5-14-18 Market Update

5-14-18 Market Update

The very big picture:

In the “decades” timeframe, the current Secular Bull Market could turn out to be among the shorter Secular Bull markets on record. This is because of the long-term valuation of the market which, after only eight years, has reached the upper end of its normal range.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that increases in market prices only occur in a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind as buyers rush in to buy first and ask questions later. Two manias in the last century – the 1920’s “Roaring Twenties” and the 1990’s “Tech Bubble” – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid and the following decade or two are spent in Secular Bear Markets, giving most or all of the mania gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 32.42, up from the prior week’s 31.66, and still exceeds the level reached at the pre-crash high in October, 2007. This value is in the lower end of the “mania” range. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been in the 0% – 3%/yr. range. (see Fig. 2).

In the big picture:

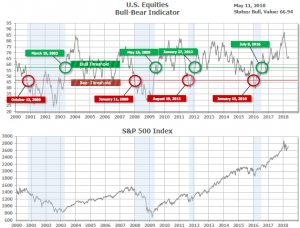

The “big picture” is the months-to-years timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator (see Fig. 3) is in Cyclical Bull territory at 66.94, up from the prior week’s 65.13.

In the intermediate and Shorter-term picture:

The Shorter-term (weeks to months) Indicator (see Fig. 4) turned positive on April 3rd. The indicator ended the week at 11, up from the prior week’s 10. Separately, the Intermediate-term Quarterly Trend Indicator – based on domestic and international stock trend status at the start of each quarter – was negative entering April, indicating poor prospects for equities in the second quarter of 2018.

Timeframe summary:

In the Secular (years to decades) timeframe (Figs. 1 & 2), the long-term valuation of the market is simply too high to sustain rip-roaring multi-year returns – but the market has entered the low end of the “mania” range, and all bets are off in a mania. The only thing certain in a mania is that it will end badly…someday. The Bull-Bear Indicator (months to years) is positive (Fig. 3), indicating a potential uptrend in the longer timeframe. In the intermediate timeframe, the Quarterly Trend Indicator (months to quarters) is negative for Q2, and the shorter (weeks to months) timeframe (Fig. 4) is positive. Therefore, with two indicators positive and one negative, the U.S. equity markets are rated as Neutral.

In the markets:

U.S. Markets: Stocks recorded solid gains this week as the major indexes moved back into positive territory for the year to date. The large cap S&P 500 achieved its best weekly advance in two months and closed above its key 100-day moving average for the first time since mid-March. The Dow Jones Industrial Average rallied 568 points, or 2.3%, to close at 24,831. The technology-heavy NASDAQ Composite added 2.7% closing at 7,402. By market cap, the large cap S&P 500 index gained 2.4%, while the mid cap S&P 400 and small cap Russell 2000 added 2.2% and 2.6%, respectively.

International Markets: Canada’s TSX closed up for the fifth consecutive week by rising 1.6%. Across the Atlantic, the United Kingdom’s FTSE recorded its seventh consecutive week of gains, adding 2.1%. On Europe’s mainland, France’s CAC 40 added 0.5%, while Germany’s DAX rose 1.4%, and Italy’s Milan FTSE retreated -0.7%. In Asia, China’s Shanghai Composite index rose 2.3%, its third straight week of gains. Japan’s Nikkei closed up for a seventh straight week rising 1.3%. Hong Kong’s Hang Seng index rebounded from last week’s drop and closed up 4%. As grouped by Morgan Stanley Capital International, developed markets rose 1.2% last week, while emerging markets gained 2.1%.

Commodities: Precious metals recovered from their weakness last week with gold rising 0.5%, or $8, to close at $1320.70 an ounce. Silver also finished up by 1.4% to end the week at $16.75 an ounce. West Texas Intermediate crude oil continued its ascent, rising four out of the last five weeks and closing at $70.70 per barrel, a gain of 1.4%. Copper, the industrial metal viewed by some analysts as a measure of global economic health, rose 0.84%.

