10-31-2022 Weekly Market Update

The very Big Picture

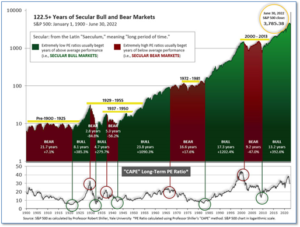

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level, and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears. The CAPE is now at 28.75, up from the prior week’s 27.66. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The Big Picture:

The ‘big picture’ is the (typically) years-long timeframe – the timeframe in which Cyclical Bulls and Bears operate. The U.S. Bull-Bear Indicator finished the week in Bear territory at 39.29, up from the prior week’s 36.25.

In the Quarterly- and Shorter-term Pictures

The Quarterly-Trend Indicator based on the combination of U.S. and International Equities trend-statuses at the start of each quarter – was Negative entering October, indicating negative prospects for equities in the fourth quarter of 2022.

Next, the short-term(weeks to months) Indicator for US Equities turned positive on October 3, and ended the week at 25, up from the prior week’s 12.

In the Markets:

U.S. Markets: Major U.S. stock benchmarks managed a second consecutive week of across-the-board gains as investors reacted to a busy calendar of third-quarter earnings reports. The Dow Jones Industrial Average surged over 1700 points finishing the week at 32,862—a gain of 5.7%. The technology-heavy NASDAQ Composite lagged the other benchmarks with a 2.2% gain. By market cap, the large cap S&P 500 finished the week up 4%, while the mid cap S&P 400 index added 5.3% and the small cap Russell 2000 surged 6% to lead all others.

International Markets: It was a similar story with major western international benchmarks. Canada’s TSX rose 3.2%, while the United Kingdom’s FTSE 100 added 1.1%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX finished up for a fourth consecutive week. France’s CAC 40 rose 3.9%, while Germany’s DAX added 4%. In Asia, China’s Shanghai Composite shed -4.0%, while Japan’s Nikkei ended up 0.8%. As grouped by Morgan Stanley Capital International, developed markets rose 3.2%, while emerging markets finished down -2.8%.

Commodities: Precious metals finished the week mixed with Gold retreating -0.7% to $1644.80 per ounce, while Silver rose 0.4% to $19.15. Oil rebounded following two weeks of declines. West Texas Intermediate crude oil rose 3.4% to $87.90 per barrel, while Brent crude added 2.4% to $95.77. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -1.3%.

U.S. Economic News: The number of Americans filing for first-time unemployment claims ticked up last week, but remained near historically low levels. The Labor Department reported initial jobless claims rose by 3,000 to 217,000 in the week ended October 22. Economists had expected claims to rise by 6,000. Analysts note that initial jobless claims is one of the earliest and best barometers of whether the economy is getting better, or worse. Meanwhile, continuing claims, which counts the number of Americans filing for first-time unemployment benefits, rose by 55,000 to 1.44 million. Rubeela Farooqi, chief U.S. economist for High Frequency Economics, wrote in a note, “Even as filings are not rising, we expect a gradual increase over coming months as demand slows in response to aggressive and ongoing Fed tightening.”

Home prices cooled at a record pace in August, according to S&P Case-Shiller, with the biggest declines on the West Coast. S&P CoreLogic reported its Case-Shiller 20-city home price index fell 1.3% in August. Year-over-year price appreciation rose to 13.1%–but that’s down from 16% in July. The annual increases in home prices have slowed sharply since hitting a peak of 21.2% in April. The West Coast, which includes some of the costliest housing markets, saw the largest monthly declines, with San Francisco (-4.3%), Seattle (-3.9%) and San Diego (-2.8%) falling the most. The broader national index fell a seasonally-adjusted 1.1% in August from July. The growth rate in housing prices peaked in the spring and has been declining ever since. Buyers are scarce now that mortgage rates are above 7% and inflation remains high. Nancy Vanden Houten, U.S. economist at Oxford Economics stated, “We expect the decline in home price growth to accelerate as sharply higher mortgage rates deliver a major blow to affordability and home sales.”

Sales of new homes fell in September, partially reversing August’s big gain, according to government statistics. The Commerce Department reported new home sales fell 10.9% to a seasonally-adjusted annual rate of 603,000. Analysts had expected new home sales to come in at 593,000. Compared to the same time last year, new home sales are down by 17.6%. The median price of a new home sold in September rose to $470,600 from $436,800 in August. Still, prices are down from the record high set at $479,800 in July. Regionally, the decline in new home sales was led by the South, where sales fell 20.2%, followed by the West. Stephen Stanley, chief economist at Amherst Pierpont is not expecting the housing market to improve anytime soon. Stanley wrote in a note to clients, “I’m prepared to bet that new home sales have yet to hit bottom, as mortgage rates continue to climb, hitting 7% this week.”

