We understand our clients risk “budget” by using software to help quantify where their individual comfort level will be. Once that number is established we can build a portfolio that fits within their individual risk “budget”. Within the software tool, we can also understand how client assets held away fit into the overall portfolio risk and where potential dangers lie. Benjamin Graham was quoted, "The essence of portfolio management is the management of risks, not the management of returns."

We use a combination of Exchange Traded Funds and Individual stocks in our process to fit into the individual's risk budget. We use a math-based approach to measure areas of strength to overweight and weakness to underweight. This math-based approach is called Trend Analysis or Trend analytics. Since this data is ever changing and quantifiable the process is repeated all the time to make sure the portfolio is positioned correctly. The ultimate goal of the portfolio construction is to avoid large losses.

As part of our holistic approach to understanding our client's needs, we believe that the financial planning process is vital to helping our clients reach retirement and maintain a lifestyle to which they are accustomed. We use EMoney, a robust software program that helps us to organize our client's financial picture and make decisions based on the information that is unique to each client.

As part of many families financial planning process, college savings is a big decision. Many families want to understand what the costs and options for college saving options are. We help to work thru those concerns and make sure that the needs of the future are met.

Many people are unsure about the best way to withdraw assets from their accumulated savings vehicles once they are retired. We make sure the assets are managed properly and efficiently to withdraw income while minimizing tax consequences and creating longevity. We make sure retirees will be able to outlive their assets and live the lifestyle they deserve.

We will facilitate meetings with all of the advisors that can help to create a long-lasting estate plan. Whether you are working with an attorney and CPA or not, we will make sure to choose professionals that will fit your needs and understand your family wishes that will create the legacy that you desire. If you are not, we will facilitate and coordinate meetings with several choices of professionals and allow you to choose which ones you feel most comfortable with. Once you have chosen professionals we will be your advocate to make sure you are getting the most from those relationships.

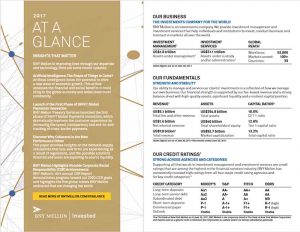

All assets at Strategic Investment Partners are held by Pershing, a division of BNY Mellon. Pershing holds global assets of 1.7 trillion dollars, and the parent companies BNY Mellon have custody over 31 trillion dollars. There are over 100,000 advisors that use Pershing clearing and custody to manage client assets in over 65 markets globally. Pershing was founded in 1939, however, Bank of New York(BNY) traces its roots all the way back to Alexander Hamilton in 1784. T. Mellon and Sons' Bank was founded in 1869. Client assets have SIPC protection(500,000) as well as excess coverage through Lloyd's of London and other Commercial Insurers(1,000,000,000). There are numerous custody and control measures in place

Cambridge Investment Research Inc. is a privately held financial solution focused Broker-Dealer firm serving independent financial advisors like Strategic Investment Partners. Cambridge is among the largest privately controlled independent Broker-Dealers in the country. Cambridge supports thousands of advisors who serve the needs of hundreds of thousands clients thru their Broker-Dealer network. Cambridge has been awarded Broker-Dealer of the Year 10 times since 2003, per Investment Advisor magazine.

MORE INFORMATION

Investment Selection Process

Strategic Investment Partners is an independent financial services firm. Our investment selection begins with the client risk tolerance. We work with clients to allocate portfolios based on market conditions and use real time analyses of mathematical data to avoid sectors that are out of favor and allocate to areas of strength. We aim to exploit market trends that occur over multiple time frames, weeks, months, and years. Our investment decisions are not based on a gut feel, however are based on a repeatable process that uses math in the decision making process according to the clients risk tolerance. That process occurs over and over to constantly measure what changes are occurring and how to implement those changes into client portfolios. We avoid making predictions and do not have theories about what may happen next. The only thing we can work to understand is the data that is available and implement to avoid large losses. We use Exchange Traded funds in many portfolios to provide a low cost solution to our clients through our managed account programs.

Fiduciary Responsibility

We provide our clients with objective opinions about the best allocation for their risk tolerance. We do not utilize proprietary products which would result in additional payout and understand we work for you. We must provide our clients with investments that are in their best interest instead of our own.

Retirement Income Strategies

When will I be able to retire comfortably? This is a key question that all clients think about during the accumulation phase of life. Where will I draw an income to pay for the activities that are part of my life? We provide guidance on how your pension, social security, investment income, and required minimum distributions will provide for your income needs. The bigger concern for many is to make sure that the assets that they have built over a lifetime last throughout the distribution phase. This is directly related to our investment selection process and how we manage the risk in our clients’ portfolios.