U.S. Economic News: The number of people applying for new unemployment benefits held steady for the second week in a row, according to the Labor Department. New claims remained flat at 211,000 in the week ended May 5, the government reported. Economists had expected a slight rise to 215,000. The four-week average of new claims, used to smooth out the weekly volatility, fell by 5,500 to 216,000—its lowest level since December of 1969. Continuing claims, which counts the number of people already receiving unemployment benefits, rose by 30,000 to 1.79 million.

For the first time ever, there’s now a job opening available for each and every unemployed worker. According to the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS), there were 6.6 million job openings in March, compared to 6.59 million unemployed workers. Job openings in total rose by 472,000 in March. In the details of the report, professional and business services added 112,000 positions, construction added 68,000, and the transportation, warehousing and utilities sectors added 37,000 new positions. The Quits rate in the JOLTS report, watched closely by the Fed, rose by 136,000 to 3.34 million. Counterintuitively, a higher quit rate is a good thing – it is presumed that workers only quit jobs if better opportunities are plentifully available.

Consumer credit grew at its slowest rate in 6 months according to the latest data from the Federal Reserve. The Fed reported consumer credit grew in March at a seasonally-adjusted 3.6%, or $11.6 billion, marking its slowest gain since September. The reading fell short of economists’ expectations of a $13.6 billion advance. Non-revolving credit, which includes student and auto loans, grew by 6%–the third consecutive month of growth for that category. Revolving credit, primarily credit cards, fell 3% marking its second drop in a row. Economists expect with rising employment and growing gains in income, consumer credit should continue to increase. However, while credit growth averaged above 7% in 2014 and 2015, it’s currently running at just an annualized 4.25% through the first quarter.

Sentiment among the nation’s small-business owners ticked up just a slight bit in April as the surge in optimism following last year’s tax cuts appears to be slowing its ascent. National Federation of Independent Business (NFIB) reported its small-business optimism index rose 0.1 point to 104.8 last month. The confidence index soared to new highs after tax cuts were passed last year, but it has struggled to maintain its momentum. Despite the lackluster headline number, the NFIB highlighted a surge in the index of expected profit trends, which hit its highest level in the survey’s 45-year history. The NFIB said in its’ statement, “The optimism small businesses owners have about the economy is turning into new job creation, increased wages and benefits, and investment.” Survey respondents continued to report that the biggest problem they face is finding qualified workers.

Prices at the wholesale level barely rose last month after strong gains in the first quarter, according to the latest producer price index reading. The Labor Department reported its Producer Price index (PPI) rose 0.1% in April, missing economists’ estimates of a 0.3% rise. The slight increase, held down by moderation in the cost of both goods and services, should ease fears that inflation pressures are rapidly building. However, analysts were quick to point out that the slowdown in wholesale price growth is likely temporary as manufacturers continue to report paying more for their raw materials. Year-over-year, the PPI is up 2.6%, down 0.4% from March.

At the consumer level, the Labor Department reported that the Consumer Price Index (CPI) rose 0.2% last month after slipping 0.1% in March. In the 12 months through April, the CPI increased 2.5%. In the report, rising costs for gas and rental accommodations were tempered by a moderation in healthcare prices. Excluding the volatile food and energy components, the so-called core CPI edged up 0.1% after two straight monthly increases of 0.2%. Year-over-year, core CPI is up 2.1%. While the Federal Reserve has publicly stated it targets a 2% rate of inflation, the Fed uses a different inflation measure for this purpose. This measure, called the Personal Consumption Expenditures (PCE) price index is currently sitting at 1.9%. Economists expect the core PCE price index to breach the Fed’s target this month.

Sentiment among the nation’s consumers was slightly higher than anticipated for the first week of May, according to the University of Michigan. The University of Michigan’s survey of consumer attitudes about the economy came in at 98.8, in line with April’s revised result. While the overall index was unchanged, there was some movement in the components of the index. Consumers’ views of their current situation slipped 1.6 points, while the expectations component gained 1.1 points. In its release, survey director Richard Curtin noted that fewer consumers anticipated additional declines in the unemployment rate and that “Consumers have a remarkable track record for anticipating changes in the actual unemployment rate.”