The economy grew in the third quarter, rebounding from two consecutive quarters of declines in the first half of the year, the government reported. The Bureau of Economic Analysis reported third quarter Gross Domestic Product—the official scorecard of the U.S. economy, grew at an annual rate of 2.6%. The positive reading was driven largely by a shrinking trade deficit that masked emerging weak spots in the economy. The main engine of the U.S. economy, consumer spending, has remained relatively stable this year. GDP had contracted by 1.6% in the first quarter and 0.6% in the second. The result exceeded economists’ forecasts of a 2.3% increase. However, analysts don’t expect the positive trend to continue. Early estimates of the fourth quarter suggest GDP could decline and many economists and business leaders predict a recession by early next year. Chief economist Jeffrey Roach of LPL Financial wrote in a note, “the U.S. is not currently in recession, given the strength of the consumer sector, but the trajectory for growth looks weak. A deteriorating housing market and nagging inflation along with an aggressive Federal Reserve puts the economy on unsure footing for 2023.”

Preliminary, or “flash”, PMI data from S&P Global showed an economic downturn in the U.S. “gathering significant momentum” in October. S&P reported the U.S. manufacturing sector ticked up slightly to 50.7 in October based on its flash survey. However, its measure of the much larger ‘services’ side of the U.S. economy (approximately 70% of GDP) fell to 46.6 from 49.3. Readings above 50 signify expansion, below that, contraction. The readings were a wide miss from economists’ forecasts. Manufacturing was expected to rise to 51.8 and Services to rise to 49.7. In the service sector, the downturn was fueled by the rising cost of living and tightening financial conditions. In manufacturing, new orders fell back into contraction territory. Chris Williamson, chief business economist at S&P Global Market Intelligence stated, “The US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply.”

Orders for goods expected to last at least three years, so-called ‘durable goods’, rose in September, but analysts pointed out that momentum is fading. The Commerce Department reported orders at U.S. factories rose 0.4% last month. It was the sixth increase in the last seven months. However, the reading missed expectations of a 0.7% increase. Core orders, which removes the often-volatile transportation and military equipment categories, actually fell -0.7%. It was the first drop in core orders since February and the biggest since March 2021. Ian Shepherdson, chief economist at Pantheon Macroeconomics stated, “It now looks increasingly likely that manufacturing will slip into recession in the months ahead. The sector has outperformed the survey data for much of this year, but that gap is now narrowing as two of its biggest supports—rising auto output and resilient capex—are fading fast.”

The confidence of the nation’s consumers fell to a three-month low in October on fears of high inflation and the rising odds of a recession. The Conference Board reported its survey of consumer confidence fell 5.3 points to 102.5 this month. Economists had expected just a slight pullback to 106.3. In the details of the report, the measure of how consumers feel about the economy “right now” dropped to 138.9 from 150.2, while a similar measure that looks ahead six months slid to 78.1 from 79.5. Lynn Franco, senior director of economic indicators at the board stated, “The expectations index is still lingering below a reading of 80 — a level associated with recession — suggesting recession risks appear to be rising.” Corporate economist Robert Frick of Navy Federal Credit Union noted, “Consumer confidence is a proxy for inflation now, particularly prices at the pump. Confidence improved as gas prices fell in August and September, and now declined as gas prices are rising.”

International Economic News: The Canadian economy ticked slightly higher at the end of summer and initial estimates pointed to growth continued in September even as worries of an impending recession grow. Statistics Canada said real gross domestic product gained 0.1% in August, topping its initial estimate that suggested no growth for the month. Karyne Charbonneau, executive director, economics, at CIBC, said the economy may have slowed, but the good news is there was at least some growth. “While we will be revising our overall 2022 growth expectation to be a tad higher, this does not alter our view that the economy will stall in the months ahead, and the lack of momentum late in Q3 is aligned with that,” Charbonneau wrote. In related news, the Bank of Canada hiked its key interest rate target by half a percentage point earlier this week to 3.75% as it said the economy remains overheated.

