Continuing claims, which counts the number of people already receiving benefits, fell by 49,000 to just 1.69 million people. That’s the lowest level since the end of 1973.

Sales among the nation’s retailers jumped 0.8% in May, twice the amount economists had forecast. Sales at gas-stations rose sharply in May, reflecting the higher prices at the pump, and home centers also posted a big boost in sales. In a bit of a surprise, traditional brick-and-mortar department stores actually outpaced their internet rivals. Auto sales were up 0.5%, which contributes about one-fifth of all retail spending. Over the past 12 months retail sales are up a solid 5.9%. Economists expect the strength to continue. Paul Ashworth, chief U.S. economist at Capital Economics stated, “U.S. households are back to their free spending ways, with the strength of May’s retail sales figures implying that second-quarter real consumption growth (and GDP growth for that matter) will now be more than 4% annualized. With the benefit of the tax cuts, strong employment growth and a slow acceleration in hourly wage growth, consumption growth should remain strong going into the second half of this year.”

Sentiment among the nation’s small business owners jumped to a 34-year high according to the latest survey by the National Federation of Independent Business (NFIB). The NFIB’s small-business optimism index rose 3 points last month to a reading of 107.8—its strongest level of this economic recovery which is now in its eighth year. The latest reading sits just below the all-time record of 108 set in July of 1983. In the details of the report a measure of compensation increases rose to a record high, as did positive earnings trends and expansion plans. Of concern, however, is that plans to raise prices are at their highest level since 2008. Concerns about quality of labor reached their second highest levels in history.

Overall the report confirms what we already knew. The economy continues to grow at a rapid pace, but held back by shortages of materials and qualified workers. About a quarter of firms reported finding skilled workers as their single largest problem, ahead of taxes and regulation.

Sentiment among the nation’s consumers improved as rising wages offset the recent upturn in inflation. The University of Michigan’s Consumer Sentiment index for June rose to 99.3, a slight improvement over May’s reading. In the details, the assessment of current conditions rose 6.1 points to 117.9, but the survey also showed people may be a bit less enthusiastic about the future. The expectations index fell 1.7 points to 87.4. Overall, consumers remain confident in their financial situations and the trend is expected to last for at least the near future. Richard Curtin, chief economist of the survey stated, “Only when inflation and interest rates are expected to persistently exceed income and job prospects will consumers begin to curtail their discretionary spending. Indeed, greater certainty about future income and job prospects have become the main drivers of more favorable purchase plans.”

Inflation at the consumer level is rising at the fastest pace in 6 years, the Bureau of Labor Statistics (BLS) reports. The BLS’ Consumer Price Index showed the cost of living increased 0.2% last month, in line with forecasts, and is up 2.8% over the last 12 months. The more closely watched “core rate”, which strips out the volatile food and energy categories, was also up 0.2%. The yearly increase in the core rate is now up to 2.2%. Rising prices for medical care, gasoline, rent and home prices spearheaded the cost of living increase. The Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index excluding food and energy, rose 1.8 % on a year-on-year basis in April, matching March’s increase. Economists expect the core PCE price index will breach the 2% target set by the Fed this year. Fed officials have indicated they would not be too concerned with inflation overshooting the target.

A key manufacturing gauge in the New York-region showed manufacturing activity at its highest level since last October. The New York Fed’s Empire State Manufacturing Index rose 4.9 points to a reading of 25. Both new orders and shipments showed solid gains, and the employment index jumped 10.3 points to a reading of 19. Despite the strong data, some economists expressed concerns for the manufacturing sector in light of a looming international trade war. Ian Shepherdson, chief economist at Pantheon Economics wrote in a note, “The core message, of strong growth and increasing pressure on prices at the producer level, is consistent with official data. But the prospect of a broadening trade war with China is raising the risk that the momentum in growth won’t be sustained.”

The Federal Reserve raised a key U.S. interest rate this week and signaled a more aggressive stance going forward as the bank acknowledged a steadily growing economy accompanied by a rise in inflationary pressures. As widely expected, the Fed lifted its benchmark federal funds rate by a quarter-percentage point to a range of 1.75%-2%. In addition, the Fed projected a total of four rate increases in 2018, up from the three previously planned. The move was in line with the Fed’s goal of gradually raising interest rates to keep the economy on an even keel. The so-called Fed “dot plot” showed one official switched from a more moderate to a slightly higher interest-rate path. Eight Fed officials said they expected interest rates to rise at least four times; seven forecast three rate hikes. Fed Chairman Powell said in the press conference following the move, “If you raise rates too quickly, you are increasing the likelihood of recession.”

International Economic News: In spite of concerns over impending U.S. trade tariffs, the Canadian economy is gaining momentum according to the latest Royal Bank of Canada Economic Outlook report. After a lackluster second-half of 2017 and a weak beginning to 2018, the economy has strengthened and could be on the upswing for remainder of the year. Increased consumer spending, wage growth, and business investment have all contributed to Canada’s economic health. While not nearing the 3.0% growth pace of 2017, RBC Economics expects real gross domestic product (GDP) to average 2.0% in 2018, followed by a slight slowing to 1.8% in 2019. Craig Wright, Senior Vice-President and Chief Economist at RBC stated, “Financial conditions remain solid and the labor market is healthy. Wage growth continues to accelerate and it will blunt the impact that rising interest rates will have on household debt service costs.”