International Economic News: The Bank of Canada’s senior deputy governor called for more diverse perspectives at the bank, stating that the bank risks falling into an “echo chamber” that reinforces the same viewpoint. Governor Carolyn Wilkins said that such a move may not seem relevant for a central bank at first, but diverse views are crucial going forward as the Bank of Canada takes on modern economic challenges such as digitalization, cryptocurrencies, and a new economy. At the G7 Women’s Forum in Toronto Wilkins remarked, “We’re doing projects where we actually require that diversity of thought.” Wilkins comments came as she discussed the benefits of an inclusive economy and the challenges to achieving it.

The Bank of England held interest rates steady as the bank played down signs of economic weakness. In its latest policy meeting the Bank of England voted to hold interest rates at 0.5%. The bank’s Monetary Policy Committee voted seven-to-two against raising interest rates immediately, with the majority stating that there was a need to “see how the data unfolded over coming months to discern whether the softness in the first quarter might persist.” Recall that the United Kingdom was hit with a significant winter storm in the first quarter, dubbed the “Beast from the East” by UK media. Mark Carney, governor for the Bank of England said, “The overall economic climate in the UK looks little changed this far.”

France’s Foreign Minister said European countries should push back harder against the Trump administration over the Iran nuclear deal. Jean-Yves Le Drian stated that France wanted to stick with the nuclear accord that Tehran had agreed with world powers in 2015—a pact which he said Iran had honored. Similarly, French Finance Minister Bruno Le Maire said that Europe should not accept that the U.S. is the “world’s economic policeman”. “Do we want to be vassals who obey decisions taken by the United States while clinging to the hem of their trousers?” Le Maire asked. “Or do we want to say we have our economic interests, we consider we will continue to do trade with Iran?” French President Emmanuel Macron is scheduled to speak to his Iranian counterpart Hassan Rouhani.

A stronger-than-expected rebound in German industrial output in March and an increase in exports helped ease concerns that Europe’s economic powerhouse had come to a standstill at the beginning of the year. The Federal Statistics Office said industrial production rose 1% in March, its strongest increase since November and better than the expectations of a 0.8% rise. The Economy Ministry pronounced, “The upswing remains intact.” The government expects growth of 2.3 percent this year, up from 2.2 percent in 2017. The bullish output and export figures brought some relief after weak data for January and February pointed to a massive slowdown in the first quarter. “Rebounding exports and industrial production show that talk of a downswing has been premature,” ING Bank economist Carsten Brzeski said.

President Xi Jinping of China has dispatched his top economic advisor Liu He to Washington this week for another round of trade negotiations with his counterparts in the Trump administration. China is eager to dissuade President Trump from imposing sanctions on Chinese imports which would trigger retaliation in kind. President Trump’s administration has rolled out a major trade initiative that could implement tariffs on $50 billion in Chinese imports as soon as this month, with the option of adding tariffs on another $100 billion. Last week, top U.S. economic officials including Treasury Secretary Steven Mnuchin traveled to China for talks. The U.S. asked China to cut its trade surplus by $200 billion, while China sought to get Washington to ease national-security reviews of Chinese investments. The talks ended inconclusively.

Household spending in Japan fell 0.7% in March from a year earlier marking its second consecutive month of declines. Weak consumer spending could prove to be troubling for the Bank of Japan, which had hoped that rising costs from companies would be passed on to consumers and help drive up inflation to its 2 percent target. Analysts were quick to point out that bad weather was likely the cause for the reduced consumption in the first quarter, and that the lull is likely temporary. “The economy is expected to return to the pace of around annualized 1.0 percent growth from April-June but we need to pay attention to impacts from the United States’ trade protectionism including the currency movements,” said Yusuke Ichikawa, senior economist at Mizuho Research Institute.

Finally: Stock market bulls got something to cheer about last week. Heritage Capital President Paul Schatz noted that New York Stock Exchange’s advance/decline line set a new all-time high this week. The indicator counts the number of stocks rising on a particular day and subtracts the number of stocks falling and plots the result over time. “When the major stock market indices make new highs but the NYSE A/D Line does not, that’s where bulls should begin to worry,” Schatz writes, adding that “the exact opposite is now happening,” which he said was “typically a good sign for further strength in stocks over the medium-term.” Still, he added the obligatory caution that past performance is no guarantee of future results.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet)

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. All Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.