Across the Atlantic, economic activity in the United Kingdom contracted at its fastest pace in almost two years this month, suggesting the country has fallen into a recession. S&P Global reported its flash UK composite output index, a measure of activity in the private sector, dropped two points to a 21-month low of 47.1 in October. October’s was the third consecutive reading under 50, which indicates a majority of businesses reporting a contraction in activity, and was below the 48.1 forecast by economists. The gloomy outlook comes amid domestic political uncertainty, with Rishi Sunak on course to become prime minister after Liz Truss resigned last week. Chris Williamson, chief business economist at S&P Global Market Intelligence, said October’s flash PMI data showed “the pace of economic decline gathering momentum” after recent political and financial market upheaval.

On Europe’s mainland, the French economy grew at a slower pace in the third quarter according to preliminary data from France’s National Institute for Statistics and Economic Studies. GDP in the Eurozone’s second-largest economy expanded by 0.2% during the period, down from its second-quarter reading of 0.5% but in line with expectations. Household consumption growth was unchanged, while expenditures on accommodations and transport fell sharply. Food consumption dropped for a third consecutive quarter, a sign that the recent surge in inflation is leading consumers to slow spending on food. However, analysts at Dutch multinational banking giant ING remain optimistic. “Overall, the figures indicate that, despite sluggish consumption and a sharp drop in momentum in tourism-related activities, economic activity is holding up well in France, thanks in particular to improvements in supply chain tensions,” the analysts wrote.

Germany, Europe’s economic powerhouse, managed to stave off the threat of a recession in the third quarter with unexpected growth, but inflation remains stubbornly high. Consumer prices, normalized with other European Union countries, were up an annualized 11.6% in October, Germany’s federal statistics office reported. Analysts had expected annualized inflation to remain unchanged at 10.9%. Economists said inflation was likely to stay in double-digit territory for some time, keeping pressure on the European Central Bank to continue raising interest rates after it hiked them to their highest level since 2009. A plunge in energy imports from Russia following the invasion of Ukraine has sent energy prices spiraling in Germany, pushing inflation to its highest rate in over 25 years and fueling concerns of a potential gas shortage this winter.

In Asia, the International Monetary Fund (IMF) downgraded its economic outlook for the continent as global monetary tightening, rising inflation, and China’s sharp slowdown dampen the prospects for the region’s recovery. In its Asia-Pacific regional economic outlook report the IMF wrote, “While inflation in Asia remains subdued compared with other regions, most central banks must continue raising interest rates to ensure inflation expectations do not become de-anchored.” Krishna Srinivasan, director of the IMF’s Asia and Pacific Department added, “Further tightening of monetary policy will be required to ensure that inflation returns to target and inflation expectations remain well anchored.” The IMF cut Asia’s growth forecast to 4% this year and 4.3% next year. The slowdown follows a 6.5% expansion in 2021.

Japan’s Cabinet approved a 29 trillion yen ($200 billion USD) economic package to counter the effects of high inflation on household budgets. While central banks around the world are raising interest rates aggressively to try to tame decades-high inflation, Japan has stuck mainly to using fiscal measures, or government spending, to counter that challenge. The spending package will be part of a supplementary budget that still must be approved by the parliament. It includes about 45,000 yen ($300) subsidies for household electricity and gas bills and coupons worth 100,000 yen ($680) for women who are pregnant or rearing babies. The stimulus package is largely seen as an attempt by Prime Minister Fumio Kishida to shore up his sagging popularity.

Finally: If you are more comfortable discussing a Single Malt Scotch or French Bordeaux than some obscure tech stock or cryptocurrency, you are not alone. Billionaire investing legend Warren Buffet says investors should stick to areas they know when they are deciding what to invest in. The fine wine benchmark Liv-ex 1000 index has returned over 38% over the last two years, while the S&P 500 has managed just a 7% gain. And during 2008, when the S&P 500 dropped ‑38%, the Liv-ex 1000 fell less than -1%. Although the ultra-wealthy have been investing in fine wines and rare spirits for years, average investors have not participated. Now offerings from vint.co and others are offering “shares” in collections of wine and spirits, making fine wine and spirits investing accessible to average investors. Cheers! (Chart from chartr.co)

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.) Content provided by WE Sherman and Company. Securities offered through Registered Representatives of Cambridge Investment Research Inc., a broker-dealer, member FINRA/SIPC. Advisory Services offered through Cambridge Investment Research Advisors, a Registered Investment Adviser. Strategic Investment Partners and Cambridge are not affiliated. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. These opinions of Strategic Investment Partners and not necessarily those of Cambridge Investment Research, are for informational purposes only and should not be construed or acted upon as individualized investment advice.