A sharp fall in manufacturing activity in the United Kingdom suggests the economy may not be rebounding quite as quickly as hoped. In its latest report, the United Kingdom’s Office of National Statistics (ONS) data showed manufacturing output shrank by 1.4% in April–the sharpest monthly decline since 2012. In addition, the ONS reported weak figures for both trade and construction. Howard Archer, chief economic adviser to the Ernst & Young Item Club, said it was “a miserable and thoroughly worrying set of UK data that fan concerns over the UK economy”. The lackluster data leads analysts to believe that the Bank of England will likely hold off on a rate hike when the bank’s Monetary Policy Committee meets next week.

French President Emmanuel Macron is being criticized again as “having a problem with poor people” after saying that France “spends a crazy amount of dough on social security.” The remarks were seen as preparing the nation’s citizens for benefit cuts in their generous social welfare programs. For France’s left-leaning critics, the comments were further evidence that Macron is the “president of the rich” calling him scornful of the less fortunate. Veteran Socialist party figure Martine Aubry told reporters, “The president has a problem with poor people and it’s starting to show more and more.” Even some members of Macron’s parliamentary party said they were uncomfortable with the language used by the 40-year-old former investment banker to get his message across. Sonia Krimi, a lawmaker in Macron’s Republic on the Move party, stated, “You need to be careful about the words you use. I am very, very uneasy about this remark.” The comment comes in the midst of a debate about whether the government should reduce France’s social spending, which is the highest among wealthy countries relative to the size of its economy.

Europe’s economic powerhouse, Germany, is now reporting that the ongoing trade threats between the U.S. and Germany are not only hurting feelings, but they are now starting to weigh on the country’s real economy. Germany saw its annualized growth rate roughly cut in half in the first quarter of 2018 as exports fell in three out of the first four months of the year. Oliver Rakau, an economist with Oxford Economics stated, “It’s clear that concerns over protectionism and the more assertive foreign-policy stance of the U.S. have begun to have real economic implications.” Because Germany is so dependent on international trade, economists argue, the protectionist sentiment coming from the White House is having a chilling effect on both sentiment and actual economic activity. Germany is the third-largest exporter in the world, after China and the U.S.

Investors became more confident in Italy’s economy as Giovanni Tria, the new Economy Minister, outlined plans that didn’t include what they had feared most—Italy exiting the euro currency. Markets panicked in the prior week as the prospect of a new populist government led to fears the Italian government may run up huge debts despite the Eurozone’s monetary rules, and perhaps even exit the Euro currency. Tria told Italian newspaper Corriere della Sera that there was “no discussion about leaving the Euro” among the new government leadership. Tria also stated he would focus on cutting debt levels. Two major populist parties, the Five Star Movement and the far-right League, emerged from months of political turmoil to form a government in early June. “Investors will be pleased to see signs of a conciliatory approach,” said Chris Beauchamp, chief market analyst at IG.

President Donald Trump approved a plan to impose a 25% tariff on billions of dollars of Chinese goods just as China’s economy may be entering a slowdown. The announcement came as both industrial output and retail sales rose less than expected in May, and fixed-asset investment growth in the first five months of the year was the slowest since data began in 1999. In addition, China’s central bank chose not to hike interest rates at its latest meeting this week, adding further concern for the health of China’s economy. Louis Kuijs, chief Asia economist at Oxford Economics in Hong Kong and a former International Monetary Fund researcher stated, “A slowing China will add to the challenges for the global economy. Until recently, the resilience of growth in China was an important buffer for the global economy in the face of headwinds from trade friction, slower growth in Europe, higher oil prices and issues in various emerging markets.” China, which is the world’s second-largest economy, is already slowing after a stronger-than expected start to 2018, even before any new U.S. tariffs on its exports. China has vowed to retaliate for the tariffs in a tit-for-tat move.

Japan’s Cabinet approved an economic plan that would allow more foreign workers to enter as the rapidly aging country seeks to compensate for its shrinking workforce. Under the plan, Japan would relax visa requirements in sectors facing severe labor shortages such as nursing care, agriculture, construction, and transport. The new categories are in addition to the highly-skilled professionals the country already seeks. Under the strict set of new rules, the workers would be allowed to stay in the country for up to five years only as visitors, not as immigrants. They would not be allowed to be accompanied by family members — a measure that would encourage them to leave Japan when their visas expire and not become part of Japanese society. Japan also sets high standards for language skills and cultural understanding. The decision underscores Japan’s need to fill its labor shortage, forcing it to put aside its reluctance to accept outsiders.

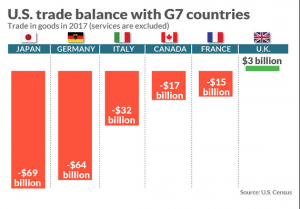

Finally: in a rather interesting exchange of tweets before the G7 summit in Canada, U.S. President Donald Trump clashed with both French President Emmanuel Macron and Canadian Prime Minister Justin Trudeau over trade policies. President Trump threatened the two leaders with higher tariffs if they don’t ease up on what he considers unfair trade policies. But as the following graph shows, neither Canada nor France is a particularly big offender when it comes to the United States’ trade imbalance. The trade deficit with the G7 countries in 2017 was just a quarter of the total (China accounted for 47%), and Canada and France were the smallest of the G7 deficits. Perhaps President Trump would have been more productive targeting Japan and Germany, since together the deficit with them is more than 4 times the combined deficits with Canada and France.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)

These are the opinions of WE Sherman and Co and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Securities offered though Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.